Region:Middle East

Author(s):Dev

Product Code:KRAB7390

Pages:80

Published On:October 2025

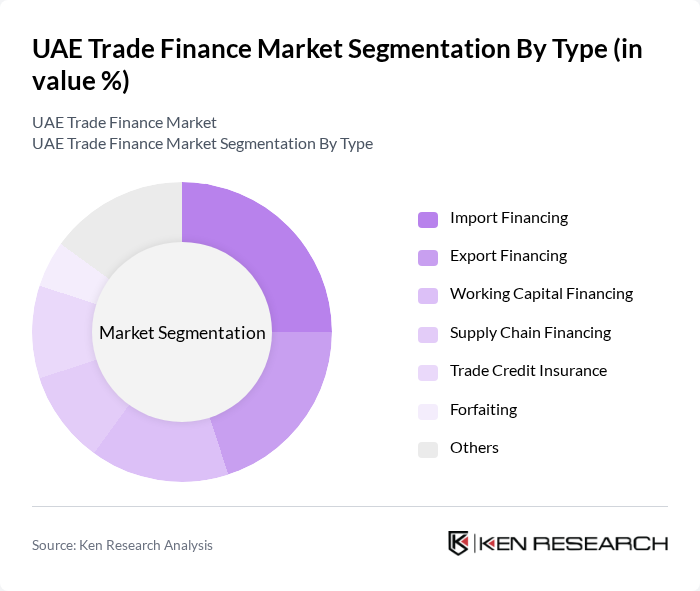

By Type:The trade finance market can be segmented into various types, including Import Financing, Export Financing, Working Capital Financing, Supply Chain Financing, Trade Credit Insurance, Forfaiting, and Others. Each of these sub-segments plays a crucial role in facilitating trade transactions and managing financial risks associated with international trade.

The Import Financing sub-segment is currently dominating the market due to the UAE's significant reliance on imported goods to meet domestic demand. This financing type allows businesses to secure the necessary funds to import products, ensuring a steady supply chain. The increasing volume of imports, particularly in sectors like consumer goods and machinery, has led to a higher demand for import financing solutions. Additionally, the ease of access to financing options has encouraged more businesses to engage in import activities, further solidifying its leading position in the trade finance market.

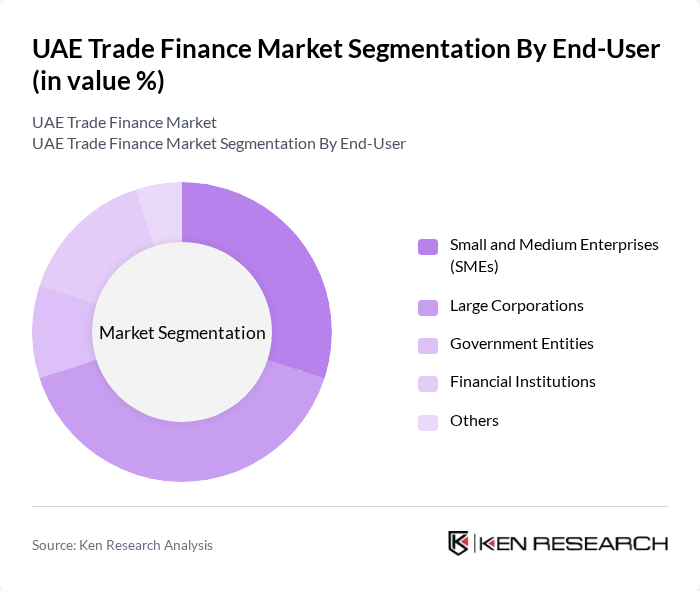

By End-User:The trade finance market can also be segmented by end-user categories, including Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, Financial Institutions, and Others. Each of these end-users has distinct financing needs and plays a vital role in the overall trade finance ecosystem.

Large Corporations are the leading end-user segment in the trade finance market, primarily due to their extensive international operations and higher financing requirements. These corporations often engage in significant import and export activities, necessitating robust trade finance solutions to manage their cash flow and mitigate risks. Their established relationships with financial institutions also facilitate easier access to various financing options, further enhancing their dominance in the market.

The UAE Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Dubai Islamic Bank, Mashreq Bank, Noor Bank, RAK Bank, Standard Chartered Bank, HSBC Bank Middle East, Qatar National Bank, Arab Bank, Bank of Baroda, Citibank N.A., BNP Paribas, and Deutsche Bank contribute to innovation, geographic expansion, and service delivery in this space.

The UAE trade finance market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of blockchain technology is expected to enhance transparency and efficiency in trade transactions, while the shift towards sustainable financing will align with global environmental goals. As businesses increasingly seek innovative financing solutions, the market will likely see a rise in partnerships between traditional banks and fintech firms, fostering a more dynamic financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Import Financing Export Financing Working Capital Financing Supply Chain Financing Trade Credit Insurance Forfaiting Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions Others |

| By Industry | Manufacturing Retail Construction Agriculture Logistics and Transportation Others |

| By Financing Method | Bank Guarantees Letters of Credit Documentary Collections Open Account Financing Others |

| By Geographical Coverage | Domestic Trade Regional Trade International Trade Others |

| By Risk Level | Low Risk Medium Risk High Risk Others |

| By Payment Terms | Short-Term Financing Medium-Term Financing Long-Term Financing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Trade Finance Users | 150 | Finance Managers, CFOs, Trade Compliance Officers |

| Banking Sector Insights | 100 | Trade Finance Executives, Relationship Managers |

| SME Trade Finance Needs | 80 | Business Owners, Financial Advisors |

| Logistics and Supply Chain Financing | 70 | Supply Chain Managers, Logistics Coordinators |

| Regulatory Impact on Trade Finance | 60 | Compliance Officers, Legal Advisors |

The UAE Trade Finance Market is valued at approximately USD 50 billion, driven by increasing trade activities and the UAE's strategic position as a global trade hub. This valuation reflects a five-year historical analysis of the market's growth.