Global Unified Communications as a Service in Healthcare Market Overview

- The Global Unified Communications as a Service in Healthcare Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient communication solutions in healthcare settings, which enhance patient care and operational efficiency. The rise in telehealth services, remote patient monitoring, and the adoption of cloud-based platforms have further accelerated the adoption of unified communications solutions in the healthcare sector. The integration of voice, video, messaging, and file sharing into single platforms is enabling seamless collaboration among healthcare professionals and supporting real-time data exchange, which is critical for modern healthcare delivery .

- Key players in this market include the United States, Germany, and the United Kingdom. The dominance of these countries can be attributed to their advanced healthcare infrastructure, high investment in technology, and a growing emphasis on digital transformation in healthcare. Additionally, the presence of major technology companies in these regions fosters innovation and the development of tailored solutions for healthcare providers. North America leads the market, accounting for over 42% of global revenue, with the U.S. being the largest contributor .

- The U.S. government has implemented regulatory frameworks to promote the use of telehealth services, including provisions for reimbursement and coverage of virtual care. For example, the Centers for Medicare & Medicaid Services (CMS) expanded telehealth reimbursement under the Consolidated Appropriations Act, 2023, enhancing access to healthcare services, particularly in rural and underserved areas. This regulatory support is driving the demand for unified communications solutions in the healthcare sector .

Global Unified Communications as a Service in Healthcare Market Segmentation

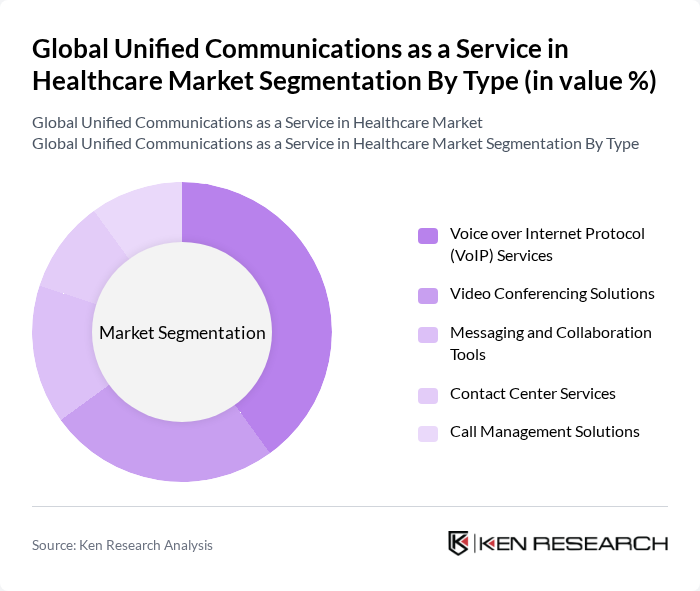

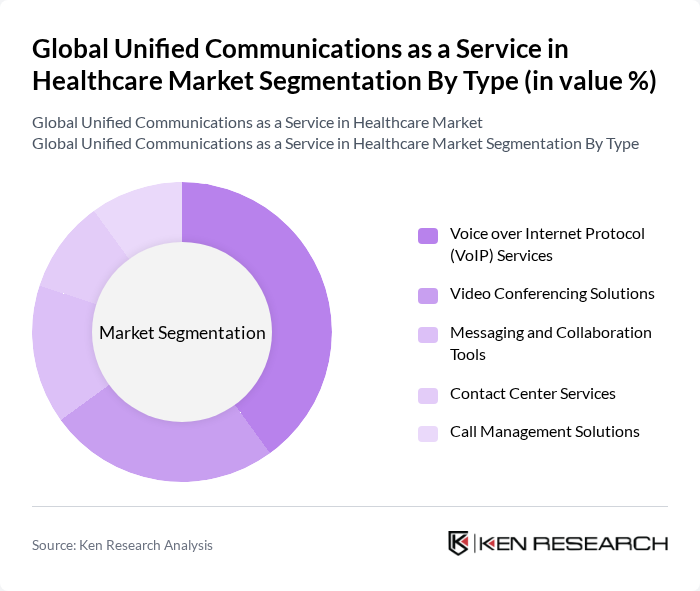

By Type:The market can be segmented into various types of services that cater to the communication needs of healthcare providers. The primary subsegments include Voice over Internet Protocol (VoIP) Services, Video Conferencing Solutions, Messaging and Collaboration Tools, Contact Center Services, and Call Management Solutions. Among these, VoIP Services are leading due to their cost-effectiveness, ability to integrate with existing healthcare systems, and facilitation of seamless communication. The adoption of video conferencing and collaboration tools is also rising, driven by the need for virtual consultations and multidisciplinary care coordination .

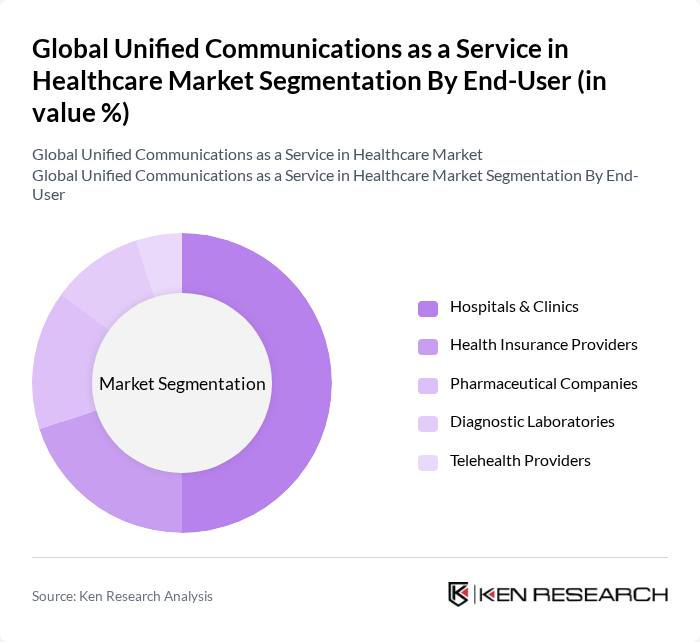

By End-User:The end-user segment includes Hospitals & Clinics, Health Insurance Providers, Pharmaceutical Companies, Diagnostic Laboratories, and Telehealth Providers. Hospitals & Clinics dominate this segment due to their extensive need for communication solutions that enhance patient care and operational efficiency. The increasing adoption of telehealth services and the need for real-time care coordination have also contributed to the growth of this segment .

Global Unified Communications as a Service in Healthcare Market Competitive Landscape

The Global Unified Communications as a Service in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Microsoft Corporation, Avaya Inc., RingCentral, Inc., Zoom Video Communications, Inc., 8x8, Inc., Mitel Networks Corporation, Vonage Holdings Corp., Dialpad, Inc., Twilio Inc., Intermedia Cloud Communications, Inc., Fuze, Inc., Nextiva, Inc., Talkdesk, Inc., Genesys Telecommunications Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Unified Communications as a Service in Healthcare Market Industry Analysis

Growth Drivers

- Increased Demand for Telehealth Services:The telehealth market is projected to reach $459.8 billion in future, driven by a growing preference for remote consultations. In future, the U.S. is expected to see over 1 billion telehealth visits, reflecting a 38% increase from the previous period. This surge is fueled by the need for accessible healthcare, particularly in rural areas, where 20% of the population lacks adequate access to medical facilities, thus propelling the demand for unified communications solutions.

- Integration of Communication Tools in Healthcare Workflows:A study by the Healthcare Information and Management Systems Society (HIMSS) indicates that 70% of healthcare organizations are prioritizing the integration of communication tools into their workflows in future. This integration is expected to enhance operational efficiency, reduce patient wait times by 30%, and improve care coordination, ultimately driving the adoption of unified communications as a service (UCaaS) in healthcare settings.

- Rising Need for Remote Patient Monitoring:The remote patient monitoring market is anticipated to grow to $2.4 billion in future, with a 25% increase in the adoption of wearable health devices. This trend is driven by the need for continuous health monitoring, especially for chronic conditions affecting 60% of adults. As healthcare providers seek to leverage UCaaS for real-time data sharing, the demand for integrated communication solutions will continue to rise significantly.

Market Challenges

- Data Security and Privacy Concerns:With healthcare data breaches costing an average of $4.24 million per incident in future, data security remains a critical challenge for UCaaS adoption. The increasing frequency of cyberattacks, which rose by 45% in the healthcare sector in the previous period, raises concerns about patient privacy and compliance with regulations like HIPAA, hindering the growth of unified communications solutions in healthcare.

- High Initial Investment Costs:The initial investment for implementing UCaaS solutions can exceed $500,000 for mid-sized healthcare organizations. This financial barrier is compounded by the need for ongoing maintenance and training, which can add an additional 20% to operational costs. As a result, many healthcare providers are hesitant to transition from traditional systems, limiting the market's growth potential in the short term.

Global Unified Communications as a Service in Healthcare Market Future Outlook

The future of unified communications in healthcare is poised for transformative growth, driven by technological advancements and evolving patient expectations. The integration of AI and machine learning is expected to enhance communication efficiency in future, while the rise of hybrid communication models will facilitate seamless interactions among healthcare providers. Additionally, the increasing focus on interoperability standards will ensure that diverse systems can work together, ultimately improving patient outcomes and operational efficiency across the healthcare landscape.

Market Opportunities

- Expansion of Cloud-Based Solutions:The cloud-based healthcare solutions market is projected to reach $64.3 billion in future, driven by the need for scalable and flexible communication systems. This expansion presents a significant opportunity for UCaaS providers to offer tailored solutions that enhance collaboration and data sharing among healthcare professionals, ultimately improving patient care.

- Growing Adoption of AI and Machine Learning:The AI in healthcare market is expected to grow to $45.2 billion in future, with a substantial focus on enhancing communication tools. This growth presents an opportunity for UCaaS providers to integrate AI-driven analytics and automation, improving decision-making processes and patient engagement, thereby driving further adoption of unified communications solutions.