Global Vertical Farming Market Overview

- The Global Vertical Farming Market is valued at USD 8.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for sustainable agricultural practices, rapid urbanization, and the need for food security in densely populated areas. The rise in consumer awareness regarding the benefits of locally grown produce and the adoption of advanced technologies such as automation and LED lighting have also contributed significantly to market expansion .

- Key players in this market include the United States, Canada, and several countries in Europe such as the Netherlands and Germany. The dominance of these regions is attributed to advanced technological infrastructure, significant investments in research and development, and supportive government policies that promote sustainable farming practices. North America holds the largest share of the market, while Europe is experiencing robust growth due to its focus on food security and sustainability .

- In 2023, the U.S. government expanded support for urban agriculture, including vertical farming, through initiatives such as the Urban Agriculture and Innovative Production grants, which allocate substantial funding to support vertical farming projects. These initiatives aim to enhance food production in urban areas, reduce transportation costs, and promote local food systems, thereby fostering a more sustainable agricultural landscape .

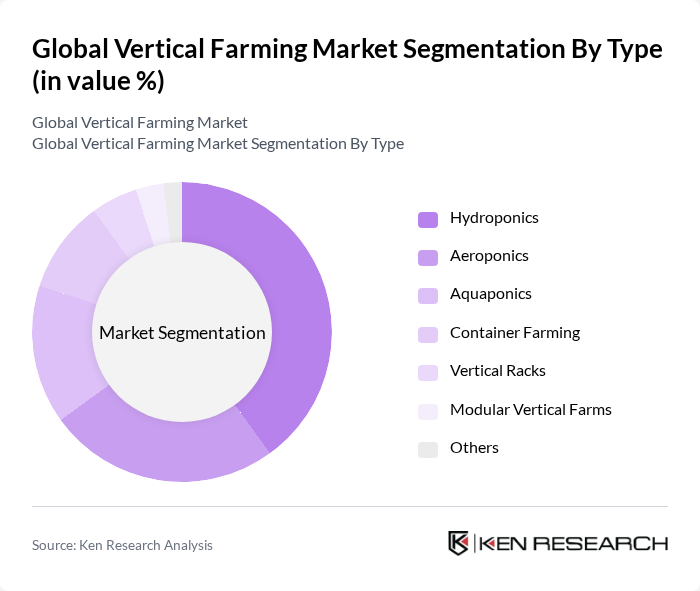

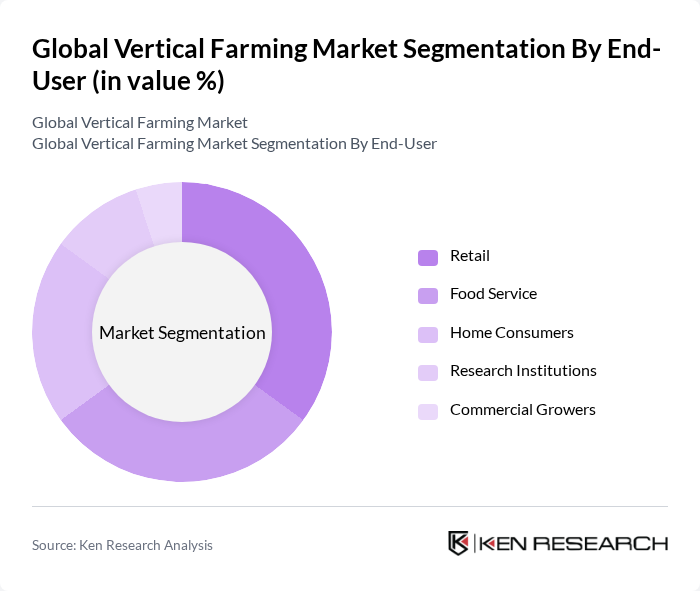

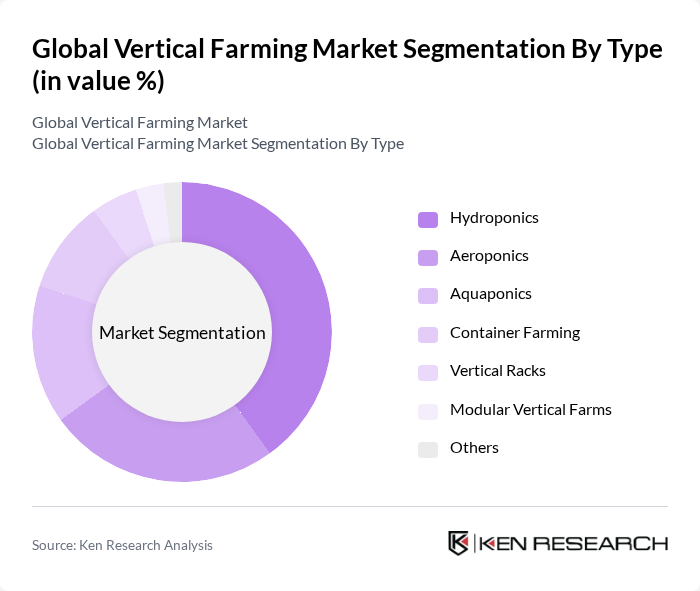

Global Vertical Farming Market Segmentation

By Type:The vertical farming market is segmented into various types, including Hydroponics, Aeroponics, Aquaponics, Container Farming, Vertical Racks, Modular Vertical Farms, and Others. Among these, Hydroponics is the most dominant segment due to its efficiency in water usage, high yields in limited space, and adaptability for urban environments. The growing trend of urban agriculture, technological advancements in nutrient delivery systems, and the increasing demand for fresh produce in urban areas further bolster the popularity of hydroponic systems .

By End-User:The end-user segmentation includes Retail, Food Service, Home Consumers, Research Institutions, and Commercial Growers. The Retail segment is currently leading the market, driven by increasing consumer preference for fresh, organic produce and the expansion of supermarkets and grocery stores that prioritize locally sourced products. This trend is further supported by heightened awareness of health and wellness, as well as the integration of vertical farming outputs into retail supply chains .

Global Vertical Farming Market Competitive Landscape

The Global Vertical Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as AeroFarms, Plenty, Bowery Farming, Vertical Harvest, Green Spirit Farms, FarmedHere, Infarm, Gotham Greens, Sky Greens, Urban Crop Solutions, GrowUp Farms, Agricool, Plantagon, Oishii, Lettuce Grow, Illumitex, American Hydroponics, Spread Co., Ltd., Mirai Co., Ltd., Crop One Holdings contribute to innovation, geographic expansion, and service delivery in this space.

Global Vertical Farming Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization is a significant driver of the vertical farming market, with the United Nations projecting that in future, approximately 56% of the global population will reside in urban areas. This shift leads to a higher demand for locally sourced food, reducing transportation costs and carbon footprints. Cities like Tokyo and New York are already investing in vertical farms, with Tokyo's urban agriculture initiatives aiming to produce 1.5 million tons of food annually in future, showcasing the potential for urban farming solutions.

- Demand for Fresh Produce:The global demand for fresh produce is expected to reach 1.5 billion tons in future, driven by health-conscious consumers seeking organic and pesticide-free options. This trend is particularly pronounced in urban areas, where access to fresh food is limited. Vertical farming offers a solution by providing fresh produce year-round, with companies like AeroFarms reporting a 30% increase in sales of leafy greens in urban markets, highlighting the growing consumer preference for fresh, locally grown food.

- Technological Advancements:Technological innovations are revolutionizing vertical farming, with investments in automation and smart farming technologies projected to exceed $10 billion in future. The integration of AI and IoT in farming practices enhances efficiency and yield, with companies like Plenty utilizing advanced sensors to monitor plant health. This technological shift not only reduces labor costs but also increases productivity, making vertical farming a more viable option for urban food production in the coming years.

Market Challenges

- High Initial Investment:The high initial investment required for setting up vertical farms poses a significant challenge, with costs ranging from $500,000 to $2 million for a medium-sized facility. This financial barrier can deter potential investors, especially in regions where traditional farming methods are more established. Additionally, the return on investment can take several years, making it crucial for stakeholders to secure funding and support to navigate these financial hurdles effectively.

- Energy Consumption:Energy consumption remains a critical challenge for vertical farming, with facilities consuming up to 20 times more energy than traditional farms. As energy costs rise, the sustainability of vertical farming practices is questioned. For instance, a study by the International Energy Agency indicates that energy costs could account for up to 40% of operational expenses in future, necessitating the adoption of renewable energy sources to mitigate these costs and enhance sustainability.

Global Vertical Farming Market Future Outlook

The future of vertical farming appears promising, driven by technological advancements and increasing consumer demand for sustainable food sources. As urban populations grow, the need for efficient food production methods will intensify. Innovations in automation and AI will likely enhance productivity, while government support for sustainable practices may further bolster the industry. Additionally, as energy-efficient technologies become more accessible, vertical farming could become a cornerstone of urban agriculture, addressing food security challenges in densely populated areas.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant opportunities for vertical farming, with countries like India and Brazil experiencing rapid urbanization. In future, India's urban population is expected to reach 600 million, creating a substantial demand for local food production. This growth can drive investments in vertical farming technologies, enabling these regions to enhance food security and reduce reliance on imports.

- Partnerships with Retailers:Collaborations between vertical farms and retailers can enhance market reach and consumer access. In future, partnerships with major grocery chains could facilitate the distribution of fresh produce, tapping into the growing consumer preference for local sourcing. Such alliances can also provide vertical farms with valuable insights into consumer trends, enabling them to tailor their offerings effectively and increase market penetration.