Region:North America

Author(s):Dev

Product Code:KRAB0471

Pages:100

Published On:August 2025

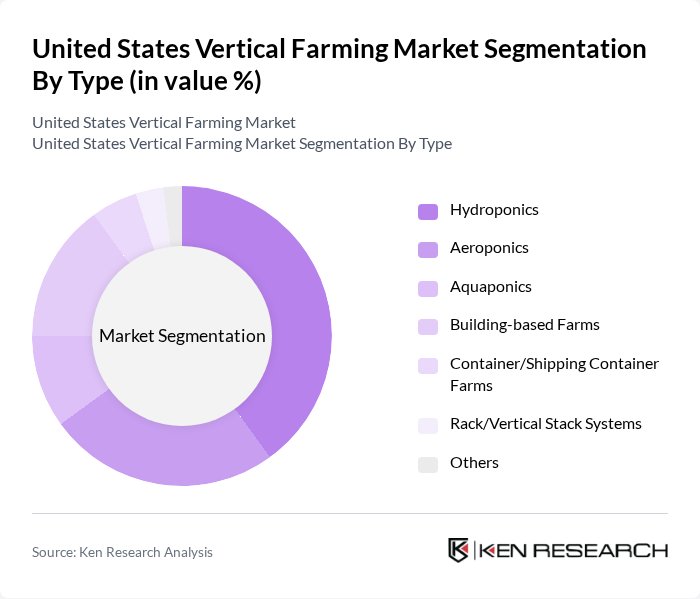

By Type:The vertical farming market can be segmented into various types, including Hydroponics, Aeroponics, Aquaponics, Building-based Farms, Container/Shipping Container Farms, Rack/Vertical Stack Systems, and Others. Each type offers unique advantages in terms of space utilization, resource efficiency, and crop yield. Hydroponics remains the most widely adopted system in vertical farms due to water efficiency and controllable nutrient delivery, while aeroponics is gaining traction for its high water savings and potential for rapid growth; aquaponics remains a smaller niche requiring integrated fish systems. Building-based farms dominate for proximity to consumers, whereas container farms serve distributed, small-footprint deployments and on-site institutional use.

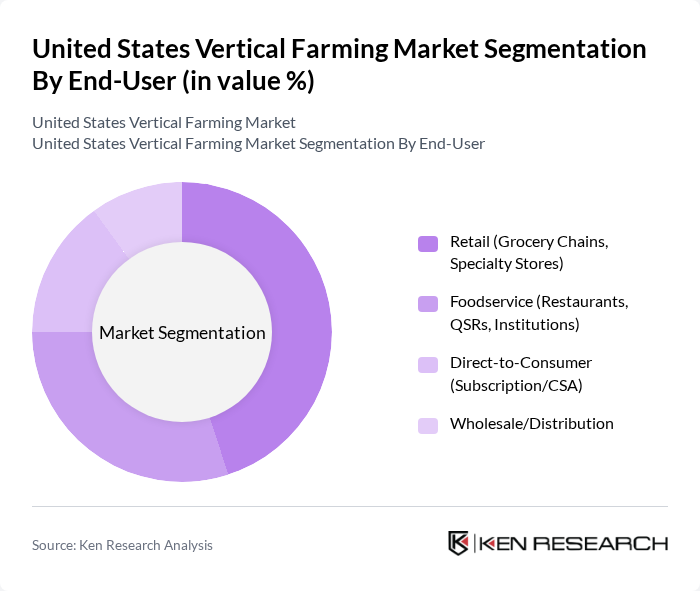

By End-User:The end-user segmentation includes Retail (Grocery Chains, Specialty Stores), Foodservice (Restaurants, QSRs, Institutions), Direct-to-Consumer (Subscription/CSA), and Wholesale/Distribution. Retail remains the primary offtake route for packaged leafy greens and herbs via national and regional grocery chains; foodservice demand is growing with emphasis on consistent year-round supply and food safety; direct-to-consumer persists as a smaller channel; wholesale/distribution supports private label and regional aggregators.

The United States Vertical Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as AeroFarms, Plenty Unlimited Inc., Bowery Farming Inc., Gotham Greens, BrightFarms, Vertical Harvest, Kalera, Local Bounti, Fifth Season (Deep Local Inc.), 80 Acres Farms, Crop One Holdings, Infarm, Plenty’s Driscoll’s Joint Venture (Berry Farming), AppHarvest, Iron Ox contribute to innovation, geographic expansion, and service delivery in this space. Notable trends include partnerships with national grocers, integration of robotics and computer vision, energy-efficiency retrofits, and selective scaling focused on unit economics and proximity to demand centers.

The future of the United States vertical farming market appears promising, driven by increasing consumer demand for sustainable and locally sourced food. As urban populations grow, the need for innovative agricultural solutions will intensify. Technological advancements, particularly in automation and AI, are expected to enhance operational efficiency. Additionally, consumer education regarding the benefits of vertical farming will likely foster greater acceptance and market penetration, paving the way for a more resilient food system in urban areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydroponics Aeroponics Aquaponics Building-based Farms Container/Shipping Container Farms Rack/Vertical Stack Systems Others |

| By End-User | Retail (Grocery Chains, Specialty Stores) Foodservice (Restaurants, QSRs, Institutions) Direct-to-Consumer (Subscription/CSA) Wholesale/Distribution |

| By Application (Crop Type) | Leafy Greens (Lettuce, Kale, Spinach) Herbs (Basil, Mint, Cilantro) Microgreens & Sprouts Berries (e.g., Strawberries) Vine Crops (Tomatoes, Cucumbers) |

| By Investment Source | Venture Capital Private Equity & Strategic Investors Government Grants/Loans Corporate/Impact Investment |

| By Distribution Channel | Supermarkets & Grocery Retail Foodservice Distributors Online/D2C Farmers’ Markets & Local Co-ops |

| By Technology | LED Lighting (White, Red/Blue, RGB) Climate/HVAC & Dehumidification Nutrient Delivery & Recirculation Systems Sensing, Monitoring & Control (IoT/AI) Automation & Robotics (Seeding, Harvesting) |

| By Policy Support | Subsidies & Incentives Tax Credits/Exemptions Grants & R&D Funding Renewable/Energy Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vertical Farms | 100 | Farm Owners, Operations Managers |

| Technology Providers for Vertical Farming | 80 | Product Managers, R&D Directors |

| Urban Agriculture Policy Makers | 60 | City Planners, Agricultural Policy Analysts |

| Retailers Sourcing from Vertical Farms | 70 | Procurement Managers, Category Buyers |

| Consumers of Vertical Farm Produce | 90 | Health-Conscious Consumers, Sustainability Advocates |

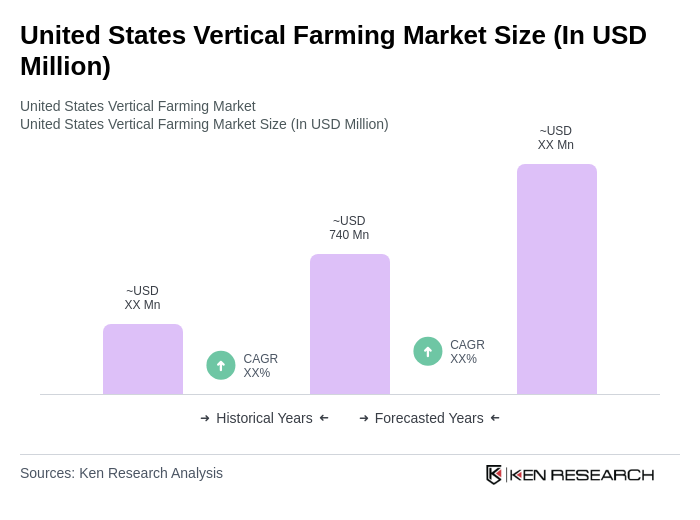

The United States Vertical Farming Market is valued at approximately USD 740 million, reflecting a significant growth trend driven by urbanization, demand for fresh produce, and advancements in controlled-environment agriculture technologies.