Global Vitamins Minerals Market Overview

- The Global Vitamins Minerals Market is valued at USD 32 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, the rise in preventive healthcare, and the growing demand for dietary supplements. The market has seen a surge in product innovations, such as personalized nutrition and clean-label supplements, and a shift towards natural and organic ingredients, further propelling its expansion.

- Key players in this market include the United States, Germany, and China. The United States dominates due to its advanced healthcare infrastructure, high disposable income, and a strong emphasis on health and wellness. Germany benefits from a robust pharmaceutical sector and a growing trend towards preventive healthcare, while China is witnessing rapid urbanization and an increasing focus on nutrition.

- In 2023, the European Union implemented Regulation (EU) 2022/2340 issued by the European Commission, which introduced enhanced safety and efficacy requirements for dietary supplements. This regulation mandates stricter labeling requirements, including clear ingredient disclosure and nutritional information, and enforces rigorous quality control measures for vitamins and minerals. The regulation aims to ensure that consumers receive accurate information about the products they purchase, improve consumer trust, and promote responsible marketing practices within the industry.

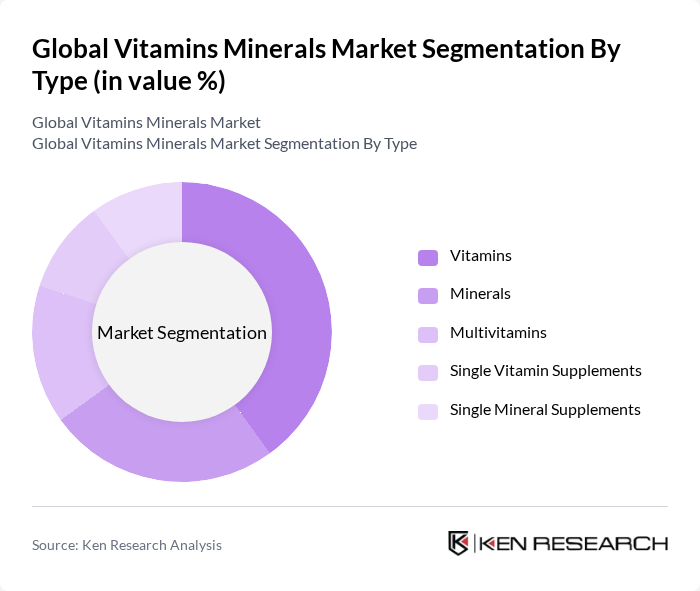

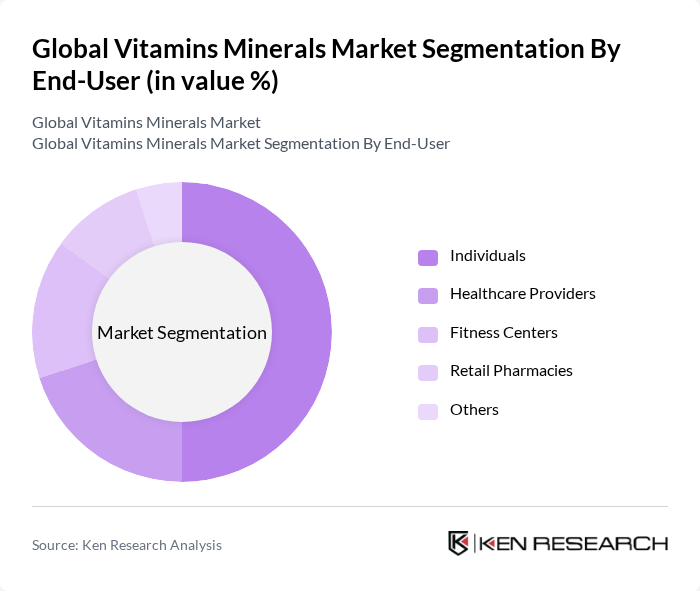

Global Vitamins Minerals Market Segmentation

By Type:The market is segmented into various types, including Vitamins, Minerals, Multivitamins, Single Vitamin Supplements, and Single Mineral Supplements. Among these, the Vitamins segment is the most dominant due to the increasing awareness of their health benefits and the rising demand for fortified foods. Consumers are increasingly seeking vitamins to support overall health, immunity, and energy levels, leading to a significant market share for this category.

By End-User:The end-user segmentation includes Individuals, Healthcare Providers, Fitness Centers, Retail Pharmacies, and Others. The Individuals segment holds the largest share as more consumers are turning to dietary supplements for personal health management. This trend is driven by a growing awareness of nutrition and wellness, leading to increased purchases of vitamins and minerals for personal use.

Global Vitamins Minerals Market Competitive Landscape

The Global Vitamins Minerals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, DSM-Firmenich, BASF SE, Abbott Laboratories, Nestlé S.A., Glanbia plc, Haleon plc, Blackmores Limited, Swisse Wellness Pty Ltd., Nature’s Bounty Co., NOW Foods, Garden of Life, Solgar Inc., MegaFood, New Chapter, Inc., Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Archer-Daniels-Midland Company (ADM), Lonza Group Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Vitamins Minerals Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The global health awareness trend is driving the vitamins and minerals market, with 75% of consumers actively seeking healthier lifestyles. According to the World Health Organization, non-communicable diseases, which can be mitigated through proper nutrition, account for 71% of global deaths. This has led to a surge in demand for dietary supplements, with the market for vitamins expected to reach $60 billion in future, reflecting a significant shift towards preventive health measures.

- Rising Demand for Nutritional Supplements:The nutritional supplements sector is projected to grow significantly, with a market value of approximately $200 billion in future. This growth is fueled by an increasing number of health-conscious consumers, particularly millennials, who prioritize wellness. The International Food Information Council reports that 80% of consumers are now taking dietary supplements, indicating a robust demand for vitamins and minerals as part of daily health regimens.

- Growth in the Aging Population:The global aging population is a critical driver for the vitamins and minerals market, with the United Nations projecting that in future, there will be over 1.7 billion people aged 60 and older. This demographic is more susceptible to nutritional deficiencies, leading to increased consumption of supplements. The market for elder-specific vitamins is expected to grow by $15 billion, highlighting the need for tailored nutritional solutions for older adults.

Market Challenges

- Stringent Regulatory Framework:The vitamins and minerals market faces significant challenges due to stringent regulations imposed by health authorities. In the U.S., the FDA enforces strict guidelines on dietary supplements, requiring compliance with Good Manufacturing Practices (GMP). Non-compliance can lead to costly recalls and legal issues, with the FDA issuing over 250 warning letters annually to companies failing to meet these standards, impacting market growth and innovation.

- High Competition Among Key Players:The vitamins and minerals market is characterized by intense competition, with major players like Bayer and Herbalife dominating. This competitive landscape results in price wars and reduced profit margins. According to industry reports, over 1,200 companies are vying for market share, leading to a fragmented market where smaller firms struggle to establish a foothold, ultimately hindering overall market growth and innovation.

Global Vitamins Minerals Market Future Outlook

The future of the vitamins and minerals market appears promising, driven by increasing consumer awareness and a shift towards preventive healthcare. Innovations in product formulations, such as personalized vitamins tailored to individual health needs, are expected to gain traction. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, will provide new growth avenues. As consumers continue to prioritize health, the demand for high-quality, effective supplements will likely rise, shaping the market landscape in the coming years.

Market Opportunities

- Innovations in Product Formulations:The market presents opportunities for companies to innovate with personalized supplements. With advancements in technology, brands can create tailored products based on genetic profiles, enhancing efficacy. This trend is supported by a growing consumer preference for customized health solutions, potentially increasing market share for innovative companies.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, offer significant growth potential for vitamins and minerals. With rising disposable incomes and increasing health awareness, these regions are witnessing a surge in demand for dietary supplements. Companies that strategically enter these markets can capitalize on this trend, driving revenue growth and brand recognition.