Region:Global

Author(s):Rebecca

Product Code:KRAA2378

Pages:88

Published On:August 2025

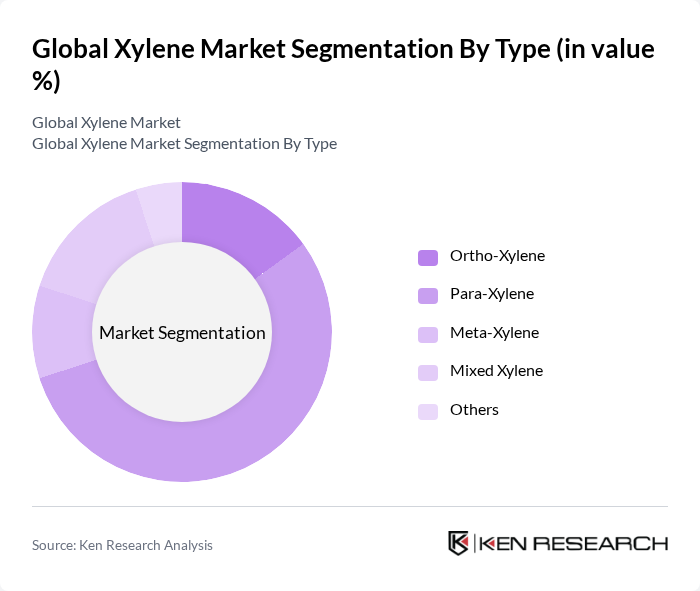

By Type:The xylene market is segmented into Ortho-Xylene, Para-Xylene, Meta-Xylene, Mixed Xylene, and Others. Para-Xylene remains the leading sub-segment due to its extensive use in producing purified terephthalic acid (PTA), a key raw material for polyester fibers and resins. The rising demand for PET bottles and textiles continues to boost para-xylene consumption, making it the dominant type in the market.

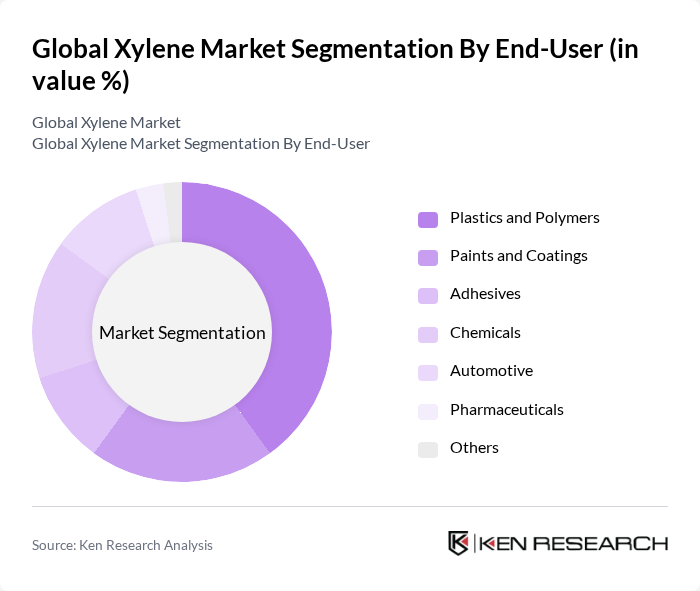

By End-User:The xylene market is also segmented by end-user industries, including Plastics and Polymers, Paints and Coatings, Adhesives, Chemicals, Automotive, Pharmaceuticals, and Others. The Plastics and Polymers segment holds the largest share, driven by the increasing demand for plastic products in packaging, construction, and consumer goods. The automotive sector also contributes significantly, utilizing xylene in manufacturing processes and coatings. The paints and coatings segment benefits from xylene’s role as a solvent, while the chemicals segment leverages xylene as a feedstock for various intermediates.

The Global Xylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Shell plc, BP plc, Chevron Phillips Chemical Company LLC, LyondellBasell Industries N.V., Eastman Chemical Company, SABIC, INEOS Group Holdings S.A., Formosa Plastics Corporation, Reliance Industries Limited, Mitsubishi Gas Chemical Company, Inc., LG Chem Ltd., BASF SE, Huntsman Corporation, Honeywell International Inc., TPC Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the xylene market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly solutions, the demand for bio-based xylene is expected to rise. Additionally, the growth of e-commerce and online sales channels is likely to enhance distribution efficiency, allowing manufacturers to reach broader markets. These trends indicate a dynamic landscape for xylene, with opportunities for innovation and expansion in various applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Ortho-Xylene Para-Xylene Meta-Xylene Mixed Xylene Others |

| By End-User | Plastics and Polymers Paints and Coatings Adhesives Chemicals Automotive Pharmaceuticals Others |

| By Application | Solvents Monomers (e.g., Purified Terephthalic Acid) Fuel Additives Intermediate Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Middle East & Africa (GCC, South Africa, Egypt, Nigeria, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Product Form | Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Xylene Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (e.g., Paints & Coatings) | 80 | Procurement Managers, Product Development Leads |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Logistics and Distribution Companies | 70 | Logistics Coordinators, Supply Chain Analysts |

The Global Xylene Market is valued at approximately USD 35 billion, driven by increasing demand for xylene derivatives in various industries such as plastics, automotive, and pharmaceuticals, as well as advancements in production technologies.