Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3923

Pages:88

Published On:November 2025

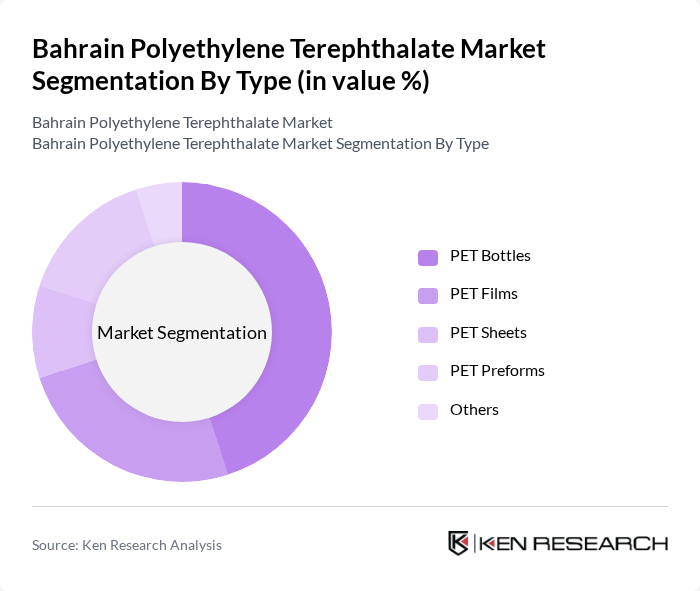

By Type:The market is segmented into various types, including PET Bottles, PET Films, PET Sheets, PET Preforms, and Others. Among these, PET Bottles dominate the market due to their extensive use in the beverage industry, driven by consumer preferences for lightweight and recyclable packaging. PET Films are also gaining traction, particularly in the food packaging sector, due to their barrier properties and versatility.

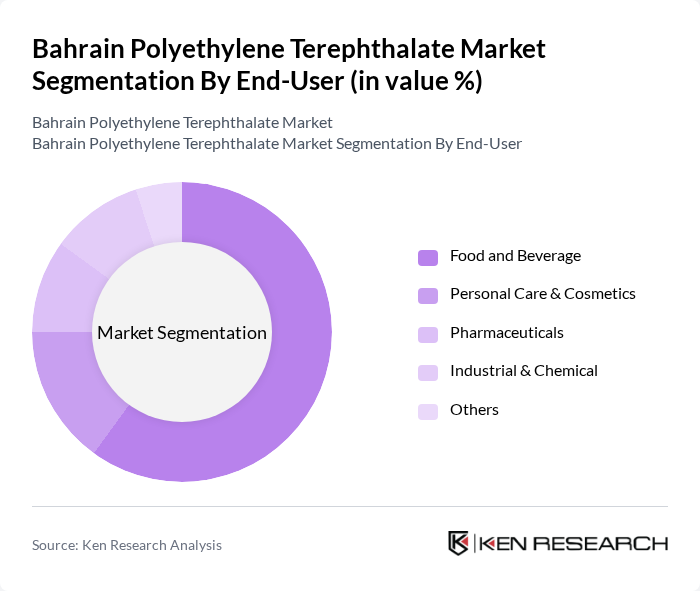

By End-User:The end-user segmentation includes Food and Beverage, Personal Care & Cosmetics, Pharmaceuticals, Industrial & Chemical, and Others. The Food and Beverage sector is the largest consumer of PET products, primarily due to the increasing demand for bottled drinks and packaged food items. The Personal Care & Cosmetics segment is also significant, as PET is widely used for packaging various personal care products.

The Bahrain Polyethylene Terephthalate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Plastic Industries Co. W.L.L., Bahrain Polymer & Plastic Products Co. W.L.L., Al Hidd Plastic Factory, Bahrain National Plastics Company, Al Mohsin Group, Gulf Petrochemical Industries Company (GPIC), Bahrain Chemical Manufacturing Company (BCMC), Al Ahlia Plastic Products Co., Bahrain Plastics Manufacturing Company W.L.L., Al Bahrain Plastics Factory, Bahrain Recycling Company, Al Muharraq Plastic Industries, Bahrain Industrial Investment Company (BINDCO), Al Fateh Plastic Factory, Bahrain Packaging Industry Co. B.S.C. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain polyethylene terephthalate market appears promising, driven by increasing consumer demand for sustainable products and government support for recycling initiatives. As the beverage industry continues to expand, the need for PET packaging will grow. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce costs, making PET a more attractive option for manufacturers. Overall, the market is poised for growth, with sustainability at its core.

| Segment | Sub-Segments |

|---|---|

| By Type | PET Bottles PET Films PET Sheets PET Preforms Others |

| By End-User | Food and Beverage Personal Care & Cosmetics Pharmaceuticals Industrial & Chemical Others |

| By Application | Packaging (Bottles, Containers, Trays) Textile (Fibers, Yarns) Automotive Components Electrical & Electronics Others |

| By Recycling Method | Mechanical Recycling Chemical Recycling Energy Recovery Others |

| By Distribution Channel | Direct Sales Online Retail Distributors/Wholesalers Others |

| By Geographic Distribution | Northern Bahrain Southern Bahrain Central Bahrain Muharraq Others |

| By Product Form | Granules Pellets Flakes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Packaging Managers, Product Development Leads |

| Textile Sector Demand Analysis | 80 | Textile Manufacturers, Supply Chain Coordinators |

| Automotive Applications of PET | 70 | Automotive Engineers, Procurement Specialists |

| Environmental Impact Assessments | 50 | Sustainability Managers, Regulatory Affairs Officers |

| Market Trends and Innovations | 60 | Industry Analysts, Market Research Professionals |

The Bahrain Polyethylene Terephthalate market is valued at approximately USD 310 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for sustainable packaging and the rising consumption of bottled beverages.