Region:Asia

Author(s):Shubham

Product Code:KRAA4990

Pages:99

Published On:September 2025

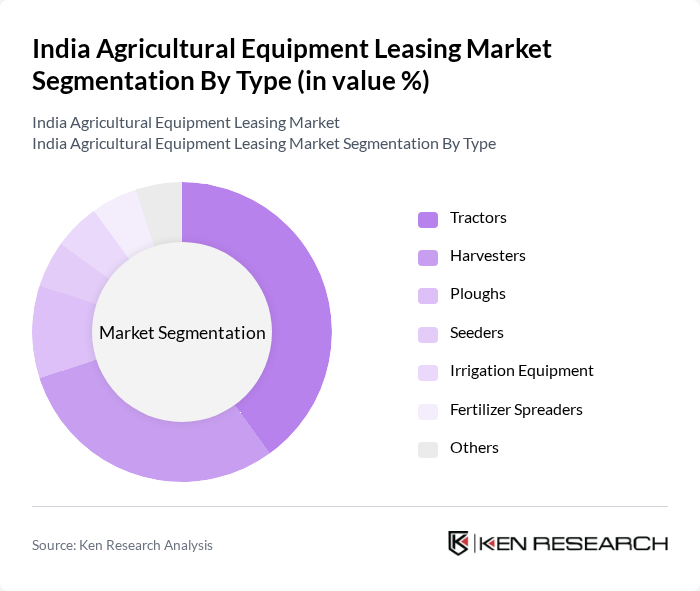

By Type:The market is segmented into various types of agricultural equipment, including tractors, harvesters, ploughs, seeders, irrigation equipment, fertilizer spreaders, and others. Among these, tractors and harvesters are the most sought-after due to their essential roles in enhancing productivity and efficiency in farming operations. The increasing adoption of mechanized farming practices has led to a significant rise in the leasing of these equipment types.

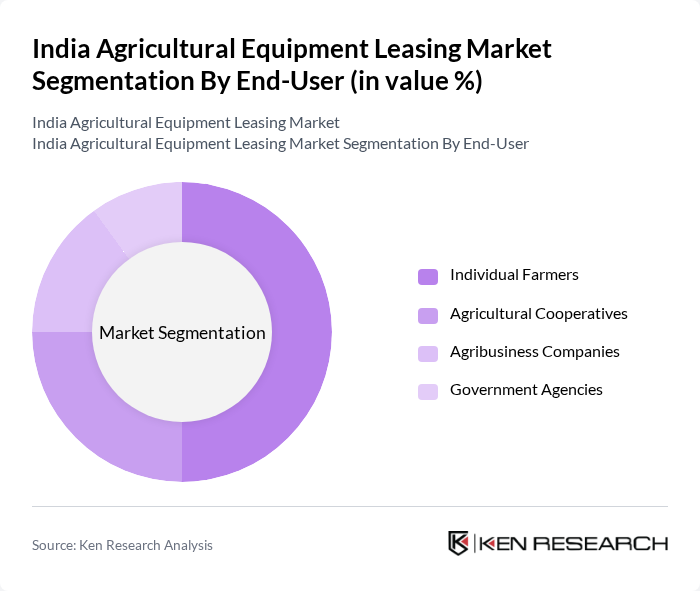

By End-User:The end-user segment includes individual farmers, agricultural cooperatives, agribusiness companies, and government agencies. Individual farmers represent the largest share of the market, driven by the need for affordable access to modern agricultural equipment. Agricultural cooperatives also play a significant role, as they pool resources to lease equipment for collective use, enhancing operational efficiency and reducing costs.

The India Agricultural Equipment Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mahindra & Mahindra Ltd., TAFE Ltd., John Deere India Pvt. Ltd., Escorts Group, CNH Industrial India Pvt. Ltd., AGCO Corporation, Tractors and Farm Equipment Limited (TAFE), Kubota Agricultural Machinery India Pvt. Ltd., SDF Group, VST Tillers Tractors Ltd., Indo Farm Equipment Ltd., Sonalika Tractors, JCB India Ltd., Bharat Earth Movers Limited (BEML), Kverneland Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India agricultural equipment leasing market appears promising, driven by increasing mechanization and government support. In the future, the market is expected to witness a surge in demand for advanced machinery leasing, particularly in precision agriculture. The integration of technology in farming practices will further enhance productivity, while the rise of digital platforms will facilitate easier access to leasing services. As awareness grows, more farmers are likely to embrace leasing as a viable alternative to ownership, fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Ploughs Seeders Irrigation Equipment Fertilizer Spreaders Others |

| By End-User | Individual Farmers Agricultural Cooperatives Agribusiness Companies Government Agencies |

| By Region | North India South India East India West India |

| By Application | Crop Production Livestock Management Horticulture Agroforestry |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| By Distribution Channel | Direct Sales Online Platforms Dealers and Distributors Rental Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 150 | Farm Owners, Agricultural Workers |

| Leasing Companies | 100 | Business Development Managers, Financial Analysts |

| Agricultural Cooperatives | 80 | Cooperative Managers, Procurement Officers |

| Equipment Manufacturers | 70 | Product Managers, Sales Directors |

| Government Officials | 50 | Policy Makers, Agricultural Advisors |

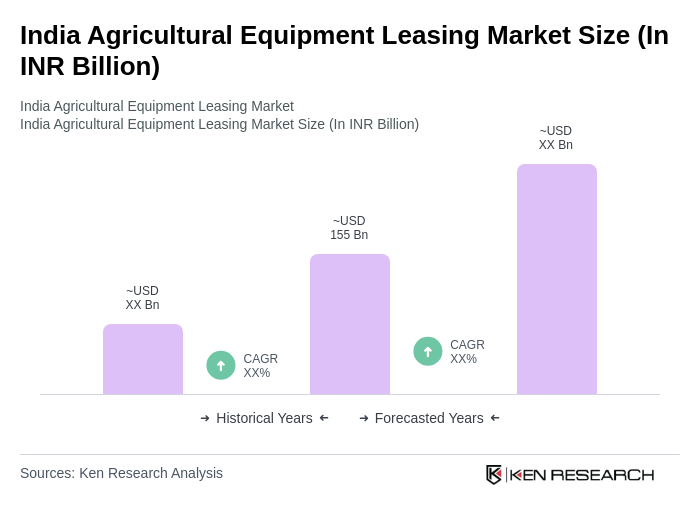

The India Agricultural Equipment Leasing Market is valued at approximately INR 155 billion, reflecting significant growth driven by the increasing need for mechanization, rising labor costs, and the trend towards precision farming.