Region:Global

Author(s):Rebecca

Product Code:KRAB5899

Pages:88

Published On:October 2025

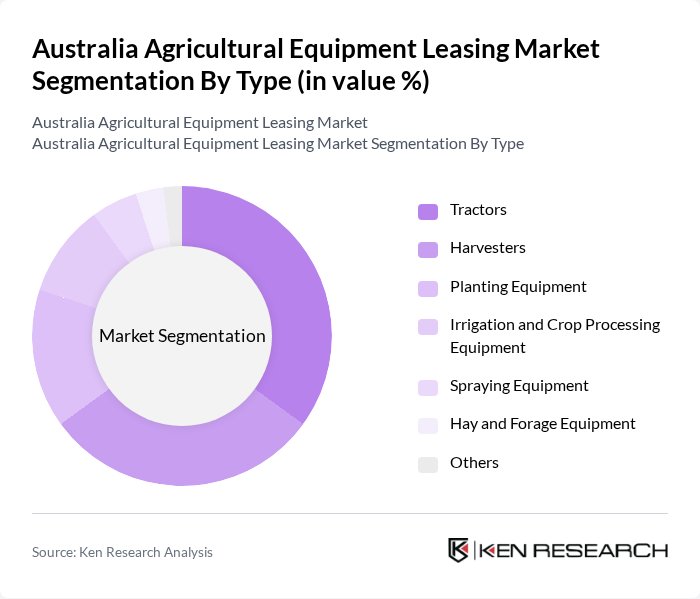

By Type:The market is segmented into various types of agricultural equipment, including tractors, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others. Each of these segments plays a crucial role in enhancing agricultural productivity and efficiency. Among these, tractors and harvesters are the most sought-after due to their essential functions in modern farming practices. The adoption of precision agriculture tools, autonomous vehicles, drones, and GPS-based systems is reshaping equipment demand, with a growing emphasis on smart, connected machinery that supports real-time monitoring and optimization of farm operations.

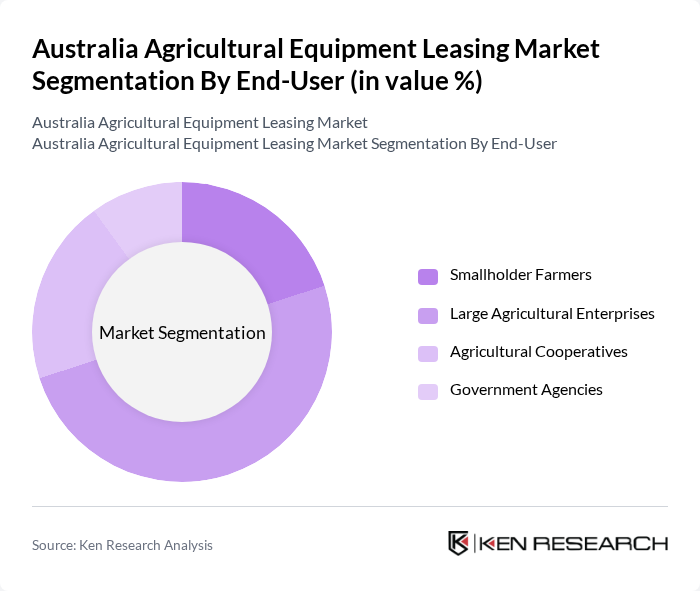

By End-User:The end-user segmentation includes smallholder farmers, large agricultural enterprises, agricultural cooperatives, and government agencies. Each segment has distinct needs and preferences regarding equipment leasing. Large agricultural enterprises dominate the market due to their capacity to lease multiple pieces of equipment simultaneously, thus benefiting from economies of scale and operational efficiency. The trend toward equipment leasing is particularly pronounced among small and medium-sized farms, which leverage leasing to access advanced technology without significant capital investment.

The Australia Agricultural Equipment Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere Financial, CNH Industrial Capital, AGCO Finance Australia, Kubota Australia Finance, Hitachi Capital Australia, Elders Limited, Rural Bank, ANZ Bank, Westpac Banking Corporation, NAB Agribusiness, Rabobank Australia, Suncorp Group, QBE Insurance Group, Finlease (Australia) Pty Ltd, Macquarie Leasing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural equipment leasing market in Australia appears promising, driven by technological advancements and a growing emphasis on sustainability. As farmers increasingly adopt smart farming technologies, the demand for flexible leasing options is expected to rise. Additionally, the integration of digital platforms for leasing services will enhance accessibility and streamline operations, making it easier for farmers to access the equipment they need while managing costs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Planting Equipment Irrigation and Crop Processing Equipment Spraying Equipment Hay and Forage Equipment Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Agricultural Cooperatives Government Agencies |

| By Lease Type | Operating Lease Finance Lease Short-Term Lease Long-Term Lease |

| By Equipment Age | New Equipment Used Equipment |

| By Payment Structure | Fixed Payments Variable Payments |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Others |

| By Distribution Channel | Direct Sales Online Platforms Dealers and Distributors Auctions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Leasing | 100 | Farm Owners, Equipment Managers |

| Harvester Leasing | 80 | Agricultural Operators, Farm Managers |

| Irrigation Equipment Leasing | 70 | Water Resource Managers, Agronomists |

| Specialized Equipment Leasing | 50 | Crop Specialists, Equipment Leasing Agents |

| Leasing Trends and Preferences | 90 | Agricultural Economists, Financial Analysts |

The Australia Agricultural Equipment Leasing Market is valued at approximately USD 1.5 billion, driven by the increasing need for modern agricultural practices and technological advancements in farming equipment. This market reflects a growing trend towards leasing as a cost-effective alternative to ownership.