Region:Africa

Author(s):Rebecca

Product Code:KRAB2944

Pages:98

Published On:October 2025

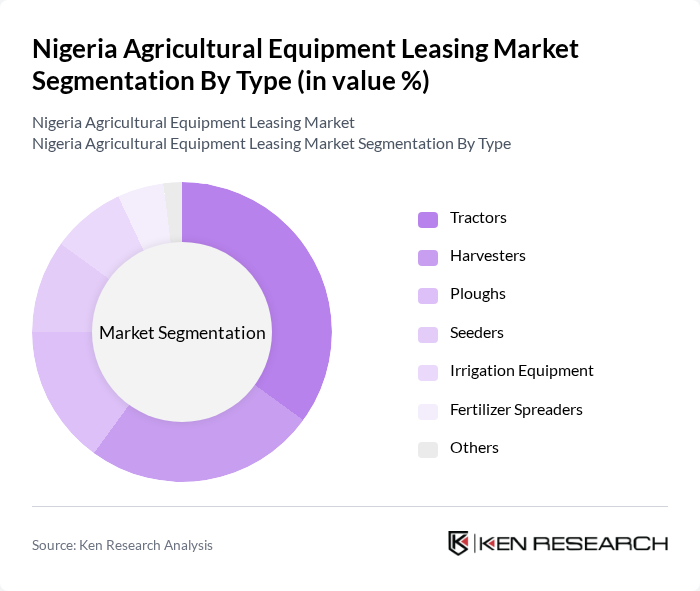

By Type:The market is segmented into various types of agricultural equipment, including tractors, harvesters, ploughs, seeders, irrigation equipment, fertilizer spreaders, and others. Each type serves specific agricultural needs, with tractors and harvesters being the most commonly leased due to their essential roles in modern farming practices.

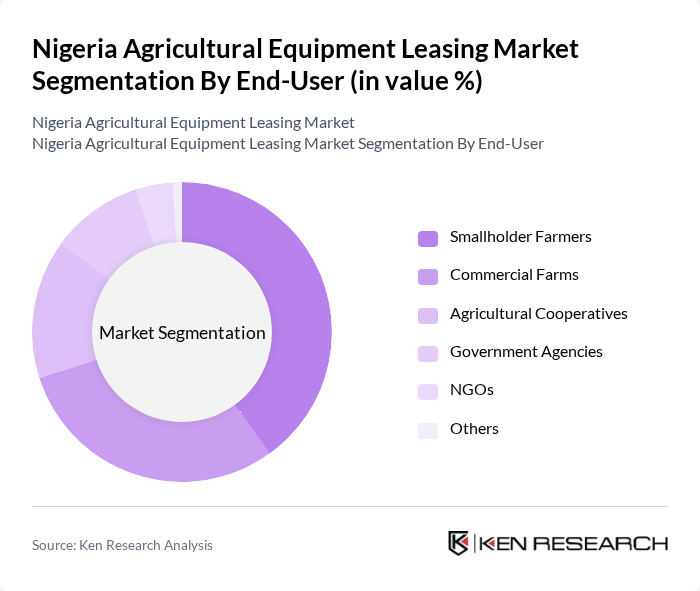

By End-User:The end-users of agricultural equipment leasing include smallholder farmers, commercial farms, agricultural cooperatives, government agencies, NGOs, and others. Smallholder farmers represent a significant portion of the market, as they often lack the capital to purchase equipment outright and benefit greatly from leasing options.

The Nigeria Agricultural Equipment Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere Nigeria, AGCO Corporation, CNH Industrial, Mahindra & Mahindra, TAFE (Tractors and Farm Equipment Limited), Kubota Corporation, Case IH, New Holland Agriculture, Yanmar Co., Ltd., AG Leader Technology, Trimble Inc., CLAAS Group, SDF Group, JCB, Landini Tractors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria agricultural equipment leasing market appears promising, driven by increasing mechanization and government support. As rural financing programs expand, more farmers will gain access to leasing options, enhancing productivity. Additionally, technological advancements in agricultural equipment will likely lead to more efficient farming practices. The integration of digital platforms for leasing will further streamline access, making it easier for farmers to obtain the necessary machinery to meet the growing food demands of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Ploughs Seeders Irrigation Equipment Fertilizer Spreaders Others |

| By End-User | Smallholder Farmers Commercial Farms Agricultural Cooperatives Government Agencies NGOs Others |

| By Application | Crop Production Livestock Farming Agro-processing Horticulture Others |

| By Financing Model | Operating Lease Financial Lease Hire Purchase Others |

| By Duration of Lease | Short-term Lease Medium-term Lease Long-term Lease Others |

| By Payment Structure | Fixed Payments Variable Payments Seasonal Payments Others |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 150 | Farm Owners, Agricultural Cooperative Members |

| Agricultural Equipment Dealers | 100 | Sales Managers, Product Specialists |

| Leasing Companies | 80 | Business Development Managers, Financial Analysts |

| Government Agricultural Agencies | 60 | Policy Makers, Agricultural Extension Officers |

| Industry Experts and Consultants | 50 | Agricultural Economists, Market Analysts |

The Nigeria Agricultural Equipment Leasing Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by modern agricultural practices, government initiatives, and technology adoption in farming.