Region:Europe

Author(s):Rebecca

Product Code:KRAB5980

Pages:93

Published On:October 2025

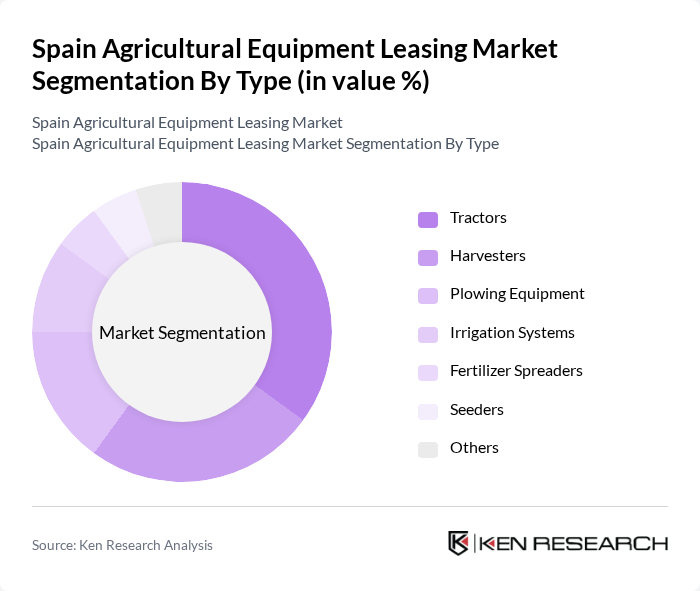

By Type:The market is segmented into various types of agricultural equipment, including tractors, harvesters, plowing equipment, irrigation systems, fertilizer spreaders, seeders, and others. Each of these sub-segments plays a crucial role in enhancing agricultural productivity and efficiency. Among these, tractors and harvesters are the most sought-after due to their essential functions in modern farming practices.

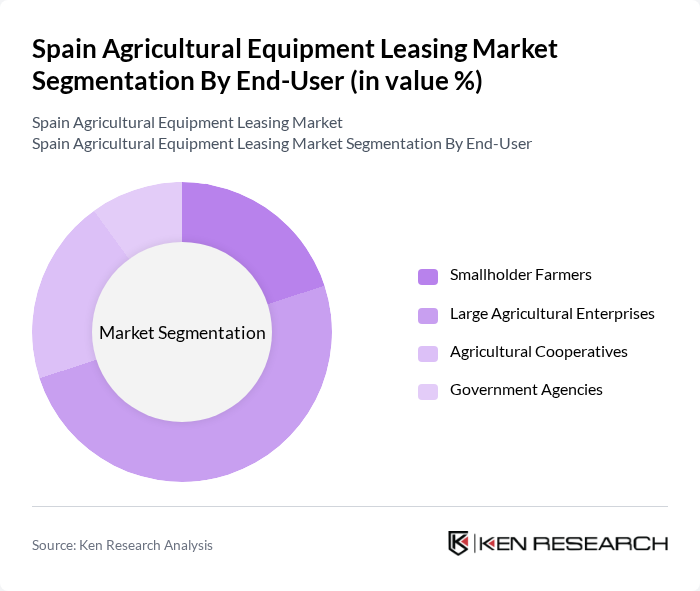

By End-User:The end-user segment includes smallholder farmers, large agricultural enterprises, agricultural cooperatives, and government agencies. Each of these groups has distinct needs and preferences when it comes to leasing agricultural equipment. Large agricultural enterprises dominate the market due to their capacity to invest in advanced machinery and their need for efficient operations to meet high production demands.

The Spain Agricultural Equipment Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial N.V., Kubota Corporation, CLAAS KGaA mbH, Valtra, Fendt, Massey Ferguson, New Holland Agriculture, SDF Group, JCB, Manitou Group, AG Leader Technology, Trimble Inc., Raven Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural equipment leasing market in Spain appears promising, driven by a growing emphasis on sustainability and technological innovation. As farmers increasingly adopt precision agriculture techniques, the demand for specialized equipment is expected to rise. Additionally, the trend towards short-term leasing options is likely to gain traction, allowing farmers to adapt quickly to changing market conditions and technological advancements, thereby enhancing operational efficiency and productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Plowing Equipment Irrigation Systems Fertilizer Spreaders Seeders Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Agricultural Cooperatives Government Agencies |

| By Application | Crop Production Livestock Farming Horticulture Aquaculture |

| By Financing Model | Operating Lease Finance Lease Sale and Leaseback |

| By Duration of Lease | Short-term Lease Medium-term Lease Long-term Lease |

| By Payment Structure | Fixed Payments Variable Payments Deferred Payments |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leasing of Tractors | 150 | Farm Owners, Equipment Managers |

| Leasing of Harvesters | 100 | Agricultural Cooperatives, Farm Managers |

| Leasing of Irrigation Equipment | 80 | Farm Operators, Agricultural Engineers |

| Leasing of Soil Preparation Equipment | 70 | Agri-business Consultants, Equipment Leasing Specialists |

| Leasing of Precision Farming Tools | 90 | Technology Adoption Officers, Agronomists |

The Spain Agricultural Equipment Leasing Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the need for modern agricultural practices and technological advancements in farming equipment.