Region:Europe

Author(s):Geetanshi

Product Code:KRAA2040

Pages:95

Published On:August 2025

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring & Tracking Systems, and Refrigeration Equipment. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain .

The Refrigerated Transport segment is currently the dominant player in the market, driven by the increasing demand for efficient logistics solutions in the food and pharmaceutical industries. The rise of e-commerce and online grocery delivery has further accelerated the need for reliable refrigerated transport services, ensuring that products reach consumers in optimal condition. Additionally, advancements in technology, such as IoT and real-time tracking, have enhanced the efficiency and reliability of refrigerated transport, making it a preferred choice for businesses .

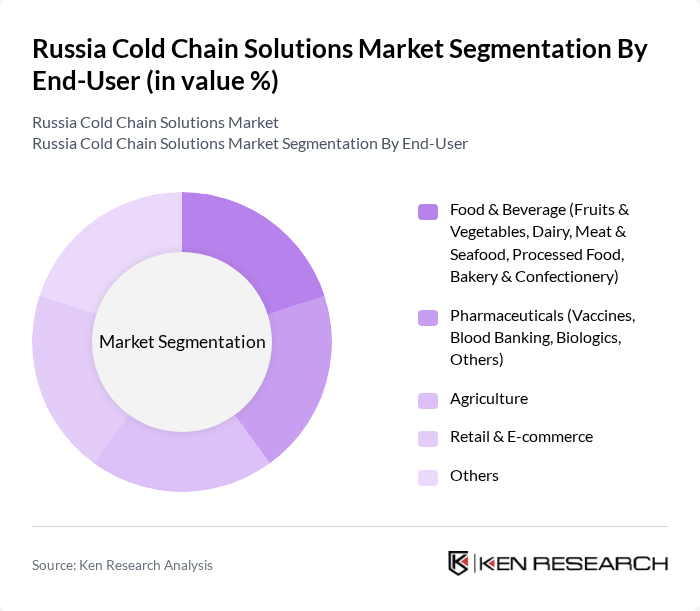

By End-User:The market is segmented by end-user into Food & Beverage, Pharmaceuticals, Agriculture, Retail & E-commerce, and Others. Each segment has unique requirements and challenges that influence the demand for cold chain solutions .

The Food & Beverage segment is the largest end-user of cold chain solutions, accounting for the majority of the market. This dominance is attributed to the increasing consumer demand for fresh and high-quality food products, which necessitates efficient cold storage and transportation solutions. Additionally, the rise of online grocery shopping and the expansion of modern retail formats have further propelled the need for robust cold chain logistics to ensure product freshness and safety during delivery .

The Russia Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as X5 Retail Group, Magnit, DPDgroup Russia, Russian Railways (RZD Logistics), Ozon Holdings, VkusVill, Miratorg, AFG National, Kuehne + Nagel Russia, DB Schenker Russia, Agrofirma "Pchela", Global Cold Chain Solutions, Tander, ROSTEC, Sovtransavto contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain solutions market in Russia appears promising, driven by technological advancements and increasing consumer expectations for food quality. The integration of automation and IoT technologies is expected to enhance operational efficiency, with investments projected to reach approximately $500 million in future. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly refrigerants and energy-efficient systems, aligning with global trends and regulatory requirements, thereby fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport (Road, Rail, Sea, Air) Cold Storage Facilities (Public, Private, Semi-Private Warehouses, Cold Rooms) Temperature-Controlled Packaging Monitoring & Tracking Systems (IoT, Sensors, Data Loggers) Refrigeration Equipment (Blast Freezers, Walk-in Coolers, Deep Freezers, Others) |

| By End-User | Food & Beverage (Fruits & Vegetables, Dairy, Meat & Seafood, Processed Food, Bakery & Confectionery) Pharmaceuticals (Vaccines, Blood Banking, Biologics, Others) Agriculture Retail & E-commerce Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Food Preservation Vaccine & Pharmaceutical Distribution Fresh Produce Handling Bakery & Confectionery Logistics Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Deep Frozen (-40°C and below) Ambient (above 5°C) |

| By Service Type | Transportation Services Storage Services Packaging Services |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Storage Facilities Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 60 | Quality Assurance Managers, Operations Directors |

| Retail Cold Chain Solutions | 50 | Retail Operations Managers, Procurement Specialists |

| Technology Providers in Cold Chain | 40 | Product Managers, Business Development Executives |

| Logistics Infrastructure Development | 40 | Urban Planners, Policy Makers |

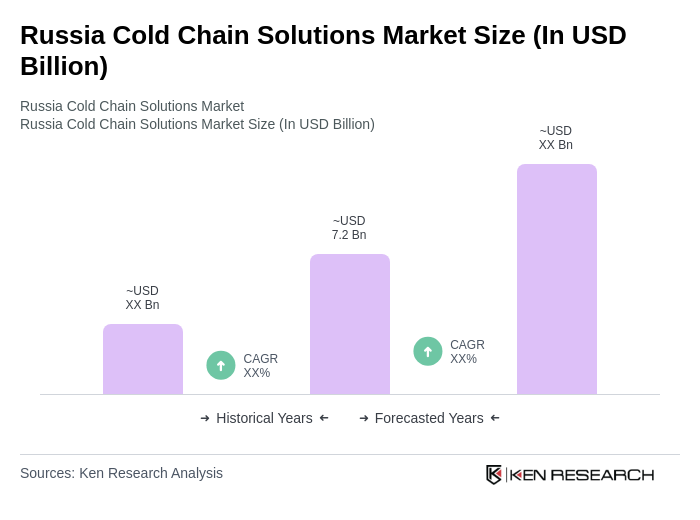

The Russia Cold Chain Solutions Market is valued at approximately USD 7.2 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and retail logistics.