Region:Central and South America

Author(s):Dev

Product Code:KRAA0450

Pages:88

Published On:August 2025

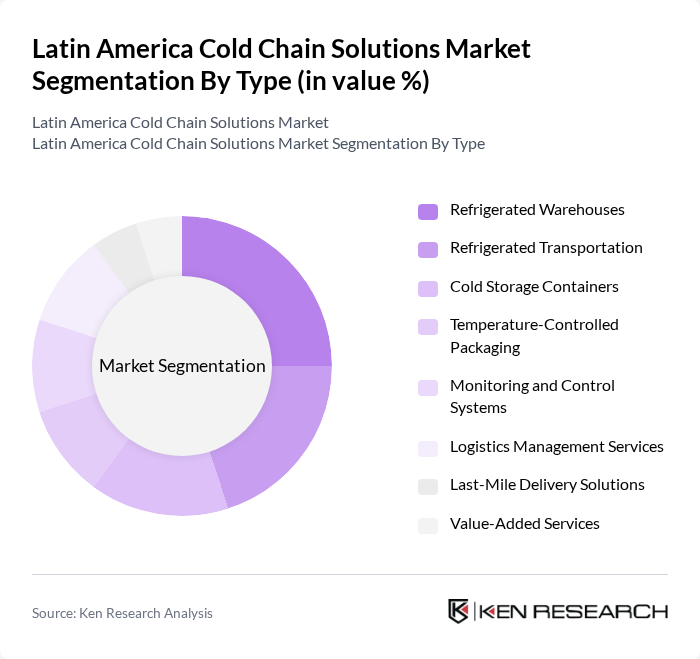

By Type:The cold chain solutions market can be segmented into various types, including Refrigerated Warehouses, Refrigerated Transportation, Cold Storage Containers, Temperature-Controlled Packaging, Monitoring and Control Systems, Logistics Management Services, Last-Mile Delivery Solutions, and Value-Added Services. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain .

By Temperature Range:The market can also be segmented by temperature range, which includes Chilled (0°C to 8°C) and Frozen (Below -18°C). These temperature ranges are critical for maintaining the quality and safety of perishable goods .

The Latin America Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emergent Cold Latin America, Friozem Armazéns Frigoríficos, SuperFrio Logística, Solistica, DHL Supply Chain, Lineage Logistics, Kuehne + Nagel, Maersk, AGRO Merchants Group (Lineage Logistics), Brasfrigo, Tópico Armazenagem, Arfrio, Multilog, Grupo Madero Logística, Columbia Logística contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain solutions market in Latin America appears promising, driven by technological advancements and increasing investments in infrastructure. The integration of IoT and smart technologies is expected to enhance operational efficiency and reduce costs. Additionally, the growing focus on sustainability will likely lead to the adoption of eco-friendly practices within the cold chain sector. As companies adapt to these trends, the market is poised for significant growth, addressing both consumer demands and regulatory requirements effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehouses Refrigerated Transportation Cold Storage Containers Temperature-Controlled Packaging Monitoring and Control Systems Logistics Management Services Last-Mile Delivery Solutions Value-Added Services |

| By Temperature Range | Chilled (0°C to 8°C) Frozen (Below -18°C) |

| By End-User | Food and Beverages Pharmaceuticals and Healthcare Chemicals Floral and Agricultural Products Others |

| By Region | Brazil Mexico Argentina Chile Colombia Peru Others |

| By Application | Fruits and Vegetables Meat, Fish, and Seafood Dairy and Frozen Desserts Bakery and Confectionery Pharmaceuticals and Vaccines Chemicals and Specialty Materials Others |

| By Technology | Refrigeration Technology IoT Solutions Blockchain for Supply Chain Transparency Automated Storage and Retrieval Systems Energy-Efficient Technologies Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Chain Operators Grants for Technology Adoption Regulatory Support for Food Safety Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 120 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Cold Storage | 90 | Quality Assurance Managers, Operations Directors |

| Retail Cold Chain Solutions | 60 | Retail Operations Managers, Procurement Specialists |

| Technology Providers in Cold Chain | 50 | Product Managers, Business Development Executives |

| Logistics Service Providers | 70 | Business Analysts, Regional Managers |

The Latin America Cold Chain Solutions Market is valued at approximately USD 18.5 billion, driven by the rising demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and logistics networks in the region.