Region:North America

Author(s):Geetanshi

Product Code:KRAA1999

Pages:80

Published On:August 2025

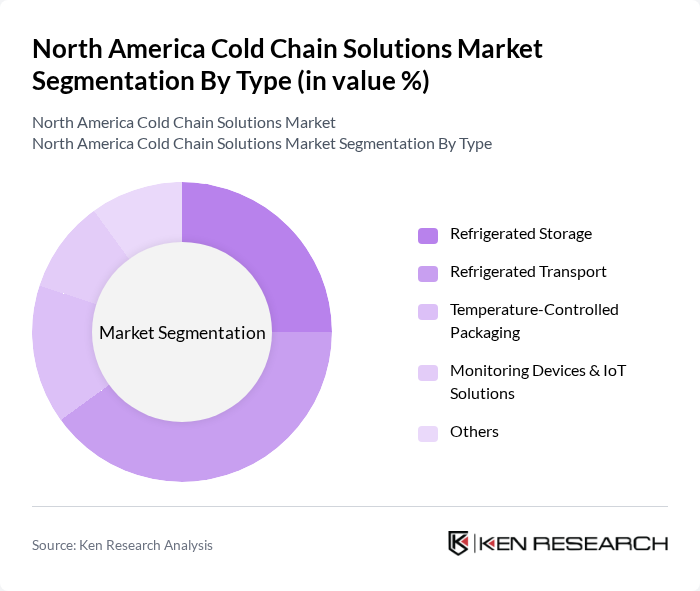

By Type:

The cold chain solutions market is segmented into various types, including Refrigerated Storage, Refrigerated Transport, Temperature-Controlled Packaging, Monitoring Devices & IoT Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for fresh produce and pharmaceuticals that require timely delivery. The rise of e-commerce and direct-to-consumer models has further contributed to the growth of this segment, as consumers expect rapid access to temperature-sensitive products. The integration of IoT solutions for real-time temperature monitoring during transit is enhancing operational efficiency, traceability, and reliability .

By End-User:

The end-user segmentation includes Food & Beverage, Pharmaceuticals & Healthcare, Biotechnology, Chemicals & Industrial Products, Retail & Supermarkets, Logistics & Distribution Companies, and Others. The Food & Beverage sector is the dominant end-user, driven by the increasing demand for fresh and frozen products, as well as the expansion of online grocery shopping and meal kit delivery services. The Pharmaceuticals & Healthcare sector is also significant, requiring stringent temperature controls for vaccines, biologics, and clinical trial materials. The growing focus on reducing food waste and ensuring product safety further supports demand across all end-user categories .

The North America Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Realty Trust, Lineage Logistics, United States Cold Storage, Cold Chain Technologies, VersaCold Logistics Services, AGRO Merchants Group, Burris Logistics, Congebec Logistics, NewCold, C.H. Robinson, DHL Supply Chain, Kuehne + Nagel, DB Schenker, Maersk, CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The North America cold chain solutions market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of IoT technologies for real-time monitoring is expected to enhance operational efficiency, while the shift towards sustainable practices will reshape logistics strategies. Additionally, the increasing focus on data analytics will optimize supply chain management, ensuring that businesses can adapt to changing market demands and regulatory requirements effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Storage Refrigerated Transport Temperature-Controlled Packaging Monitoring Devices & IoT Solutions Others |

| By End-User | Food & Beverage (Meat, Seafood, Dairy, Bakery, Confectionery, Fruits & Vegetables) Pharmaceuticals & Healthcare (Vaccines, Biologics, Clinical Trial Materials) Biotechnology Chemicals & Industrial Products Retail & Supermarkets Logistics & Distribution Companies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Food Preservation Pharmaceutical & Vaccine Distribution Chemical Storage Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (15°C to 25°C) |

| By Service Type | Transportation Services Warehousing Services Packaging Services Monitoring & Compliance Services Others |

| By Region | United States Canada Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Networks | 100 | Logistics Managers, Supply Chain Analysts |

| Pharmaceutical Cold Chain Management | 80 | Operations Directors, Quality Assurance Managers |

| Biotechnology Product Transport | 60 | Procurement Managers, Regulatory Affairs Specialists |

| Retail Cold Storage Solutions | 50 | Warehouse Managers, Inventory Control Specialists |

| Temperature-Controlled Logistics Innovations | 40 | R&D Managers, Technology Officers |

The North America Cold Chain Solutions Market is valued at approximately USD 79 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as advancements in cold chain technology and logistics.