Region:Asia

Author(s):Geetanshi

Product Code:KRAB5713

Pages:94

Published On:October 2025

By Type:The market can be segmented into various types of cybersecurity solutions, including Endpoint Security, Network Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, and Others. Each of these sub-segments plays a crucial role in addressing specific security needs of organizations.

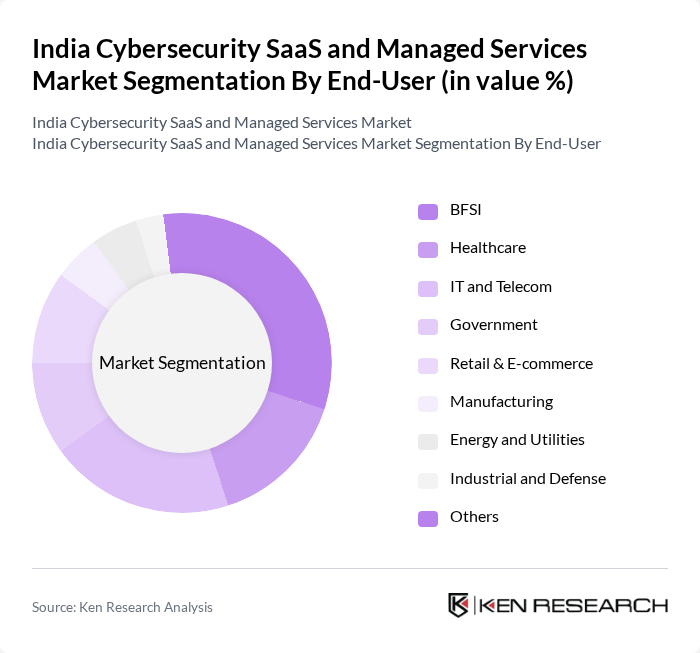

By End-User:The end-user segmentation includes various industries such as BFSI, Healthcare, IT and Telecom, Government, Retail & E-commerce, Manufacturing, Energy and Utilities, Industrial and Defense, and Others. Each sector has unique cybersecurity requirements based on the nature of their operations and the sensitivity of the data they handle.

The India Cybersecurity SaaS and Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services, Wipro Limited, Infosys Limited, HCL Technologies, Tech Mahindra, Quick Heal Technologies, Paladion Networks (an Atos company), K7 Computing, Lucideus (Safe Security), Seqrite, IBM India, Cisco Systems, Check Point Software Technologies, Palo Alto Networks, Fortinet, McAfee, CrowdStrike, Zscaler, Sophos, Trend Micro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity SaaS and managed services market in India appears promising, driven by increasing digital transformation initiatives and a heightened focus on data protection. As organizations continue to embrace cloud technologies, the demand for integrated cybersecurity solutions will rise. Additionally, the growing emphasis on regulatory compliance and data privacy will further propel investments in advanced cybersecurity measures, fostering innovation and collaboration among service providers and technology partners in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Endpoint Security Network Security Application Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Others |

| By End-User | BFSI Healthcare IT and Telecom Government Retail & E-commerce Manufacturing Energy and Utilities Industrial and Defense Others |

| By Region | North India South India East India West India |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Managed Security Services Professional Services Consulting Services |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Industry Compliance | ISO 27001 DPDPA (Digital Personal Data Protection Act) PCI DSS HIPAA GDPR |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cybersecurity Solutions | 120 | CISOs, IT Security Managers |

| SME Cybersecurity Services | 80 | IT Managers, Business Owners |

| Cloud Security Solutions | 60 | Cloud Architects, DevOps Engineers |

| Managed Security Service Providers (MSSPs) | 50 | Service Delivery Managers, Security Analysts |

| Regulatory Compliance in Cybersecurity | 40 | Compliance Officers, Risk Management Professionals |

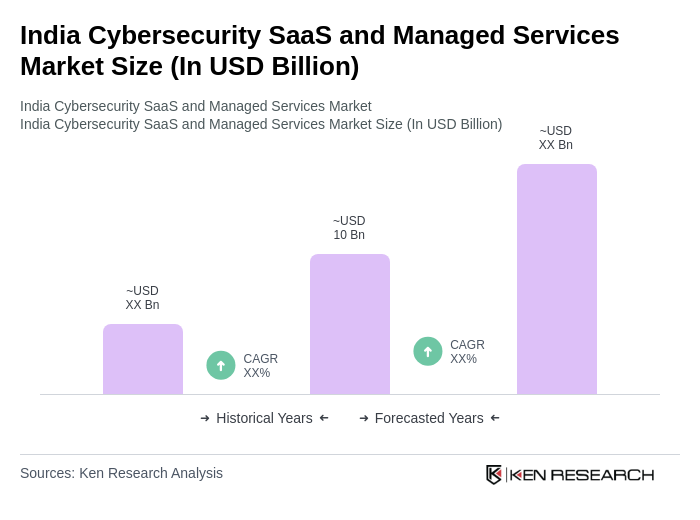

The India Cybersecurity SaaS and Managed Services Market is valued at approximately USD 10 billion, driven by increasing cyber threats, digital transformation initiatives, and heightened awareness of data privacy regulations among organizations.