Region:Europe

Author(s):Rebecca

Product Code:KRAB5868

Pages:94

Published On:October 2025

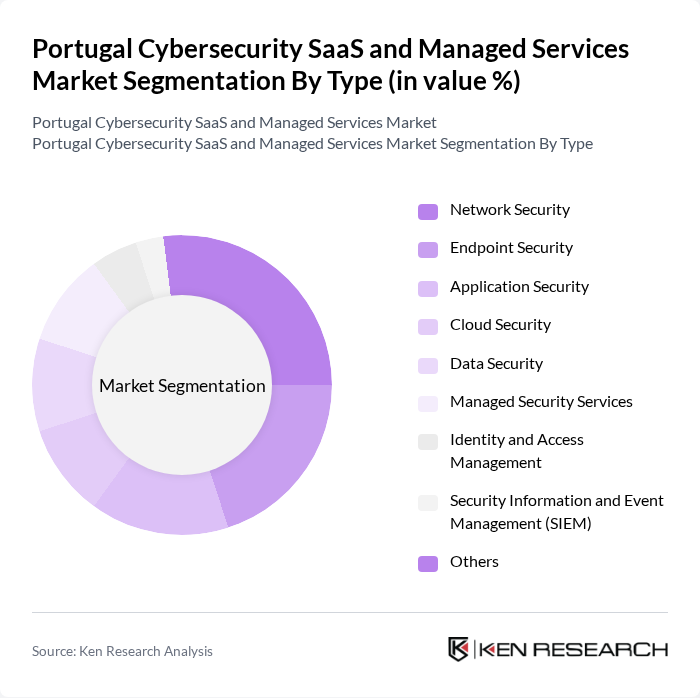

By Type:The market is segmented into various types, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Managed Security Services, Identity and Access Management, Security Information and Event Management (SIEM), and Others. Each of these segments plays a crucial role in addressing specific cybersecurity needs, with Network Security and Endpoint Security representing the largest shares due to widespread adoption across enterprises. Cloud Security and Managed Security Services are rapidly growing as organizations migrate workloads and seek external expertise to meet regulatory obligations.

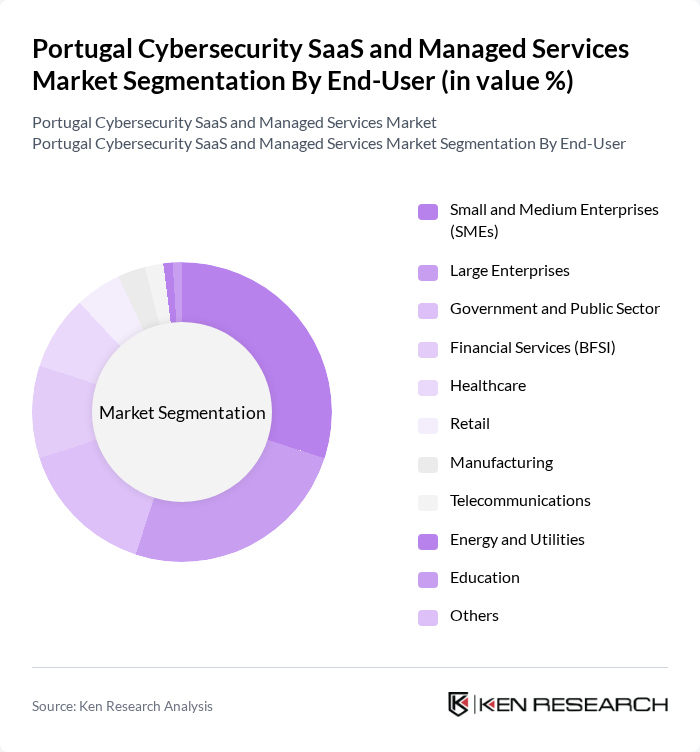

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, Financial Services (BFSI), Healthcare, Retail, Manufacturing, Telecommunications, Energy and Utilities, Education, and Others. Each sector has unique cybersecurity requirements that drive the demand for tailored solutions. SMEs are increasing cybersecurity spending due to Portugal 2030 grants, while BFSI and public sector investments are driven by compliance with the Digital Operational Resilience Act and NIS2.

The Portugal Cybersecurity SaaS and Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as S21sec, VisionWare, Claranet Portugal, Noesis, Critical Software, Cipher (Prosegur), Fortinet, IBM Security, Cisco Systems, Trend Micro, Palo Alto Networks, Sophos, Kaspersky, Check Point Software Technologies, Microsoft contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity market in Portugal appears promising, driven by increasing awareness of cyber threats and the necessity for compliance with stringent regulations. As organizations continue to embrace digital transformation, the demand for innovative cybersecurity solutions will grow. The integration of artificial intelligence and machine learning into security protocols is expected to enhance threat detection and response capabilities, positioning companies to better defend against evolving cyber threats while ensuring data protection and privacy.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Managed Security Services Identity and Access Management Security Information and Event Management (SIEM) Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Financial Services (BFSI) Healthcare Retail Manufacturing Telecommunications Energy and Utilities Education Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Service Type | Consulting Services Implementation Services Managed Detection and Response (MDR) Support and Maintenance Services Incident Response Services Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Government Healthcare Retail Manufacturing Telecommunications Energy and Utilities Education Others |

| By Geographic Region | Lisbon Porto Centro Braga Coimbra Faro Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity Solutions | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection Services | 70 | Healthcare IT Directors, Data Privacy Officers |

| SME Cybersecurity Adoption | 110 | Small Business Owners, IT Consultants |

| Government Cybersecurity Initiatives | 60 | Public Sector IT Managers, Policy Makers |

| Cloud Security Services | 80 | Cloud Architects, DevOps Engineers |

The Portugal Cybersecurity SaaS and Managed Services Market is valued at approximately USD 1.2 billion, driven by increasing cyber threats, the need for data protection, and the growing adoption of cloud services among businesses.