Region:Middle East

Author(s):Shubham

Product Code:KRAB5643

Pages:85

Published On:October 2025

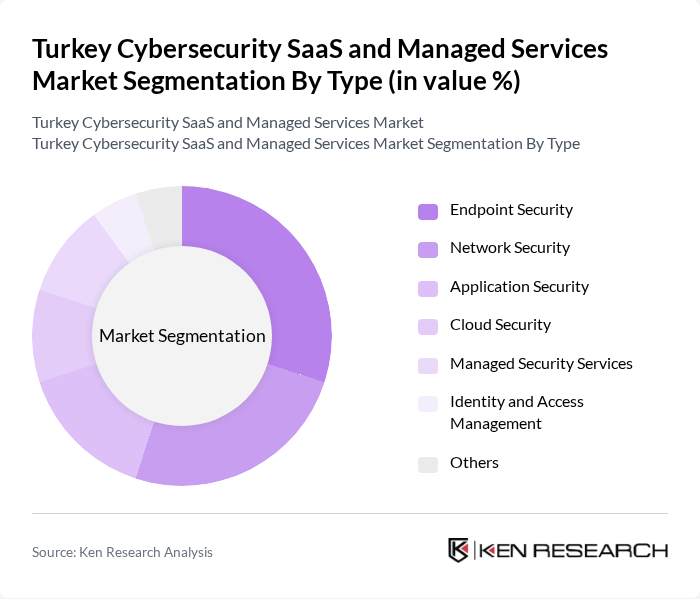

By Type:The market is segmented into various types, including Endpoint Security, Network Security, Application Security, Cloud Security, Managed Security Services, Identity and Access Management, and Others. Among these, Endpoint Security is gaining traction due to the increasing number of remote workers and the need to secure devices accessing corporate networks.

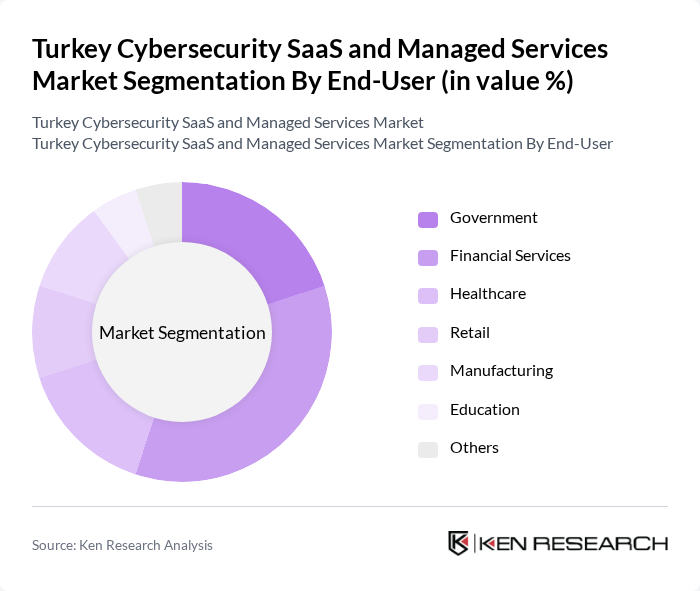

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Manufacturing, Education, and Others. The Financial Services sector is the leading segment due to stringent regulatory requirements and the high value of sensitive data that needs protection.

The Turkey Cybersecurity SaaS and Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro Inc., Fortinet Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., IBM Security, McAfee Corp., Symantec Corporation, Kaspersky Lab, Trend Micro Turkey, CyberArk Software Ltd., Proofpoint Inc., CrowdStrike Holdings Inc., Zscaler Inc., Bitdefender LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkish cybersecurity SaaS and managed services market appears promising, driven by increasing investments in technology and a heightened focus on data protection. As organizations adapt to the evolving threat landscape, the adoption of advanced security solutions, including AI-driven technologies, is expected to rise. Furthermore, the government's commitment to enhancing cybersecurity infrastructure will likely foster innovation and collaboration, creating a robust ecosystem for cybersecurity service providers in Turkey.

| Segment | Sub-Segments |

|---|---|

| By Type | Endpoint Security Network Security Application Security Cloud Security Managed Security Services Identity and Access Management Others |

| By End-User | Government Financial Services Healthcare Retail Manufacturing Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) |

| By Industry Vertical | Telecommunications Energy and Utilities Transportation and Logistics Media and Entertainment |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Chief Information Officers, Data Privacy Officers |

| Retail Cybersecurity Solutions | 70 | Operations Managers, IT Directors |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Adoption | 90 | Business Owners, IT Consultants |

The Turkey Cybersecurity SaaS and Managed Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats and the rising need for data protection among businesses.