Region:Middle East

Author(s):Rebecca

Product Code:KRAA6939

Pages:97

Published On:September 2025

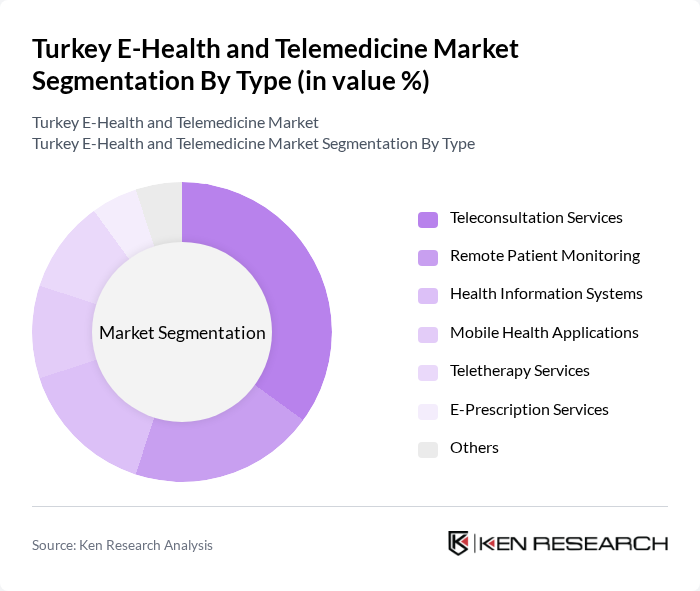

By Type:The Turkey E-Health and Telemedicine Market is segmented into various types, including Teleconsultation Services, Remote Patient Monitoring, Health Information Systems, Mobile Health Applications, Teletherapy Services, E-Prescription Services, and Others. Among these, Teleconsultation Services have emerged as the leading segment, driven by the growing demand for virtual consultations and the convenience they offer to patients. The increasing acceptance of telehealth solutions by both patients and healthcare providers has significantly contributed to the growth of this segment.

By End-User:The market is also segmented by end-users, which include Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, and Others. Hospitals are the leading end-user segment, as they increasingly adopt telemedicine solutions to enhance patient care and streamline operations. The growing need for efficient healthcare delivery and the integration of telehealth services into hospital systems have driven this segment's growth.

The Turkey E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ac?badem Healthcare Group, Anadolu Medical Center, Medtronic Turkey, Siemens Healthineers Turkey, TEB (Türk Ekonomi Bankas?), Vodafone Turkey, Türk Telekom, Eczac?ba??-Monrol, Novartis Turkey, Roche Turkey, Pfizer Turkey, Johnson & Johnson Turkey, GSK Turkey, Abbott Laboratories Turkey, Sanofi Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's e-health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. In the future, the integration of artificial intelligence in telehealth platforms is expected to enhance diagnostic accuracy and patient engagement. Additionally, the focus on preventive healthcare will likely lead to more personalized health solutions. As the government continues to invest in digital health initiatives, the market is poised for significant growth, improving healthcare accessibility and quality across Turkey.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Services Remote Patient Monitoring Health Information Systems Mobile Health Applications Teletherapy Services E-Prescription Services Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Emergency Services Routine Check-ups Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Technologies Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Operations Managers |

| Healthcare Professionals Using E-Health | 150 | Doctors, Nurses, Health Technicians |

| Patients Utilizing Telehealth Services | 200 | Patients, Caregivers |

| Health Policy Makers | 50 | Government Officials, Health Administrators |

| Technology Providers in E-Health | 80 | Product Managers, IT Specialists |

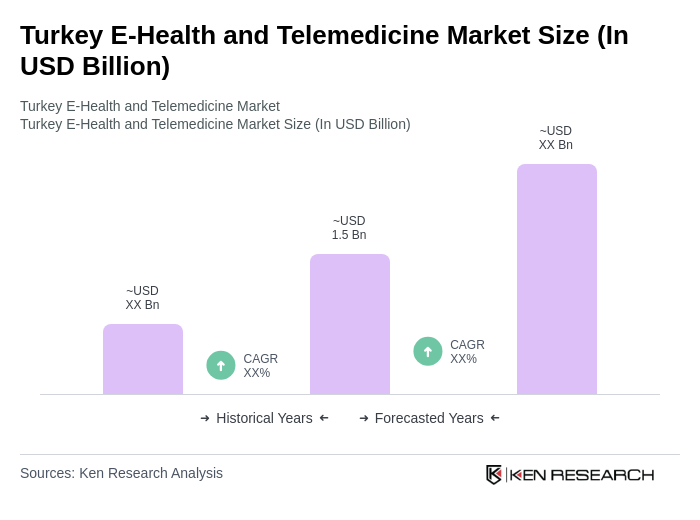

The Turkey E-Health and Telemedicine Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of digital health solutions and the increasing prevalence of chronic diseases, particularly accelerated by the COVID-19 pandemic.