Region:Asia

Author(s):Rebecca

Product Code:KRAB0207

Pages:84

Published On:August 2025

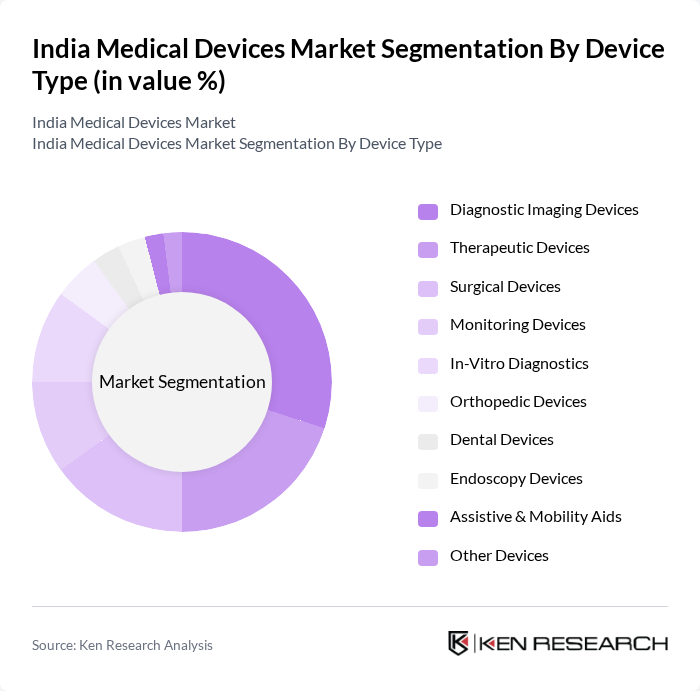

By Device Type:The medical devices market can be segmented into various device types, including diagnostic imaging devices, therapeutic devices, surgical devices, monitoring devices, in-vitro diagnostics, orthopedic devices, dental devices, endoscopy devices, assistive & mobility aids, and other devices. Among these, diagnostic imaging devices are currently leading the market due to their critical role in disease diagnosis and management. The increasing adoption of advanced imaging technologies, such as MRI and CT scans, is driving their demand. Additionally, the rise in chronic diseases and musculoskeletal disorders necessitates accurate diagnostic tools and orthopedic solutions, further solidifying the dominance of these segments.

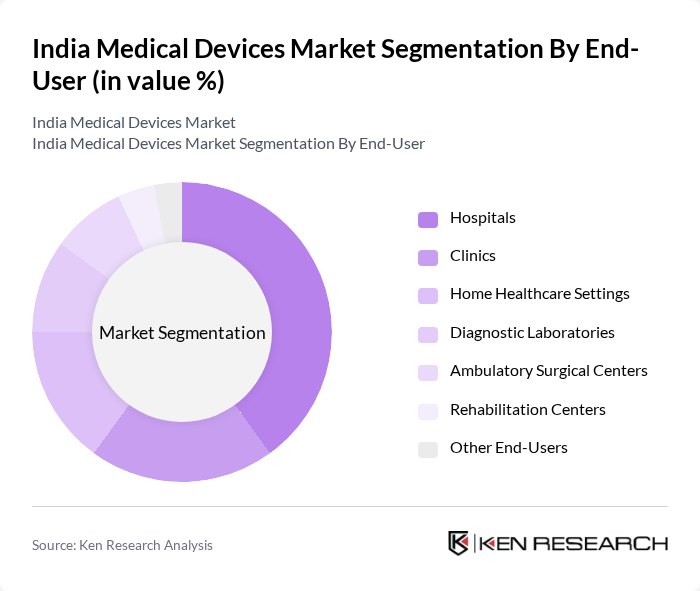

By End-User:The end-user segmentation of the medical devices market includes hospitals, clinics, home healthcare settings, diagnostic laboratories, ambulatory surgical centers, rehabilitation centers, and other end-users. Hospitals are the leading end-user segment, driven by the increasing number of hospital admissions, expansion of private hospital networks, and the growing demand for advanced medical technologies. The rise in surgical procedures, diagnostic imaging, and the need for comprehensive patient care in hospitals further enhance the demand for medical devices in this segment.

The India Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Siemens Healthineers, GE Healthcare, Philips Healthcare, Johnson & Johnson, Abbott Laboratories, Stryker Corporation, B. Braun Melsungen AG, Boston Scientific, Zimmer Biomet, Terumo Corporation, Olympus Corporation, Canon Medical Systems, Hologic, Inc., Fresenius Medical Care, Trivitron Healthcare, Poly Medicure Ltd., Sahajanand Medical Technologies, Transasia Bio-Medicals Ltd., Opto Circuits (India) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The India medical devices market is poised for significant transformation, driven by technological innovations and increasing healthcare investments. The integration of AI and IoT in medical devices is expected to enhance patient monitoring and treatment personalization. Additionally, the expansion of telemedicine services will facilitate remote healthcare access, particularly in rural areas. As the government continues to prioritize healthcare infrastructure, the market is likely to witness accelerated growth, fostering a more robust ecosystem for medical device manufacturers and healthcare providers.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Diagnostic Imaging Devices Therapeutic Devices Surgical Devices Monitoring Devices In-Vitro Diagnostics Orthopedic Devices Dental Devices Endoscopy Devices Assistive & Mobility Aids Other Devices |

| By End-User | Hospitals Clinics Home Healthcare Settings Diagnostic Laboratories Ambulatory Surgical Centers Rehabilitation Centers Other End-Users |

| By Therapeutic Application | Cardiology Orthopedics Neurology Ophthalmology General Surgery Dental Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology Platform | Conventional Electro-mechanical & Disposable Devices Wearable & Remote Monitoring Telehealth & mHealth Robotic Surgery D Printing Augmented / Virtual Reality (AR / VR) Nanotechnology Others |

| By Regulatory Compliance | CDSCO Approval CE Marking FDA Approval ISO Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Directors |

| Medical Device Manufacturers | 60 | Product Managers, Sales Directors |

| Healthcare Professionals | 80 | Doctors, Surgeons, Medical Technologists |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Distributors and Wholesalers | 50 | Distribution Managers, Sales Representatives |

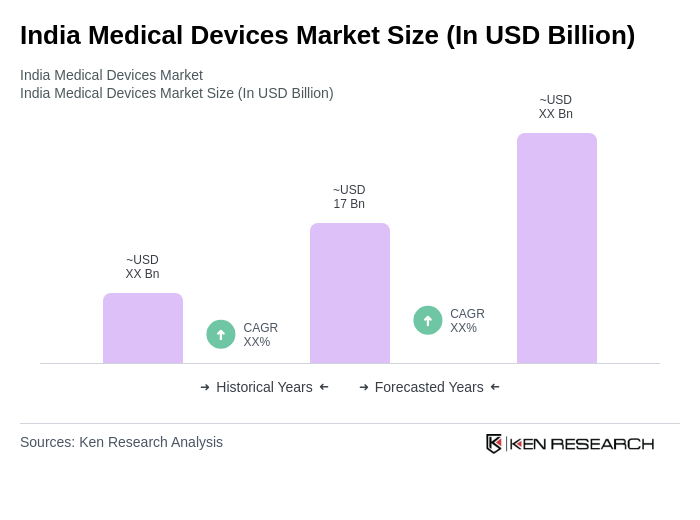

The India Medical Devices Market is valued at approximately USD 17 billion, driven by increasing healthcare expenditure, the prevalence of chronic diseases, and advancements in medical technology. This growth reflects a robust demand for innovative medical devices across the country.