Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA3255

Pages:80

Published On:September 2025

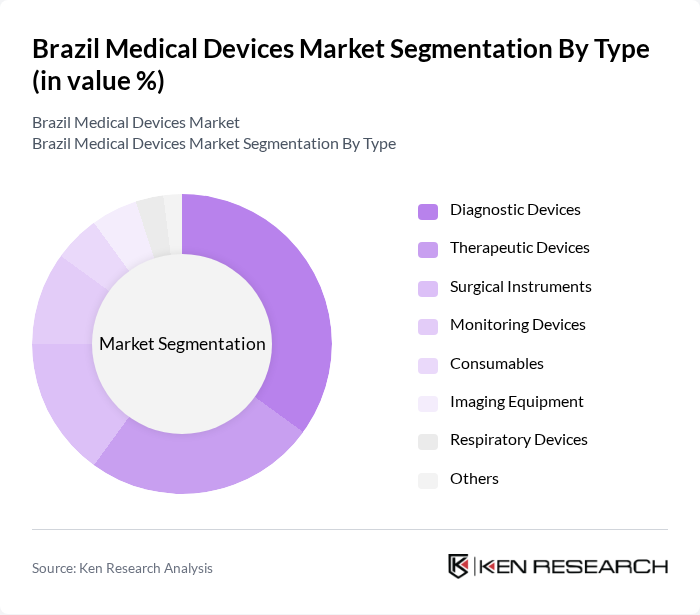

By Type:The medical devices market in Brazil is segmented into diagnostic devices, therapeutic devices, surgical instruments, monitoring devices, consumables, imaging equipment, respiratory devices, and others. Among these,diagnostic deviceslead the market, propelled by the increasing demand for early disease detection, preventive healthcare, and the adoption of advanced diagnostic technologies such as point-of-care testing and molecular diagnostics. The rising awareness of health issues and the emphasis on regular health check-ups continue to drive demand for diagnostic devices.

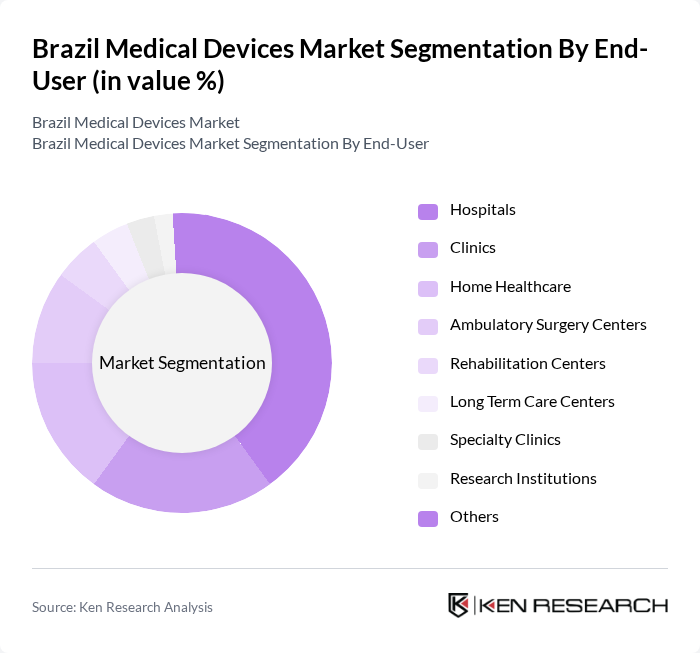

By End-User:The end-user segmentation of the medical devices market includes hospitals, clinics, home healthcare, ambulatory surgery centers, rehabilitation centers, long-term care centers, specialty clinics, research institutions, and others.Hospitalsare the dominant end-user segment, driven by the increasing number of hospital admissions and the need for advanced medical technologies to enhance patient care. The trend of hospitals investing in state-of-the-art medical devices to improve operational efficiency and patient outcomes continues to strengthen this segment’s leadership.

The Brazil Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, GE Healthcare, Medtronic, Johnson & Johnson, Abbott Laboratories, Becton Dickinson, Stryker Corporation, Boston Scientific, Zimmer Biomet, 3M Health Care, Terumo Corporation, Olympus Corporation, Canon Medical Systems, Hologic, Inc., Mindray Medical do Brasil, Fanem Ltda, Baumer S.A., WEM Equipamentos Eletrônicos Ltda, Lifemed Industrial de Equipamentos e Artigos Médicos e Hospitalares S/A, Leventon (Werfen Group), Dräger Brasil Ltda, Baxter International Inc., Fresenius Medical Care Brasil, Cardinal Health contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil medical devices market is poised for significant transformation, driven by technological advancements and increasing healthcare investments. The integration of telemedicine and remote monitoring solutions is expected to enhance patient care, particularly in underserved areas. Additionally, the expansion of private healthcare facilities will likely create new opportunities for medical device manufacturers, fostering innovation and improving access to advanced medical technologies across the country, ultimately benefiting the healthcare system as a whole.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Surgical Instruments Monitoring Devices Consumables Imaging Equipment Respiratory Devices Others |

| By End-User | Hospitals Clinics Home Healthcare Ambulatory Surgery Centers Rehabilitation Centers Long Term Care Centers Specialty Clinics Research Institutions Others |

| By Application | Cardiovascular Orthopedic Neurology Respiratory Dental Oncology Others |

| By Distribution Channel | Direct Sales Distributors Third Party Distributor Online Sales Retail Pharmacies Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Component | Hardware Software Services |

| By Technology | Digital Health Technologies Wearable Devices Robotics AI-Driven Devices Others |

| By Facility Size | Small Medium Large |

| By Mode | Tabletop Standalone Portable |

| By Product Category | CPAP/BiPAP Spirometers Oxygen Concentrators Anesthesia Machines Ventilators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Manufacturers | 60 | Product Managers, Sales Directors |

| Healthcare Providers | 50 | Clinical Directors, Medical Staff |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Distributors and Wholesalers | 40 | Distribution Managers, Logistics Coordinators |

The Brazil Medical Devices Market is valued at approximately USD 360 billion, reflecting significant growth driven by factors such as an aging population, increasing chronic disease prevalence, and advancements in medical technology.