Region:Asia

Author(s):Rebecca

Product Code:KRAB2884

Pages:80

Published On:October 2025

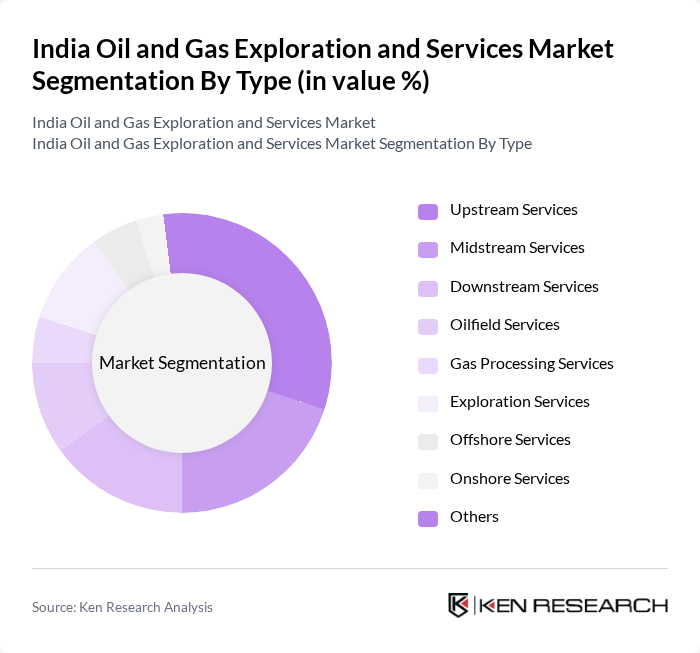

By Type:The market is segmented into Upstream Services, Midstream Services, Downstream Services, Oilfield Services, Gas Processing Services, Exploration Services, Offshore Services, Onshore Services, and Others. Upstream Services focus on exploration and extraction of crude oil and natural gas. Midstream Services involve transportation, storage, and wholesale marketing of crude or refined petroleum products. Downstream Services encompass refining and distribution of petroleum products. Oilfield Services provide specialized support such as drilling, reservoir management, and equipment maintenance. Gas Processing Services include purification and treatment of natural gas. Exploration Services cover seismic surveys and geological analysis. Offshore and Onshore Services pertain to activities conducted at sea or on land, respectively, while Others include ancillary support services.

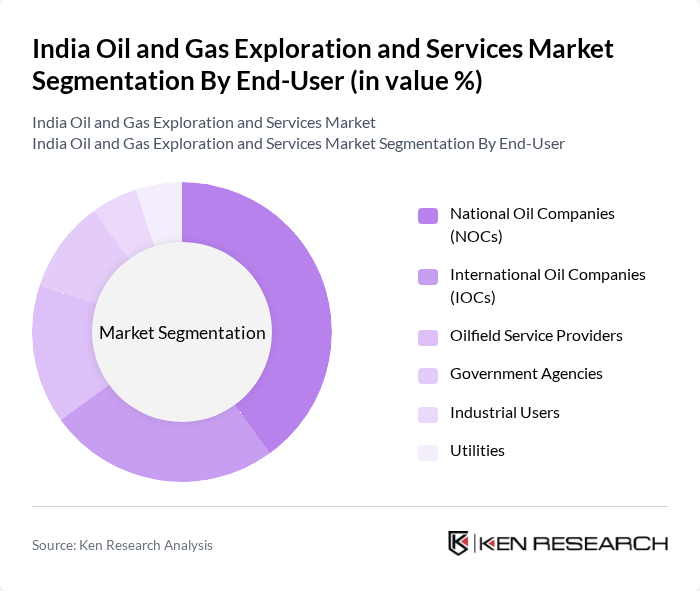

By End-User:End-user segmentation includes National Oil Companies (NOCs), International Oil Companies (IOCs), Oilfield Service Providers, Government Agencies, Industrial Users, and Utilities. National Oil Companies such as ONGC and Oil India Limited are responsible for the majority of domestic exploration and production. International Oil Companies participate through joint ventures and production sharing contracts. Oilfield Service Providers deliver technical expertise and equipment. Government Agencies oversee regulatory compliance and strategic reserves. Industrial Users include large-scale manufacturing and processing industries, while Utilities are involved in power generation and distribution using oil and gas resources.

The India Oil and Gas Exploration and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oil and Natural Gas Corporation Limited (ONGC), Reliance Industries Limited, Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), GAIL (India) Limited, Cairn Oil & Gas, Vedanta Limited, Essar Oil and Gas Exploration and Production Ltd (EOGEPL), Oil India Limited, Petronet LNG Limited, Indian Oil Corporation Limited (IOCL), Adani Total Gas Limited, Schlumberger Limited, Halliburton Company, Baker Hughes Company, TechnipFMC plc, Weatherford International plc, L&T Hydrocarbon Engineering Limited, Engineers India Limited (EIL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India oil and gas exploration market appears promising, driven by a combination of increasing energy demands and government support for exploration initiatives. As the country transitions towards a more sustainable energy framework, investments in renewable energy sources will complement traditional oil and gas operations. Additionally, technological advancements will continue to enhance operational efficiencies, enabling companies to explore and develop resources in previously inaccessible regions, thus ensuring a balanced energy portfolio for the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Services Midstream Services Downstream Services Oilfield Services Gas Processing Services Exploration Services Offshore Services Onshore Services Others |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Oilfield Service Providers Government Agencies Industrial Users Utilities |

| By Region | North India South India East India West and Central India East and Northeast India |

| By Technology | Seismic Survey Technology Drilling Technology Production Technology Refining Technology Digital Oilfield Technology |

| By Application | Exploration Production Transportation Refining |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Incentives for Renewable Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Exploration Projects | 100 | Project Managers, Geologists |

| Offshore Drilling Operations | 80 | Operations Managers, Marine Engineers |

| Oilfield Services Providers | 60 | Business Development Managers, Technical Managers |

| Regulatory Compliance in Exploration | 50 | Compliance Officers, Legal Advisors |

| Environmental Impact Assessments | 40 | Environmental Scientists, Sustainability Managers |

The India Oil and Gas Exploration and Services Market is valued at approximately USD 29 billion, reflecting significant growth driven by rising energy demand, government initiatives, and infrastructure expansion in the sector.