Region:Europe

Author(s):Shubham

Product Code:KRAB2416

Pages:95

Published On:October 2025

By Type:The market is segmented into Onshore Exploration, Offshore Exploration, Drilling Services, Production Services, Maintenance Services, Consulting Services, Seismic Survey Services, Well Completion Services, and Enhanced Oil Recovery (EOR) Services. Onshore Exploration remains the dominant segment, reflecting the concentration of Ukraine’s proven reserves in the Dnieper-Donetsk and Carpathian basins. Offshore Exploration is limited but gaining interest due to untapped Black Sea potential. Drilling and Production Services are critical for operational continuity, while Maintenance, Consulting, and Seismic Survey Services support efficiency and risk management. Well Completion and EOR Services are increasingly relevant as operators seek to maximize output from mature fields .

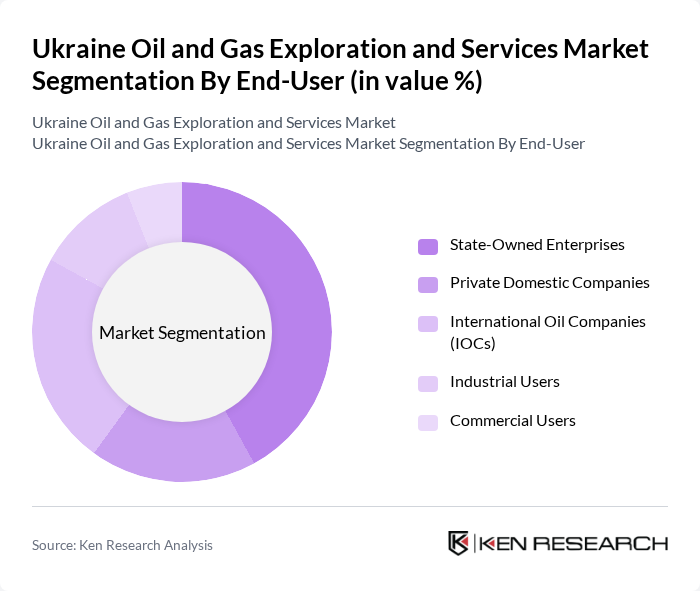

By End-User:The end-user segmentation includes State-Owned Enterprises, Private Domestic Companies, International Oil Companies (IOCs), Industrial Users, and Commercial Users. State-Owned Enterprises, led by Naftogaz and Ukrnafta, dominate due to their control over the majority of production and infrastructure assets. Private Domestic Companies are expanding their role, particularly in gas extraction and service provision. International Oil Companies participate mainly through joint ventures and technical partnerships, while Industrial and Commercial Users drive demand for downstream services and supply contracts .

The Ukraine Oil and Gas Exploration and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naftogaz of Ukraine, Ukrnafta, DTEK Oil & Gas, Burisma Group, Smart Energy, Poltava Petroleum Company, Cadogan Energy Solutions, Alfa Gas, Arawak Energy, Eni S.p.A., Shell Ukraine, ExxonMobil, TotalEnergies, OMV Petrom, Wintershall Dea, Chevron contribute to innovation, geographic expansion, and service delivery in this space.

The future of Ukraine's oil and gas exploration and services market appears promising, driven by a combination of increased domestic demand and foreign investment. As the government continues to prioritize energy independence, technological advancements will play a crucial role in enhancing production efficiency. In future, the integration of renewable energy sources alongside traditional oil and gas operations is expected to reshape the energy landscape, fostering a more sustainable and resilient energy sector that can adapt to global market changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Offshore Exploration Drilling Services Production Services Maintenance Services Consulting Services Seismic Survey Services Well Completion Services Enhanced Oil Recovery (EOR) Services |

| By End-User | State-Owned Enterprises Private Domestic Companies International Oil Companies (IOCs) Industrial Users Commercial Users |

| By Application | Exploration Production Transportation Storage Refining |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Regulatory Compliance | Environmental Compliance Safety Standards Compliance Operational Licensing |

| By Market Segment | Large Enterprises Medium Enterprises Small Enterprises |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 60 | CEOs, Exploration Managers |

| Gas Production Firms | 50 | Operations Directors, Production Engineers |

| Service Providers in Oil & Gas | 40 | Business Development Managers, Technical Directors |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| Industry Analysts and Consultants | 45 | Market Analysts, Energy Consultants |

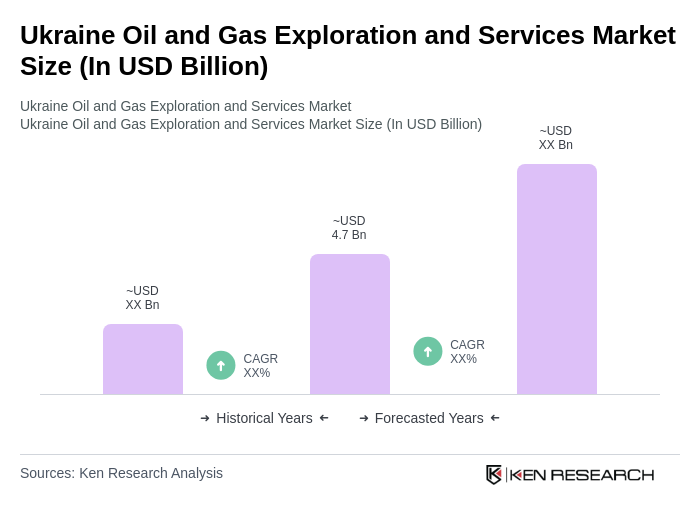

The Ukraine Oil and Gas Exploration and Services Market is valued at approximately USD 4.7 billion. This valuation reflects historical revenue trends and investment flows, particularly influenced by reduced domestic production and increased investment in new wells and legacy asset redevelopment.