Region:Asia

Author(s):Shubham

Product Code:KRAB6255

Pages:84

Published On:October 2025

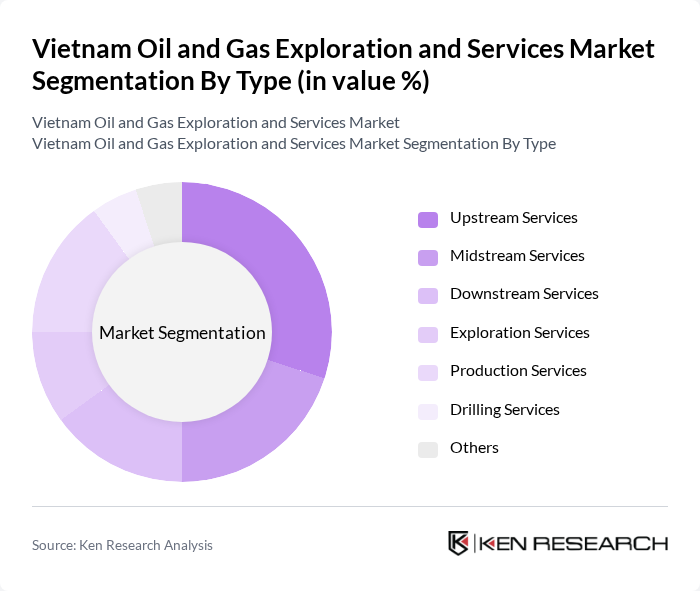

By Type:The market is segmented into various types, including Upstream Services, Midstream Services, Downstream Services, Exploration Services, Production Services, Drilling Services, and Others. Each of these segments plays a crucial role in the overall oil and gas value chain, contributing to the efficiency and effectiveness of operations.

The Upstream Services segment is currently dominating the market due to the increasing exploration and production activities in Vietnam's offshore oil fields. This segment includes drilling, well completion, and production services, which are essential for extracting oil and gas resources. The rising demand for energy, coupled with government support for enhancing domestic production capabilities, has led to significant investments in upstream activities. As a result, this segment is expected to maintain its leadership position in the market.

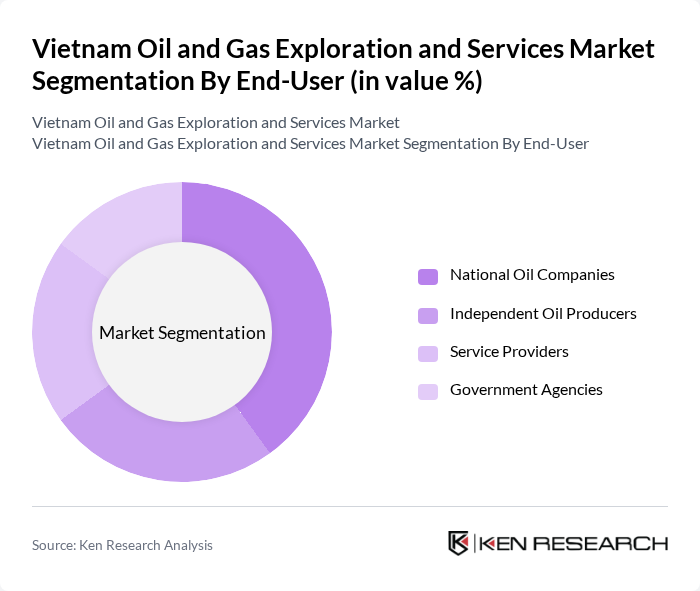

By End-User:The market is segmented by end-users, including National Oil Companies, Independent Oil Producers, Service Providers, and Government Agencies. Each of these end-users has distinct needs and requirements, influencing their demand for oil and gas exploration and services.

The National Oil Companies segment is the leading end-user in the market, primarily due to their significant role in oil and gas exploration and production in Vietnam. These companies, such as PetroVietnam, have extensive resources and capabilities, allowing them to undertake large-scale projects. Their established infrastructure and government backing further enhance their position, making them the dominant players in the oil and gas exploration and services market.

The Vietnam Oil and Gas Exploration and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetroVietnam, Vietsovpetro, PV Drilling, Hoang Long Group, Cuu Long JOC, Binh Son Refining and Petrochemical, PVD Offshore, Vung Ro Petroleum, Thang Long Investment Group, Geoservices, Vietnam National Petroleum Group, Petrovietnam Gas Corporation, Vietnam Oil and Gas Group, PetroVietnam Exploration Production Corporation, Vietnam Oil and Gas Engineering Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's oil and gas exploration market appears promising, driven by increasing energy demands and government support for infrastructure development. As the country transitions towards a more sustainable energy model, the integration of renewable energy sources alongside traditional oil and gas will become crucial. Additionally, advancements in technology will likely enhance exploration efficiency, while strategic partnerships with global players can facilitate knowledge transfer and investment, positioning Vietnam as a competitive player in the regional energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Services Midstream Services Downstream Services Exploration Services Production Services Drilling Services Others |

| By End-User | National Oil Companies Independent Oil Producers Service Providers Government Agencies |

| By Application | Oil Exploration Gas Exploration Oil Refining Gas Processing |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Regulatory Compliance | Environmental Compliance Safety Standards Compliance Operational Licensing Quality Assurance Compliance |

| By Market Maturity | Emerging Market Established Market Declining Market |

| By Policy Support | Subsidies Tax Exemptions Regulatory Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | CEOs, Exploration Managers |

| Drilling Services Providers | 80 | Operations Directors, Project Managers |

| Production Services Firms | 70 | Technical Leads, Production Supervisors |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Industry Consultants | 60 | Market Analysts, Energy Consultants |

The Vietnam Oil and Gas Exploration and Services Market is valued at approximately USD 15 billion, driven by increasing energy demand, government initiatives to boost domestic production, and significant foreign investments in exploration and production activities.