Region:Middle East

Author(s):Rebecca

Product Code:KRAB1806

Pages:95

Published On:October 2025

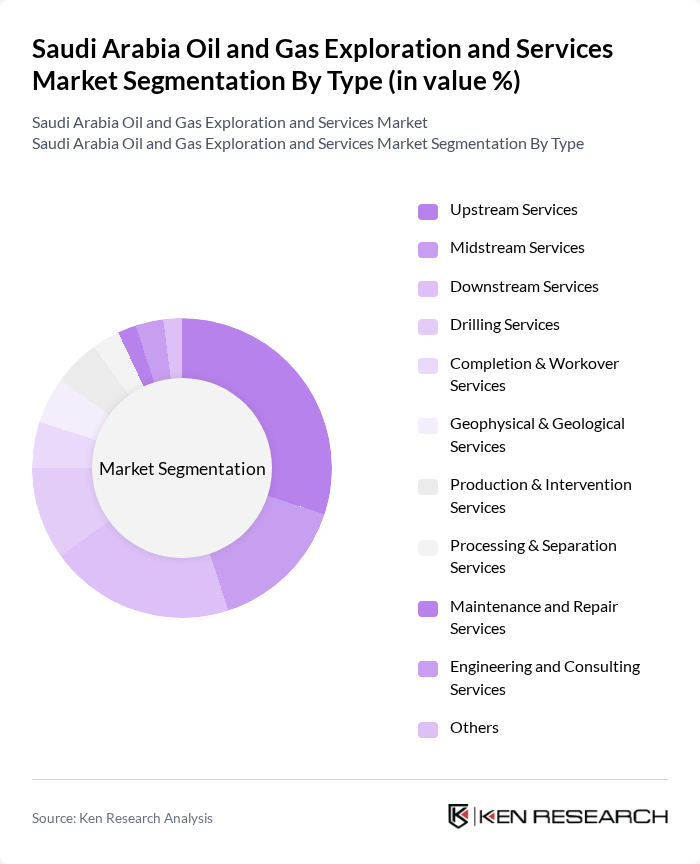

By Type:The market is segmented into a comprehensive range of services supporting all phases of oil and gas operations. Subsegments include Upstream Services, Midstream Services, Downstream Services, Drilling Services, Completion & Workover Services, Geophysical & Geological Services, Production & Intervention Services, Processing & Separation Services, Maintenance and Repair Services, Engineering and Consulting Services, and Others. Upstream Services hold the largest share, driven by robust exploration activity, increased drilling of new wells, and the adoption of advanced digital and automation technologies to optimize hydrocarbon recovery .

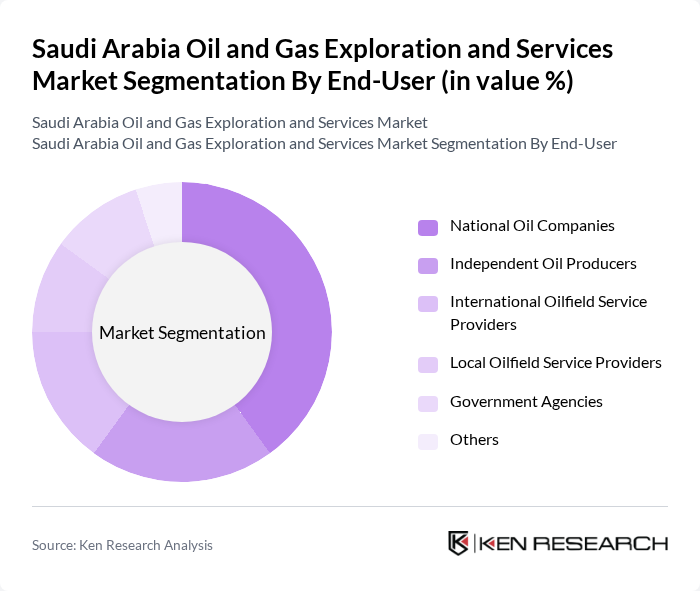

By End-User:The market is segmented by end-user, including National Oil Companies, Independent Oil Producers, International Oilfield Service Providers, Local Oilfield Service Providers, Government Agencies, and Others. National Oil Companies remain the dominant end-users, underpinned by their extensive capital investments, strategic partnerships, and leadership in deploying new technologies to maximize production efficiency and meet domestic and export demand .

The Saudi Arabia Oil and Gas Exploration and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International, National Oilwell Varco, TechnipFMC, Saipem S.p.A., KBR, Inc., Petrofac Limited, JGC Corporation, Aker Solutions, Wood Group PLC, ENI S.p.A., Arabian Drilling Company, Rawabi Oil & Gas, TAQA (Industrialization & Energy Services Company), AlMansoori Specialized Engineering, NESR (National Energy Services Reunited Corp.), Sinopec Oilfield Service Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia oil and gas exploration and services market appears promising, driven by ongoing technological advancements and government support for diversification. As the country invests in renewable energy and enhanced oil recovery techniques, the sector is likely to see increased efficiency and sustainability. Furthermore, the integration of digital technologies will streamline operations, allowing for better resource management and cost reduction. These trends indicate a robust market evolution, positioning Saudi Arabia as a leader in both traditional and emerging energy sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Services Midstream Services Downstream Services Drilling Services Completion & Workover Services Geophysical & Geological Services Production & Intervention Services Processing & Separation Services Maintenance and Repair Services Engineering and Consulting Services Others |

| By End-User | National Oil Companies Independent Oil Producers International Oilfield Service Providers Local Oilfield Service Providers Government Agencies Others |

| By Application | Exploration Production Transportation Refining Enhanced Oil Recovery (EOR) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding Others |

| By Regulatory Compliance | Environmental Compliance Safety Standards Compliance Quality Assurance Compliance Others |

| By Market Maturity | Emerging Market Established Market Growth Market Others |

| By Pricing Strategy | Cost-Plus Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Services | 120 | Exploration Managers, Geoscientists |

| Drilling Services | 100 | Drilling Engineers, Operations Supervisors |

| Seismic Survey Services | 80 | Geophysicists, Survey Technicians |

| Maintenance and Repair Services | 70 | Maintenance Managers, Field Technicians |

| Environmental and Safety Services | 60 | Safety Officers, Environmental Consultants |

The Saudi Arabia Oil and Gas Exploration and Services Market is valued at approximately USD 52 billion, driven by the country's extensive oil reserves and ongoing investments in advanced exploration and production technologies.