Region:Asia

Author(s):Dev

Product Code:KRAB3010

Pages:97

Published On:October 2025

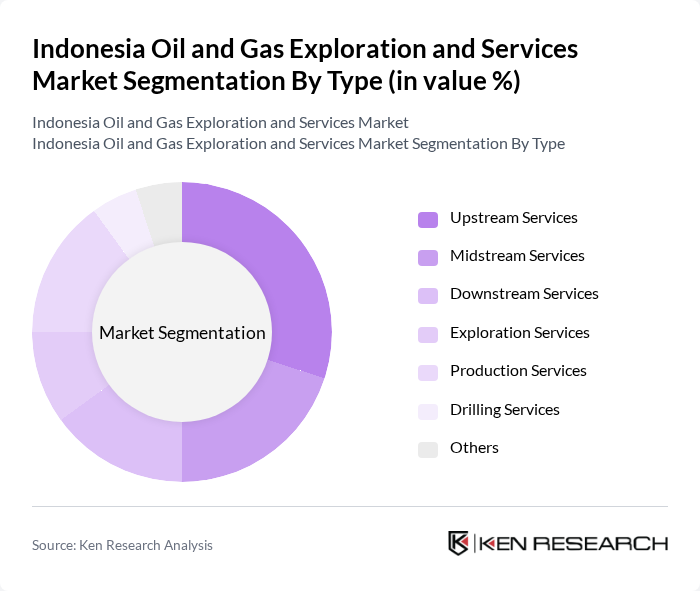

By Type:The market is segmented into various types, including Upstream Services, Midstream Services, Downstream Services, Exploration Services, Production Services, Drilling Services, and Others. Each of these segments plays a crucial role in the overall oil and gas value chain, catering to different operational needs and market demands.

By End-User:The end-user segmentation includes Oil Companies, Gas Companies, Government Agencies, Industrial Users, Utilities, and Others. Each of these end-users has distinct requirements and contributes to the overall demand for oil and gas exploration and services.

The Indonesia Oil and Gas Exploration and Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pertamina, TotalEnergies, Chevron, ConocoPhillips, ENI S.p.A., Schlumberger, Halliburton, Baker Hughes, Medco Energi, Apexindo Pratama Duta Tbk, PetroChina, Woodside Energy, Santos Ltd., Kangean Energy Indonesia, Talisman Energy contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's oil and gas exploration market appears promising, driven by increasing energy demands and government support for infrastructure development. As the country continues to embrace technological advancements, the efficiency of exploration activities is expected to improve significantly. However, companies must navigate regulatory challenges and environmental concerns. Strategic partnerships and investments in sustainable practices will be crucial for long-term success, ensuring that the sector remains competitive and responsive to global energy trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Services Midstream Services Downstream Services Exploration Services Production Services Drilling Services Others |

| By End-User | Oil Companies Gas Companies Government Agencies Industrial Users Utilities Others |

| By Service Type | Seismic Services Drilling Services Production Services Maintenance Services Consulting Services Others |

| By Region | Sumatra Java Kalimantan Sulawesi Papua Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding Others |

| By Regulatory Compliance | Environmental Compliance Safety Compliance Local Content Compliance Others |

| By Technology Adoption | Conventional Technologies Advanced Technologies Digital Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | CEOs, Exploration Managers |

| Service Providers in Drilling | 80 | Operations Directors, Technical Managers |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Environmental Consultants | 60 | Sustainability Managers, Environmental Engineers |

| Investment Analysts in Oil & Gas | 70 | Financial Analysts, Market Researchers |

The Indonesia Oil and Gas Exploration and Services Market is valued at approximately USD 20 billion, reflecting significant growth driven by the country's abundant natural resources and increasing energy demand, alongside substantial investments in exploration and production activities.