Region:Asia

Author(s):Geetanshi

Product Code:KRAA4522

Pages:81

Published On:September 2025

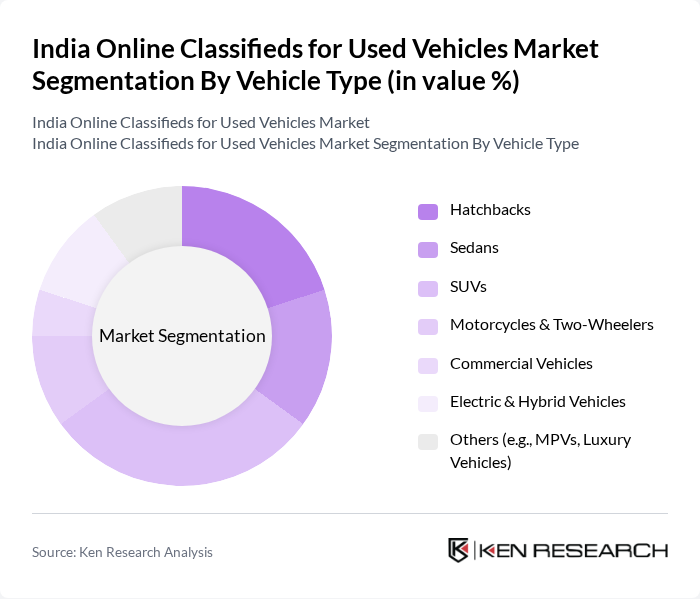

By Vehicle Type:The vehicle type segmentation includes various categories such as Hatchbacks, Sedans, SUVs, Motorcycles & Two-Wheelers, Commercial Vehicles, Electric & Hybrid Vehicles, and Others (e.g., MPVs, Luxury Vehicles). Among these, SUVs have gained significant popularity due to their spaciousness and versatility, appealing to families and adventure seekers alike. Hatchbacks and Sedans also maintain a strong presence due to their affordability and fuel efficiency, making them attractive options for urban commuters.

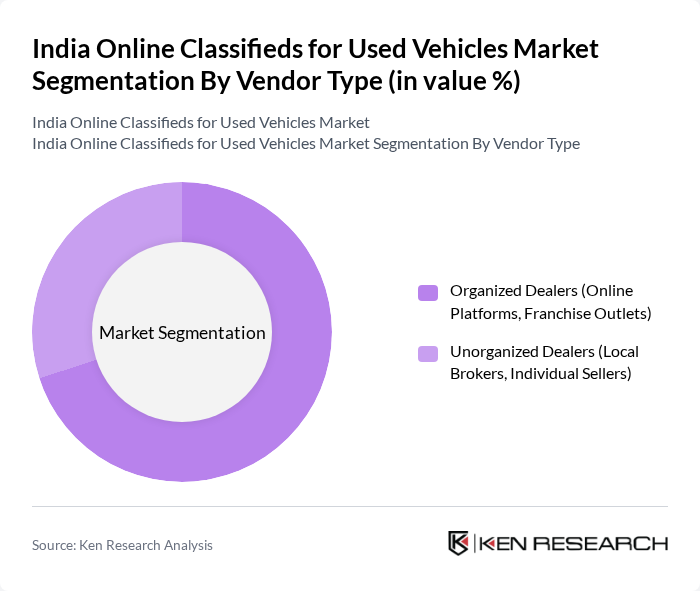

By Vendor Type:The vendor type segmentation consists of Organized Dealers (Online Platforms, Franchise Outlets) and Unorganized Dealers (Local Brokers, Individual Sellers). Organized dealers dominate the market due to their established online presence and trustworthiness among consumers. They offer a wide range of vehicles, often with warranties and quality checks, which enhances consumer confidence in purchasing used vehicles online.

The India Online Classifieds for Used Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Autos, CarDekho, Cars24, QuikrCars, Droom, Mahindra First Choice Wheels, Spinny, CarTrade, CarWale, Truebil, CredR, Maruti Suzuki True Value, Autoportal, BikeDekho, ZigWheels contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online classifieds market for used vehicles in India appears promising, driven by technological advancements and changing consumer preferences. The integration of AI and machine learning is expected to enhance user experiences, making transactions more efficient and personalized. Additionally, the increasing adoption of mobile platforms will likely facilitate easier access to listings, further expanding the market. As consumers become more comfortable with online purchases, the sector is poised for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Hatchbacks Sedans SUVs Motorcycles & Two-Wheelers Commercial Vehicles Electric & Hybrid Vehicles Others (e.g., MPVs, Luxury Vehicles) |

| By Vendor Type | Organized Dealers (Online Platforms, Franchise Outlets) Unorganized Dealers (Local Brokers, Individual Sellers) |

| By Fuel Type | Petrol Diesel CNG/LPG Electric/Hybrid |

| By Region | North India South India East India West India |

| By Price Range | Below INR 3 Lakhs INR 3 Lakhs - INR 5 Lakhs INR 5 Lakhs - INR 8 Lakhs INR 8 Lakhs - INR 12 Lakhs Above INR 12 Lakhs |

| By Transmission | Manual Automatic |

| By Sales Channel | Online Platforms Mobile Applications Social Media Marketplaces Offline Dealerships |

| By Vehicle Condition | Certified Pre-Owned Non-Certified Used Vehicles |

| By Financing Options | Cash Purchases Loan Financing Lease Options Subscription Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Vehicle Buyers | 100 | Recent buyers of used vehicles through online platforms |

| Online Vehicle Sellers | 80 | Individuals who have listed vehicles for sale on classifieds |

| Automotive Industry Experts | 40 | Analysts and consultants specializing in the automotive market |

| Digital Marketing Professionals | 50 | Marketing managers from online classifieds platforms |

| Consumer Behavior Researchers | 40 | Researchers focusing on e-commerce and consumer trends |

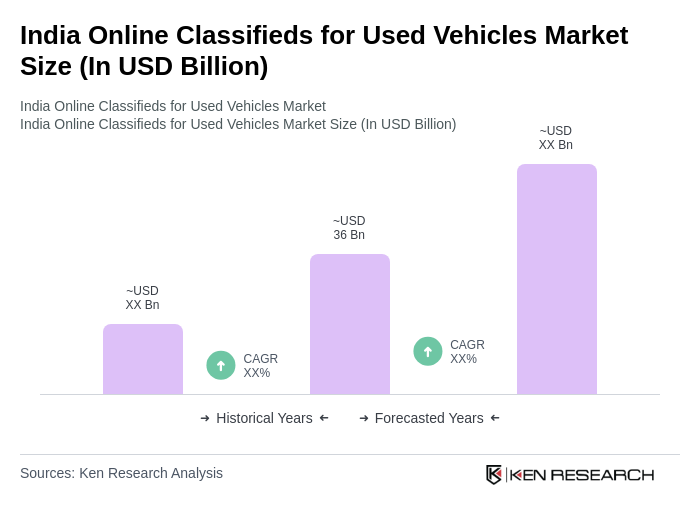

The India Online Classifieds for Used Vehicles Market is valued at approximately USD 36 billion, reflecting significant growth driven by increased internet penetration, smartphone usage, and a shift towards online shopping for vehicles.