Region:Asia

Author(s):Dev

Product Code:KRAB5490

Pages:97

Published On:October 2025

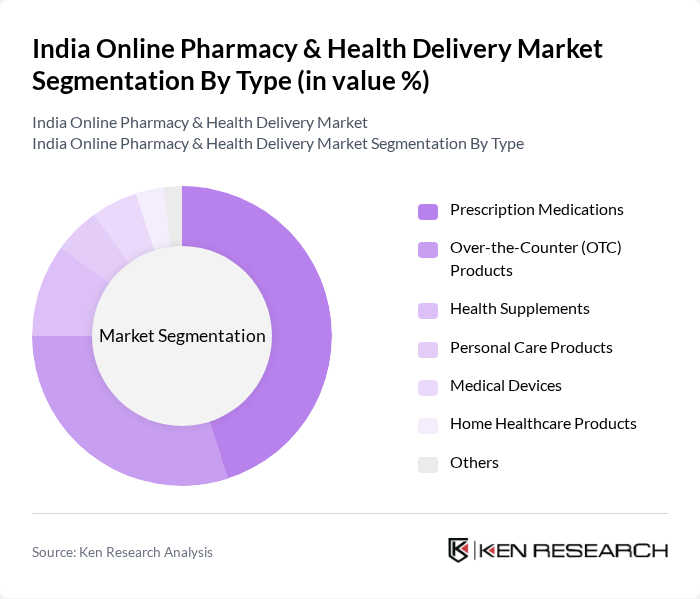

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter (OTC) Products, Health Supplements, Personal Care Products, Medical Devices, Home Healthcare Products, and Others. Among these, Prescription Medications and Over-the-Counter (OTC) Products are the most significant contributors to market growth. The increasing prevalence of chronic diseases and the growing awareness of health and wellness are driving the demand for these products. Consumers are increasingly opting for online platforms to purchase medications due to convenience and accessibility.

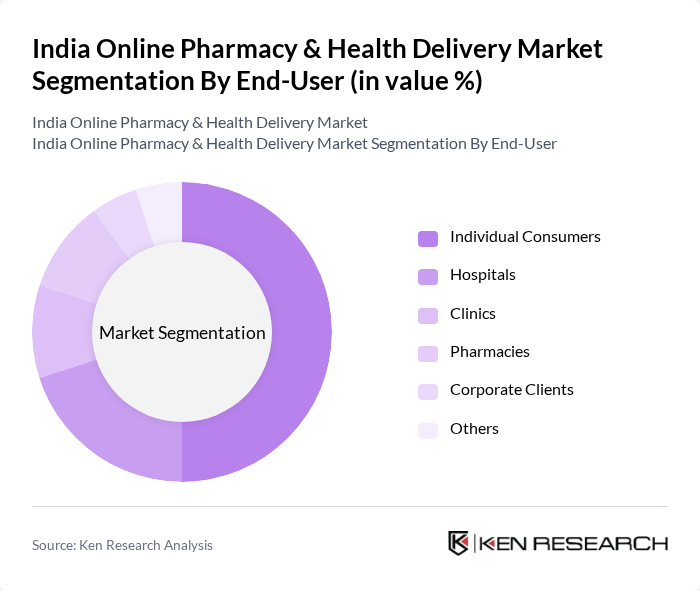

By End-User:The end-user segmentation includes Individual Consumers, Hospitals, Clinics, Pharmacies, Corporate Clients, and Others. Individual Consumers represent the largest segment, driven by the increasing trend of self-medication and the convenience of online shopping. Hospitals and Clinics also contribute significantly, as they increasingly rely on online pharmacies for procurement of medications and supplies. The growing awareness of health management among consumers is further propelling the demand in this segment.

The India Online Pharmacy & Health Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as PharmEasy, Netmeds, 1mg, Medlife, Apollo Pharmacy, Myra Medicines, Zomato Pharmacy, HealthKart, Practo, SastaSundar, CureJoy, Pharmeasy, MedPlus, BigBasket, Tata 1mg contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India online pharmacy and health delivery market appears promising, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence in pharmacy services is expected to enhance operational efficiency and customer engagement. Additionally, the growing trend of preventive healthcare will likely encourage consumers to seek online health solutions, fostering innovation and expansion in the sector. As the market evolves, companies that adapt to these trends will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter (OTC) Products Health Supplements Personal Care Products Medical Devices Home Healthcare Products Others |

| By End-User | Individual Consumers Hospitals Clinics Pharmacies Corporate Clients Others |

| By Region | North India South India East India West India Central India Others |

| By Sales Channel | Direct-to-Consumer Third-Party Platforms Retail Pharmacies Hospital Pharmacies Others |

| By Distribution Mode | Home Delivery Click-and-Collect In-Store Pickup Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Customer Segment | Urban Customers Rural Customers Senior Citizens Young Adults Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Online Pharmacies | 150 | Online Shoppers, Health-Conscious Consumers |

| Healthcare Professional Insights | 100 | Doctors, Pharmacists, Healthcare Administrators |

| Market Trends in E-Pharmacy | 80 | Industry Analysts, Market Researchers |

| Regulatory Impact Assessment | 60 | Policy Makers, Regulatory Affairs Specialists |

| Consumer Satisfaction and Feedback | 120 | First-Time Users, Regular Online Pharmacy Customers |

The India Online Pharmacy & Health Delivery Market is valued at approximately INR 35 billion, reflecting significant growth driven by increased digital health solutions and consumer demand for convenience, particularly accelerated during the pandemic.