Region:Asia

Author(s):Rebecca

Product Code:KRAB5302

Pages:80

Published On:October 2025

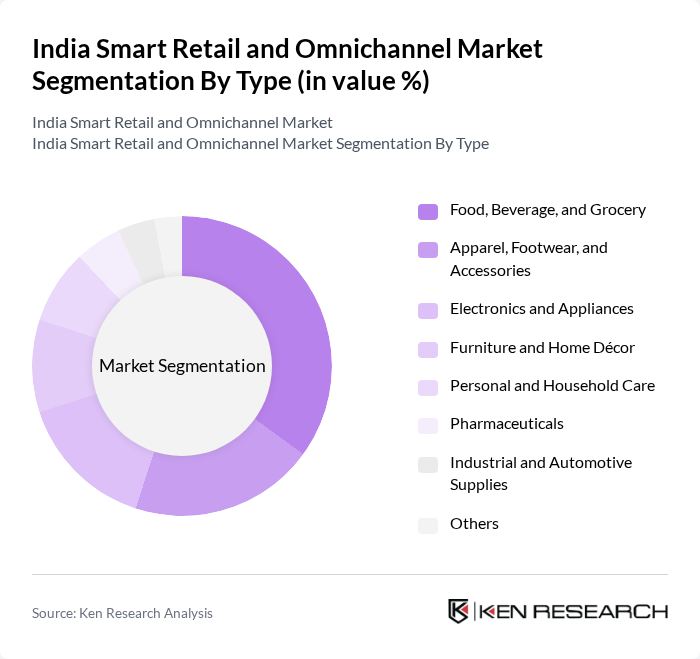

By Type:The market is segmented into various types, including Food, Beverage, and Grocery; Apparel, Footwear, and Accessories; Electronics and Appliances; Furniture and Home Décor; Personal and Household Care; Pharmaceuticals; Industrial and Automotive Supplies; and Others. Among these, theFood, Beverage, and Grocerysegment is currently leading the market due to the surging demand for online grocery shopping, especially following the pandemic. Consumers are increasingly opting for convenience, speed, and variety, which is driving robust growth in this segment .

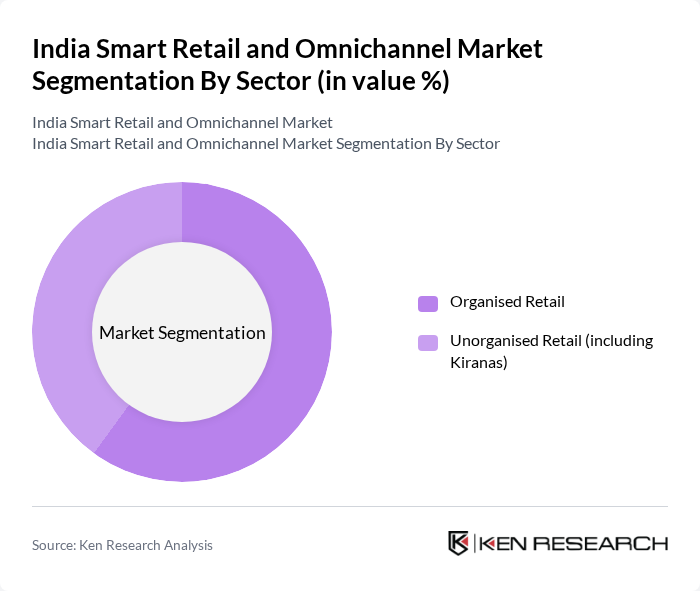

By Sector:The market is divided into Organised Retail and Unorganised Retail (including Kiranas). TheOrganised Retailsector is currently dominating the market, supported by the proliferation of modern retail formats, digital payment adoption, and a growing preference for branded products among consumers. This shift is driven by changing lifestyles, rising disposable income, and the expansion of omnichannel retail models into Tier II and III cities .

The India Smart Retail and Omnichannel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Reliance Retail, Avenue Supermarts Ltd. (DMart), Aditya Birla Fashion & Retail Ltd., Walmart India (Flipkart Wholesale), Amazon India, Flipkart, Tata Digital (Tata Neu, Croma, Westside), Metro Cash & Carry India, Spencer’s Retail (RP-Sanjiv Goenka Group), V-Mart Retail Ltd., BigBasket (Tata Group), Nykaa, Zomato, Paytm Mall, Snapdeal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India smart retail and omnichannel market appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI and data analytics, personalized shopping experiences will become more prevalent. Additionally, the integration of sustainable practices is expected to gain traction, aligning with consumer values. The expansion into Tier II and III cities will further enhance market reach, creating new opportunities for growth and innovation in the retail sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Food, Beverage, and Grocery Apparel, Footwear, and Accessories Electronics and Appliances Furniture and Home Décor Personal and Household Care Pharmaceuticals Industrial and Automotive Supplies Others |

| By Sector | Organised Retail Unorganised Retail (including Kiranas) |

| By Distribution Channel | E-commerce Platforms Hypermarkets & Supermarkets Convenience Stores Speciality Stores Department Stores Others |

| By Region | North India East and Central India West India South India |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Omnichannel Retail Strategies | 100 | Retail Executives, Omnichannel Managers |

| Consumer Shopping Preferences | 150 | General Consumers, Online Shoppers |

| Supply Chain Innovations in Retail | 80 | Supply Chain Managers, Logistics Coordinators |

| Impact of Technology on Retail | 60 | IT Managers, Digital Transformation Leads |

| Customer Experience in Retail | 90 | Customer Service Managers, Experience Designers |

The India Smart Retail and Omnichannel Market is valued at approximately USD 950 billion, reflecting significant growth driven by digital technology adoption, internet penetration, and changing consumer preferences for integrated shopping experiences.