Region:Asia

Author(s):Geetanshi

Product Code:KRAA0287

Pages:86

Published On:August 2025

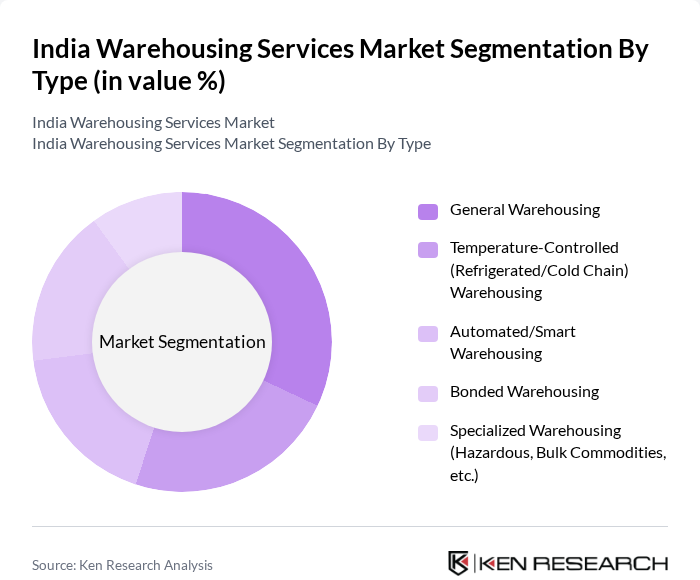

By Type:The warehousing services market can be segmented into various types, including General Warehousing, Temperature-Controlled (Refrigerated/Cold Chain) Warehousing, Automated/Smart Warehousing, Bonded Warehousing, and Specialized Warehousing (Hazardous, Bulk Commodities, etc.). Each of these sub-segments caters to specific needs and industries, with varying levels of demand based on consumer behavior and technological advancements .

The General Warehousing segment is currently dominating the market due to its versatility and ability to cater to a wide range of industries. This segment is favored by businesses looking for cost-effective storage solutions without specific temperature requirements. The increasing trend of online shopping has also led to a surge in demand for general warehousing, as retailers seek to store products closer to consumers for faster delivery. The flexibility and scalability of general warehousing make it a preferred choice for many businesses .

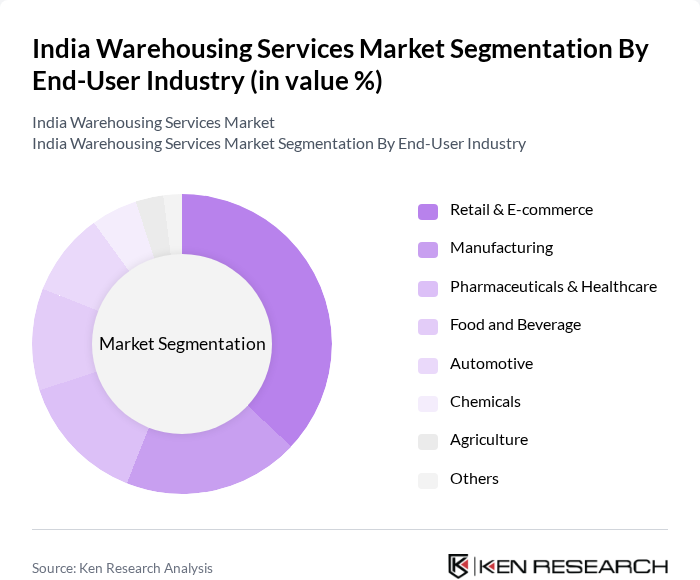

By End-User Industry:The warehousing services market is segmented by end-user industries, including Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, Chemicals, Agriculture, and Others. Each industry has unique requirements that influence the type of warehousing services utilized, with varying levels of growth and demand .

The Retail & E-commerce segment is the leading end-user industry in the warehousing services market, driven by the exponential growth of online shopping and the need for efficient logistics solutions. This sector demands quick turnaround times and flexible storage options, leading to increased investments in warehousing infrastructure. The rise in consumer expectations for fast delivery has further solidified the dominance of this segment, making it a critical driver of growth in the warehousing services market .

The India Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mahindra Logistics, Gati Ltd., DHL Supply Chain India, Blue Dart Express, TCI Supply Chain Solutions (Transport Corporation of India), Allcargo Logistics, Xpressbees, Delhivery, Rivigo, Snowman Logistics, Stellar Value Chain Solutions, TVS Supply Chain Solutions, Future Supply Chain Solutions, Adani Logistics, Avvashya CCI (Allcargo Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India warehousing services market appears promising, driven by technological advancements and evolving consumer preferences. The integration of automation and AI is expected to enhance operational efficiency, while the expansion of cold chain logistics will cater to the growing demand for perishable goods. Furthermore, as sustainability becomes a priority, companies are likely to invest in eco-friendly warehousing solutions, aligning with global trends towards greener practices and reducing carbon footprints.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Temperature-Controlled (Refrigerated/Cold Chain) Warehousing Automated/Smart Warehousing Bonded Warehousing Specialized Warehousing (Hazardous, Bulk Commodities, etc.) |

| By End-User Industry | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive Chemicals Agriculture Others |

| By Region | North India South India East India West India |

| By Application | Retail Distribution E-commerce Fulfillment Bulk Storage Cross-Docking Value-Added Services (Packaging, Sorting, Labelling, etc.) Others |

| By Service Type | Storage Services Value-Added Services Transportation & Distribution Services Inventory Management Others |

| By Technology Adoption | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Robotics & Automation RFID & IoT Solutions Others |

| By Ownership | Private Warehouses Public Warehouses Bonded Warehouses Cooperative Warehouses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| E-commerce Fulfillment Centers | 80 | Operations Managers, Supply Chain Analysts |

| Cold Storage Facilities | 60 | Facility Managers, Quality Control Supervisors |

| Third-Party Logistics Providers | 90 | Business Development Managers, Account Executives |

| Manufacturing Warehousing Solutions | 70 | Production Managers, Inventory Control Specialists |

The India Warehousing Services Market is valued at approximately USD 60 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and government infrastructure initiatives.