Region:Europe

Author(s):Rebecca

Product Code:KRAA0324

Pages:84

Published On:August 2025

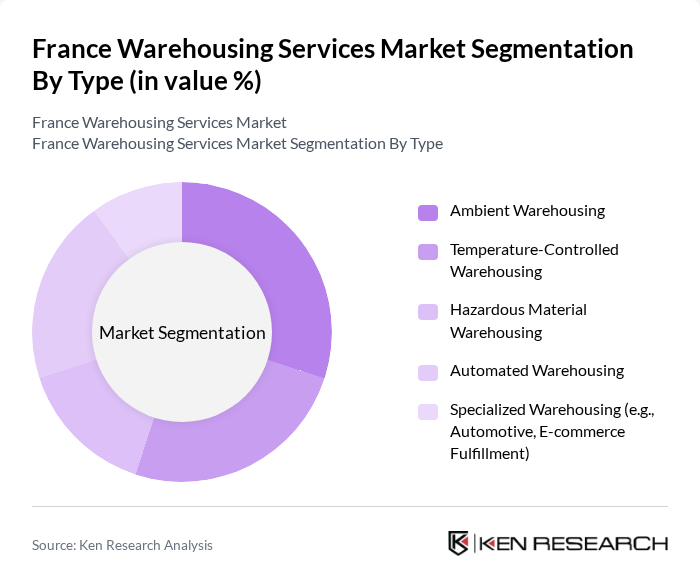

By Type:The market is segmented into various types of warehousing services, including Ambient Warehousing, Temperature-Controlled Warehousing, Hazardous Material Warehousing, Automated Warehousing, and Specialized Warehousing (e.g., Automotive, E-commerce Fulfillment). Each type serves distinct needs based on the nature of the goods stored and the specific requirements of different industries .

The Ambient Warehousing segment is currently dominating the market due to its versatility and ability to accommodate a wide range of products. This type of warehousing is essential for industries such as retail and manufacturing, where goods do not require specific temperature controls. The increasing demand for quick and efficient storage solutions, coupled with the growth of e-commerce and omnichannel retail, has further propelled the need for ambient warehousing facilities. As a result, this segment is expected to maintain its leadership position in the market .

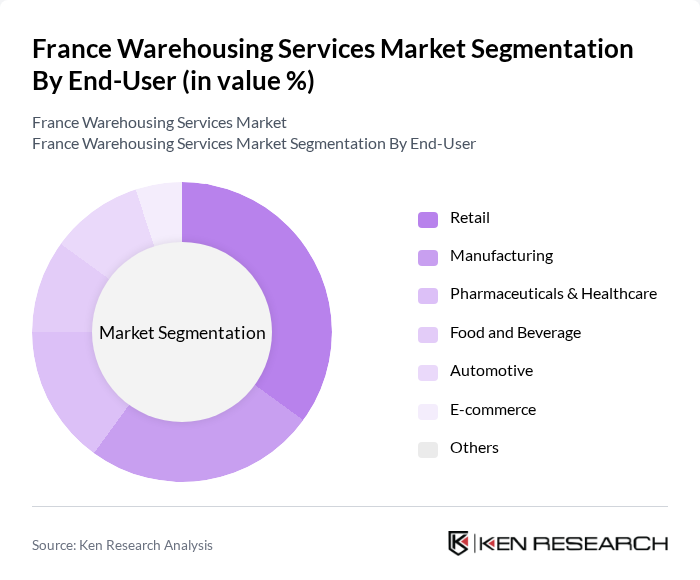

By End-User:The end-user segmentation includes Retail, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, E-commerce, and Others. Each sector has unique requirements that influence the type of warehousing services utilized, reflecting the diverse nature of the market .

The Retail sector is the leading end-user of warehousing services, driven by the rapid growth of e-commerce, omnichannel retail strategies, and the need for efficient inventory management. Retailers require flexible warehousing solutions to accommodate fluctuating demand and seasonal variations. The increasing trend of online shopping and last-mile delivery has further intensified the need for efficient warehousing and distribution networks, solidifying the retail sector's dominance in the market .

The France Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as FM Logistic, Geodis, XPO Logistics, Kuehne + Nagel, DB Schenker, DHL Supply Chain, ID Logistics, CEVA Logistics, Bolloré Logistics, DSV, Rhenus Logistics, U-Logistique SAS, Amazon France Logistique SAS, Groupe Charles André, Stef, Stef Logistique, Stef Transport, Stef International, Stef Multimodal, Stef Iberica contribute to innovation, geographic expansion, and service delivery in this space .

The future of the France warehousing services market appears promising, driven by ongoing digital transformation and sustainability initiatives. As companies increasingly adopt automation and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable practices will likely reshape warehousing strategies, aligning with consumer preferences for environmentally friendly solutions. These trends will create a dynamic landscape, fostering innovation and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Hazardous Material Warehousing Automated Warehousing Specialized Warehousing (e.g., Automotive, E-commerce Fulfillment) |

| By End-User | Retail Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive E-commerce Others |

| By Service Type | Storage Services Value-Added Services (e.g., Packaging, Labelling, Kitting) Inventory Management Transportation & Distribution Services Cross-Docking Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Internet of Things (IoT) Solutions Robotics Process Automation (RPA) RFID & Barcode Systems Others |

| By Location | Urban Warehousing Suburban Warehousing Rural Warehousing Port-Centric Warehousing Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing Cooperative Warehousing Others |

| By Duration of Storage | Short-Term Storage Long-Term Storage Seasonal Storage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Services | 60 | Warehouse Managers, Logistics Coordinators |

| Cold Storage Facilities | 40 | Operations Directors, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 50 | eCommerce Operations Managers, Inventory Control Specialists |

| Third-Party Logistics Providers | 45 | Business Development Managers, Client Relationship Managers |

| Manufacturing Warehousing Solutions | 55 | Production Managers, Supply Chain Executives |

The France Warehousing Services Market is valued at approximately USD 14.5 billion, driven by increasing demand for efficient logistics solutions, e-commerce growth, and advanced supply chain management practices.