Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0163

Pages:82

Published On:August 2025

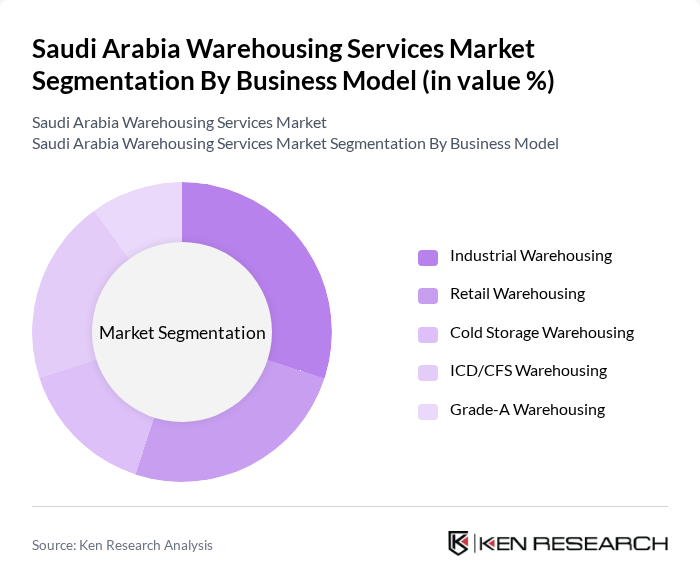

By Business Model:The warehousing services market can be segmented into various business models, including Industrial Warehousing, Retail Warehousing, Cold Storage Warehousing, ICD/CFS Warehousing, and Grade-A Warehousing. Each of these models caters to specific industry needs and consumer demands, reflecting the diverse requirements of the market.

The Industrial Warehousing segment is currently leading the market due to the increasing demand from manufacturing and construction sectors. This segment benefits from the growth of industrial activities and the need for efficient storage solutions. Retail Warehousing is also significant, driven by the booming e-commerce sector, which requires extensive warehousing facilities to manage inventory and fulfill orders promptly. Cold Storage Warehousing is gaining traction due to the rising demand for perishable goods, especially in food and pharmaceuticals. ICD/CFS Warehousing is essential for facilitating international trade, while Grade-A Warehousing, although smaller in market share, is crucial for businesses seeking high-quality storage solutions .

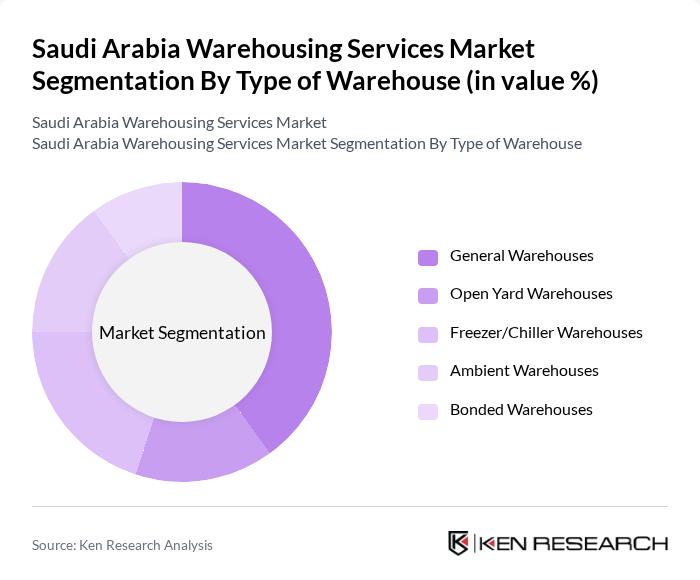

By Type of Warehouse:The market can also be segmented by the type of warehouse, including General Warehouses, Open Yard Warehouses, Freezer/Chiller Warehouses, Ambient Warehouses, and Bonded Warehouses. Each type serves different storage needs and operational requirements.

General Warehouses dominate the market due to their versatility and ability to accommodate various goods. They are essential for businesses across multiple sectors, including retail and manufacturing. Freezer/Chiller Warehouses are increasingly important as the demand for temperature-sensitive products rises, particularly in the food and pharmaceutical industries. Open Yard Warehouses are utilized for bulk storage and are favored by industries dealing with large equipment or materials. Ambient Warehouses cater to non-perishable goods, while Bonded Warehouses are crucial for international trade, allowing goods to be stored without immediate customs duties .

The Saudi Arabia Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Logistics Services (SAL), Bahri Logistics, Agility Logistics, DHL Supply Chain Saudi Arabia, Aramex Saudi Arabia, Almarai Logistics, Al-Futtaim Logistics, Kuehne + Nagel Saudi Arabia, DB Schenker Saudi Arabia, CEVA Logistics Saudi Arabia, GAC Saudi Arabia, FedEx Express Saudi Arabia, JAS Forwarding Saudi Arabia, Panalpina Saudi Arabia, Almajdouie Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the warehousing services market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. The integration of automation and IoT technologies is expected to enhance operational efficiency, while the focus on sustainable practices will align with global trends. Additionally, the ongoing expansion of e-commerce and retail sectors will further stimulate demand for innovative warehousing solutions, positioning the industry for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Industrial Warehousing Retail Warehousing Cold Storage Warehousing ICD/CFS Warehousing Grade-A Warehousing |

| By Type of Warehouse | General Warehouses Open Yard Warehouses Freezer/Chiller Warehouses Ambient Warehouses Bonded Warehouses |

| By End-User | Industrial & Construction FMCG Retail Food & Beverage Pharmaceuticals Automotive Others |

| By Region | Riyadh (Central Region) Jeddah (Western Region) Dammam (Eastern Region) Makkah Madinah Southern Region |

| By Service Type | Storage Services Value-Added Logistics Services Transportation Services Inventory Management Services Courier, Express, and Parcel (CEP) Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Robotics RFID Technology IoT and Smart Warehousing Solutions Others |

| By Duration of Service | Short-Term Warehousing Long-Term Warehousing Seasonal Warehousing Others |

| By Policy Support | Subsidies for Infrastructure Development Tax Incentives for Warehousing Investments Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 50 | Supply Chain Directors, Compliance Officers |

| E-commerce Fulfillment Centers | 70 | Operations Managers, IT Systems Analysts |

| Automotive Parts Warehousing | 40 | Procurement Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Supervisors |

The Saudi Arabia Warehousing Services Market is valued at approximately USD 10 billion, reflecting significant growth driven by the expansion of e-commerce, logistics services demand, and infrastructure investments.