Region:Global

Author(s):Geetanshi

Product Code:KRAA0271

Pages:99

Published On:August 2025

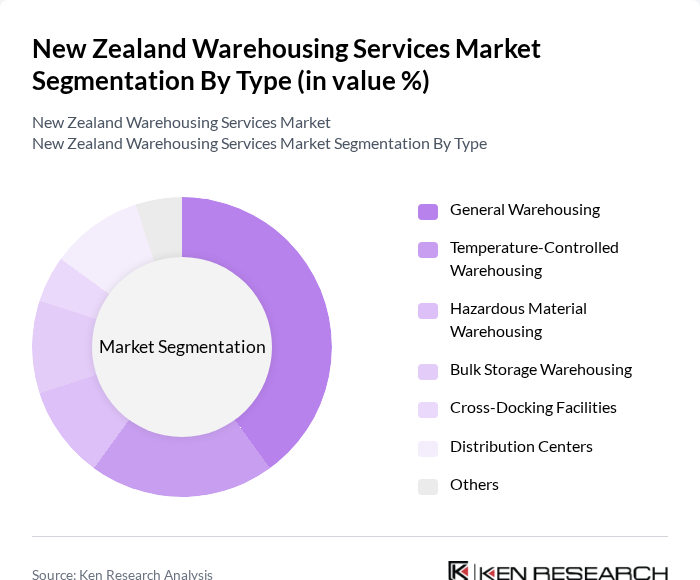

By Type:The warehousing services market is segmented into General Warehousing, Temperature-Controlled Warehousing, Hazardous Material Warehousing, Bulk Storage Warehousing, Cross-Docking Facilities, Distribution Centers, and Others. General Warehousing is the most dominant segment, driven by the increasing demand for storage solutions across various industries. The rise of e-commerce has significantly boosted the need for general warehousing, as businesses seek to optimize their supply chains and improve inventory management. Temperature-controlled warehousing is also growing due to the expansion of the food, beverage, and pharmaceutical sectors, which require specialized storage environments .

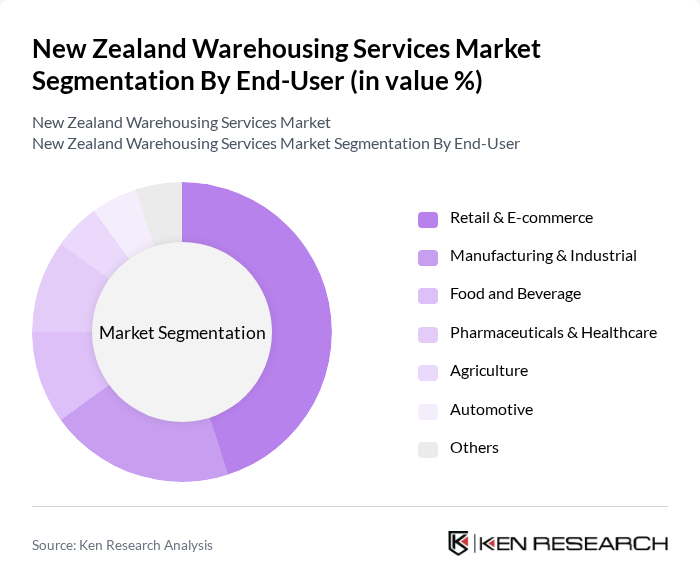

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Industrial, Food and Beverage, Pharmaceuticals & Healthcare, Agriculture, Automotive, and Others. The Retail & E-commerce segment is the leading end-user, fueled by the rapid growth of online shopping and the need for efficient logistics solutions. This segment's dominance is attributed to changing consumer behavior, with more customers preferring online purchases, thereby increasing the demand for warehousing services to support last-mile delivery. Manufacturing, food and beverage, and pharmaceutical sectors also represent significant demand due to their requirements for specialized and temperature-controlled storage .

The New Zealand Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Toll Group, NZL Group, Freightways Limited, C3 Limited, PBT Transport, Fliway Group, MetroBox, Kuehne + Nagel, DB Schenker, DHL Supply Chain, Linfox, C.H. Robinson, XPO Logistics, and CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the New Zealand warehousing services market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As companies increasingly adopt smart warehousing solutions, operational efficiencies are expected to improve significantly. Additionally, the integration of AI and machine learning will enhance inventory management and forecasting capabilities. These trends, coupled with the expansion of e-commerce, will likely create a dynamic environment for warehousing services, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Temperature-Controlled Warehousing Hazardous Material Warehousing Bulk Storage Warehousing Cross-Docking Facilities Distribution Centers Others |

| By End-User | Retail & E-commerce Manufacturing & Industrial Food and Beverage Pharmaceuticals & Healthcare Agriculture Automotive Others |

| By Location | Auckland Region Wellington Region Canterbury Region Other North Island Other South Island Others |

| By Service Type | Storage Services Value-Added Services (Packaging, Labelling, Kitting) Inventory Management Transportation & Distribution Services Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing (3PL) Cooperative Warehousing Others |

| By Technology Utilization | Automated Warehousing Manual Warehousing Hybrid Warehousing Others |

| By Industry Sector | Consumer Goods Automotive Electronics Agriculture & Horticulture Oil & Gas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Supply Chain Coordinators |

| Manufacturing Logistics | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Centers | 70 | eCommerce Directors, Logistics Analysts |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Officers |

| Third-Party Logistics Providers | 55 | Business Development Managers, Account Executives |

The New Zealand Warehousing Services Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and specialized storage facilities.