Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0304

Pages:83

Published On:August 2025

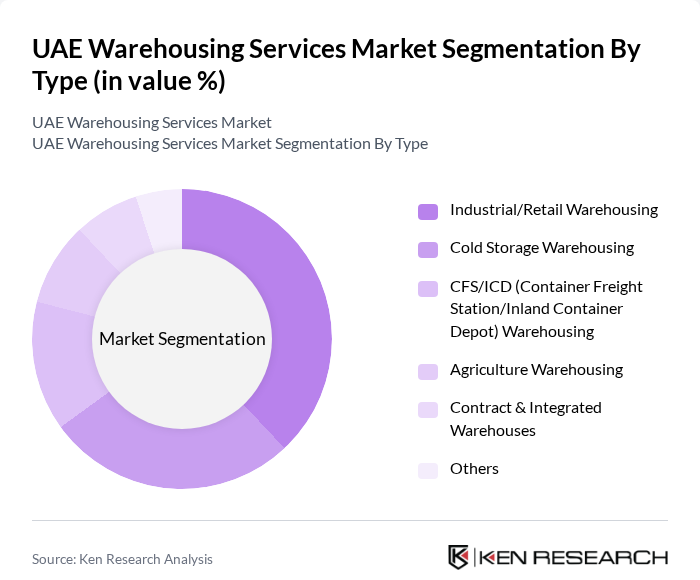

By Type:The warehousing services market can be segmented into Industrial/Retail Warehousing, Cold Storage Warehousing, CFS/ICD (Container Freight Station/Inland Container Depot) Warehousing, Agriculture Warehousing, Contract & Integrated Warehouses, and Others. Industrial/Retail Warehousing remains the leading segment, propelled by the surge in e-commerce, omnichannel retailing, and the increasing need for flexible storage solutions from retail and manufacturing businesses. Cold Storage Warehousing is also expanding rapidly, supported by the growing demand for temperature-controlled logistics in the food, pharmaceutical, and healthcare sectors .

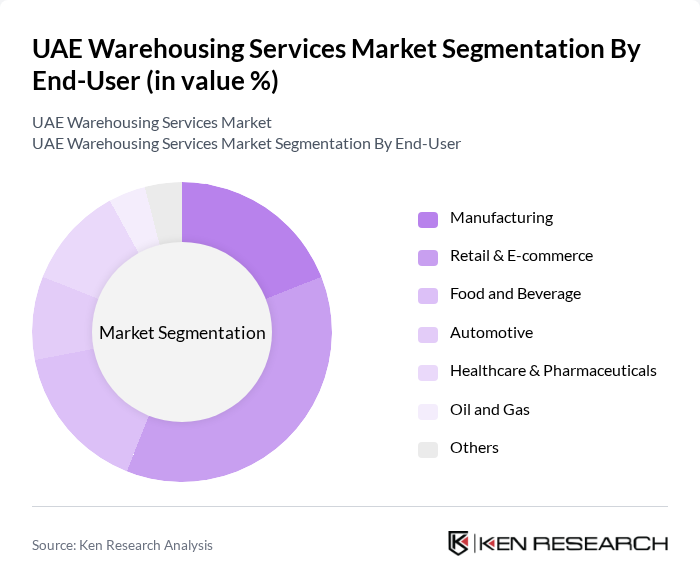

By End-User:The end-user segmentation of the warehousing services market includes Manufacturing, Retail & E-commerce, Food and Beverage, Automotive, Healthcare & Pharmaceuticals, Oil and Gas, and Others. Retail & E-commerce is the most significant contributor, driven by the rapid growth of online shopping, omnichannel distribution, and the need for last-mile delivery solutions. The Food and Beverage sector is also expanding due to rising demand for cold storage and compliance with food safety standards. Healthcare & Pharmaceuticals are increasingly reliant on specialized warehousing for temperature-sensitive and high-value products .

The UAE Warehousing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics, DB Schenker, Kuehne + Nagel, Aramex, DHL Supply Chain, CEVA Logistics, GAC Group, Al-Futtaim Logistics, Emirates Logistics, DSV Solutions, Hellmann Worldwide Logistics, Al Naboodah Group Enterprises, Al Jaber Group, Abu Dhabi Ports Logistics, and RSA Global contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE warehousing services market appears promising, driven by technological advancements and evolving consumer preferences. The integration of automation and AI technologies is expected to enhance operational efficiency, while the growth of e-commerce will continue to shape logistics strategies. Additionally, sustainability initiatives are likely to gain traction, prompting companies to adopt eco-friendly practices. As the market adapts to these trends, it will create new avenues for growth and innovation in warehousing services.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial/Retail Warehousing Cold Storage Warehousing CFS/ICD (Container Freight Station/Inland Container Depot) Warehousing Agriculture Warehousing Contract & Integrated Warehouses Others |

| By End-User | Manufacturing Retail & E-commerce Food and Beverage Automotive Healthcare & Pharmaceuticals Oil and Gas Others |

| By Region | Dubai Abu Dhabi Sharjah KIZAD (Khalifa Industrial Zone Abu Dhabi) JAFZA (Jebel Ali Free Zone) Others |

| By Service Type | Storage Services Value-Added Services (Packaging, Labelling, Kitting, etc.) Transportation & Distribution Services Inventory Management Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Storage & Retrieval Systems (AS/RS) Robotics & Automation RFID & IoT Solutions Others |

| By Duration of Service | Short-Term Warehousing Long-Term Warehousing Seasonal Warehousing Others |

| By Policy Support | Subsidies for Warehousing Development Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| E-commerce Fulfillment Centers | 50 | Operations Managers, Supply Chain Analysts |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Supervisors |

| Third-Party Logistics Providers | 55 | Business Development Managers, Account Executives |

| Automotive Parts Warehousing | 45 | Inventory Managers, Procurement Specialists |

The UAE Warehousing Services Market is valued at approximately USD 6.3 billion, reflecting significant growth driven by e-commerce expansion, increased trade activities, and investments in logistics infrastructure.