Region:Asia

Author(s):Dev

Product Code:KRAC4763

Pages:99

Published On:October 2025

By Type:The market is segmented into various types of Lidar technologies, including Solid-State Lidar, Mechanical Lidar, Frequency Modulated Continuous Wave (FMCW) Lidar, MEMS Lidar, and Others. Among these,Solid-State Lidaris gaining traction due to its compact size, durability, and cost-effectiveness, making it suitable for mass-market vehicles.Mechanical Lidar, while offering high precision, is less favored due to its bulkiness and higher costs. TheFMCW Lidarsegment is emerging for advanced applications, particularly where high-resolution and velocity data are required for autonomous driving and ADAS.

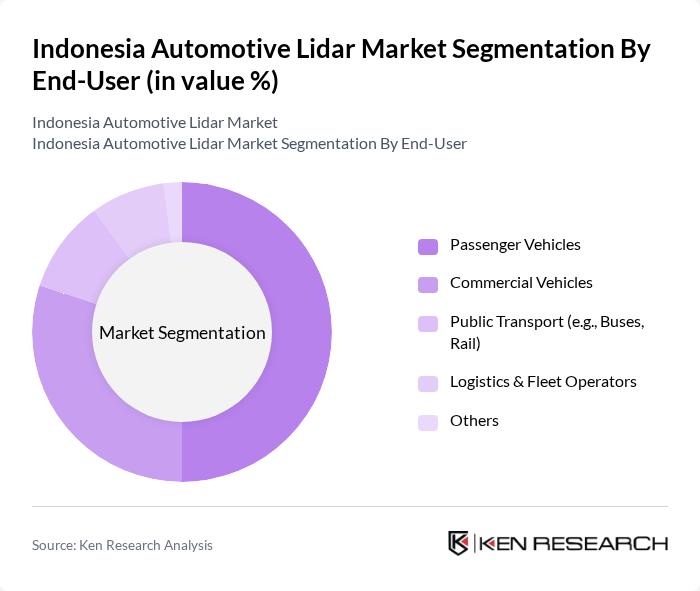

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Public Transport (e.g., Buses, Rail), Logistics & Fleet Operators, and Others. ThePassenger Vehiclessegment leads the market, driven by growing consumer demand for advanced safety features and ADAS integration.Commercial Vehiclesare increasingly adopting Lidar for fleet safety, route optimization, and regulatory compliance, whilePublic Transportis gradually integrating Lidar to enhance operational efficiency and passenger safety.

The Indonesia Automotive Lidar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Velodyne Lidar, Inc., Luminar Technologies, Inc., Ouster, Inc., Innoviz Technologies Ltd., Aeva, Inc., Quanergy Systems, Inc., LeddarTech Inc., RoboSense (Suteng Innovation Technology Co., Ltd.), Hesai Technology, AEye, Inc., Waymo LLC, Mobileye N.V., Continental AG, Bosch Mobility Solutions, Denso Corporation, PT Astra Otoparts Tbk, PT Toyota Astra Motor, PT Mitsubishi Motors Krama Yudha Sales Indonesia, PT Hyundai Motors Indonesia, PT Mobil Anak Bangsa (MAB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian automotive Lidar market appears promising, driven by increasing investments in smart transportation and the growing adoption of electric vehicles. As the government continues to support innovation through funding and regulatory frameworks, the integration of Lidar technology is expected to accelerate. Additionally, partnerships between automotive manufacturers and technology firms will likely enhance the development of advanced Lidar systems, paving the way for safer and more efficient transportation solutions in urban areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid-State Lidar Mechanical Lidar Frequency Modulated Continuous Wave (FMCW) Lidar MEMS Lidar Others |

| By End-User | Passenger Vehicles Commercial Vehicles Public Transport (e.g., Buses, Rail) Logistics & Fleet Operators Others |

| By Application | Autonomous Driving Advanced Driver Assistance Systems (ADAS) Traffic Management & Monitoring Mapping and Surveying Others |

| By Distribution Channel | Direct Sales (OEMs) Online Sales Distributors & System Integrators Others |

| By Component | Hardware (Sensors, Lasers, Detectors) Software (Perception, Mapping, Data Processing) Services (Installation, Maintenance, Integration) Others |

| By Price Range | Low-End Mid-Range High-End Others |

| By Technology | Time-of-Flight (ToF) Phase-Shift Frequency Modulated Continuous Wave (FMCW) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, Engineering Leads |

| Commercial Vehicle Producers | 60 | Operations Managers, Technology Integration Specialists |

| Automotive Component Suppliers | 50 | Supply Chain Managers, R&D Directors |

| Government Transportation Agencies | 40 | Policy Makers, Transportation Planners |

| Research Institutions Focused on Automotive Technology | 40 | Research Scientists, Technology Analysts |

The Indonesia Automotive Lidar Market is valued at approximately USD 40 million, driven by the increasing adoption of advanced driver assistance systems (ADAS) and the rising demand for autonomous vehicles, supported by government initiatives for smart transportation.