Region:Asia

Author(s):Dev

Product Code:KRAA6168

Pages:88

Published On:September 2025

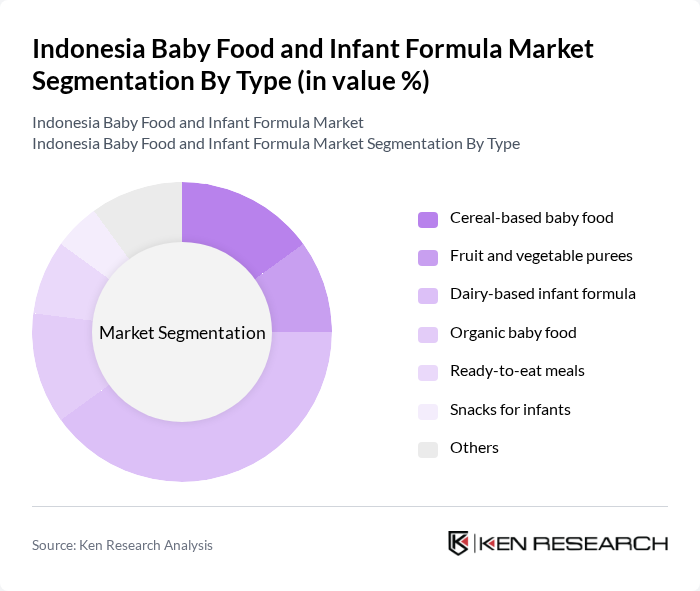

By Type:The market is segmented into various types of baby food and infant formula, including cereal-based baby food, fruit and vegetable purees, dairy-based infant formula, organic baby food, ready-to-eat meals, snacks for infants, and others. Among these, dairy-based infant formula is the leading sub-segment due to its high nutritional value and the growing preference for formula feeding among parents. The increasing awareness of the importance of balanced nutrition for infants has further propelled the demand for dairy-based products.

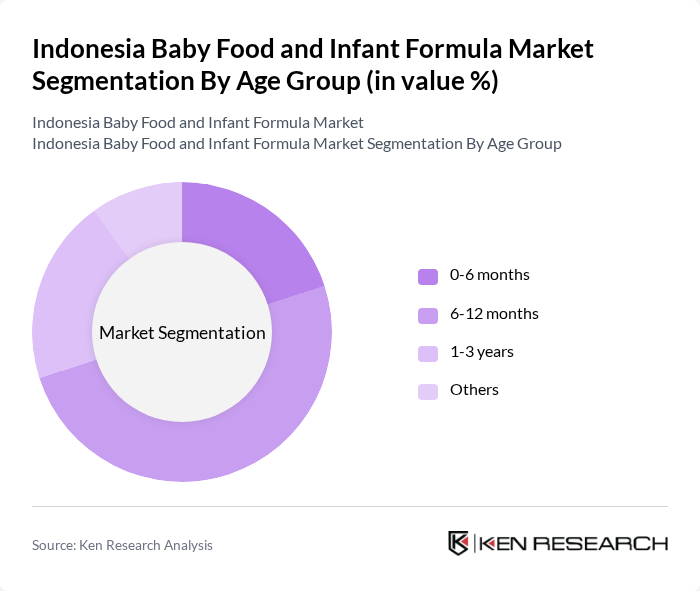

By Age Group:The market is categorized by age groups, including 0-6 months, 6-12 months, 1-3 years, and others. The 6-12 months age group is the most significant segment, as this is the period when infants transition to solid foods and require a variety of nutritious options. Parents are increasingly seeking products that cater to this age group, which has led to a surge in demand for diverse baby food options that support healthy growth and development.

The Indonesia Baby Food and Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Nestle Indonesia, PT. Danone Indonesia, PT. Mead Johnson Nutrition Indonesia, PT. Kalbe Farma Tbk, PT. Heinz ABC Indonesia, PT. Unilever Indonesia Tbk, PT. Friso Indonesia, PT. Nutricia Indonesia Sejahtera, PT. Sarihusada Generasi Mahardhika, PT. Bebelac Indonesia, PT. Orami, PT. Baby Food Indonesia, PT. Pigeon Indonesia, PT. Abbott Indonesia, PT. Hero Supermarket Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia baby food and infant formula market appears promising, driven by evolving consumer preferences and economic growth. As urbanization continues, the demand for convenient and nutritious baby food options will likely rise. Additionally, the increasing focus on health and wellness among parents will propel the market towards organic and specialized products. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and meet the needs of health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereal-based baby food Fruit and vegetable purees Dairy-based infant formula Organic baby food Ready-to-eat meals Snacks for infants Others |

| By Age Group | 6 months 12 months 3 years Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pharmacies Convenience Stores Others |

| By Packaging Type | Jars Pouches Tins Others |

| By Brand Type | Premium brands Mid-range brands Economy brands Others |

| By Nutritional Content | High-protein formulas Fortified formulas Lactose-free options Others |

| By Price Range | Low price Mid price High price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parent Purchasing Behavior | 150 | Parents of infants aged 0-12 months |

| Pediatric Healthcare Insights | 100 | Pediatricians, Nutritionists, and Childcare Experts |

| Retailer Perspectives | 80 | Store Managers and Category Buyers in Baby Food Sections |

| Market Trends Analysis | 70 | Market Analysts and Industry Experts |

| Consumer Attitudes towards Organic Products | 90 | Health-conscious Parents and Caregivers |

The Indonesia Baby Food and Infant Formula Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and increased awareness of infant nutrition among parents.