Indonesia Biodegradable Stretch Film Market Overview

- The Indonesia Biodegradable Stretch Film Market is valued at USD 120 million, based on a five-year historical analysis and considering Indonesia’s share within the Asia Pacific biodegradable stretch film and broader flexible packaging base. This growth is primarily driven by increasing environmental awareness, government initiatives to reduce plastic waste, and rising demand for eco-friendly alternatives in industries such as food, agriculture, and e?commerce packaging.

- Key cities such as Jakarta, Surabaya, and Bandung dominate the market due to their significant industrial activities, logistics hubs, and high population density, which collectively drive packaging consumption. These urban centers are witnessing a surge in demand for biodegradable and recyclable packaging solutions, supported by modern retail formats, growing e?commerce, and corporate sustainability initiatives among food, beverage, and FMCG manufacturers.

- In 2023, the Indonesian government strengthened policy measures on plastic waste reduction, including implementing the Regulation of the Minister of Environment and Forestry No. P.75/MENLHK/SETJEN/KUM.1/10/2019 on the Roadmap of Waste Reduction by Producers, which requires brand owners and retailers to redesign packaging, increase recyclable and degradable materials, and report progress toward specific waste-reduction targets for packaged food and consumer products. This framework, together with local government restrictions on single-use plastics in major cities, is encouraging the use of biodegradable and compostable packaging materials, thereby enhancing the market for biodegradable stretch films.

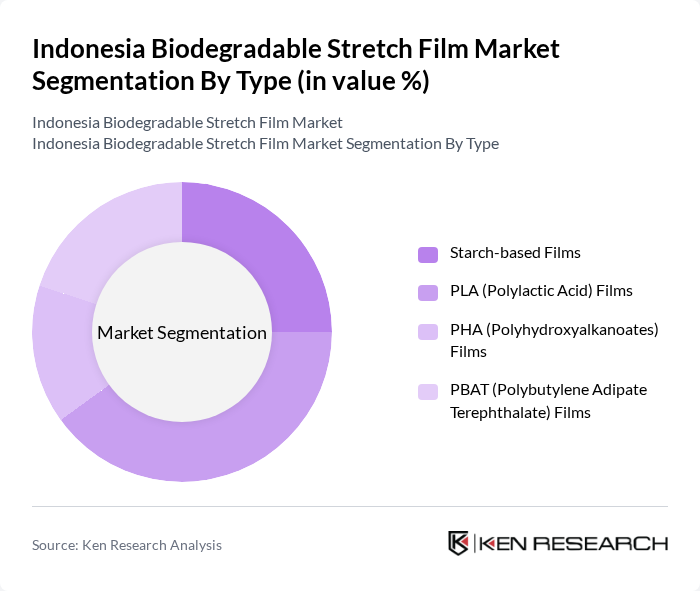

Indonesia Biodegradable Stretch Film Market Segmentation

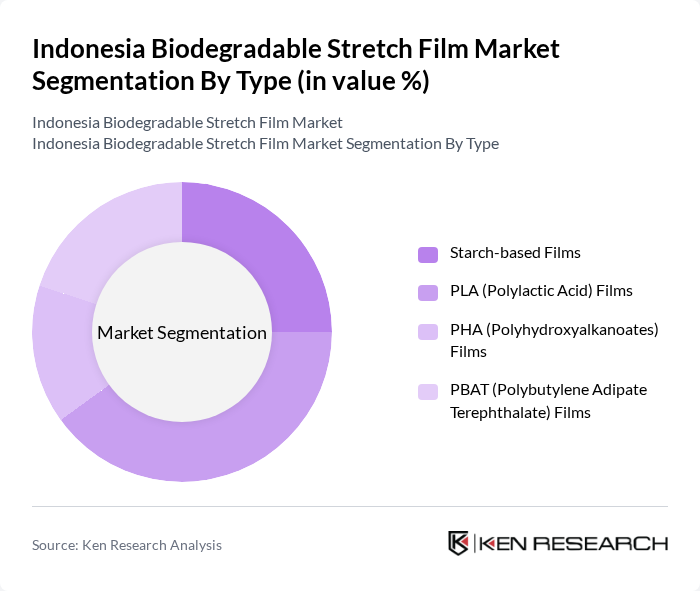

By Type:The biodegradable stretch film market is segmented into various types, including starch-based films, PLA (Polylactic Acid) films, PHA (Polyhydroxyalkanoates) films, and PBAT (Polybutylene Adipate Terephthalate) films, in line with global material classifications for biodegradable stretch films. Starch-based and PLA/PBAT blend films are gaining significant traction due to their good mechanical performance, compatibility with existing stretch-wrapping equipment, and compostability, making them suitable for pallet wrapping, food distribution, and agricultural applications. Increasing consumer demand for sustainable packaging solutions and brand-owner commitments to lower plastic footprints are driving the adoption of these materials, especially in food and beverage, fresh produce, and logistics sectors.

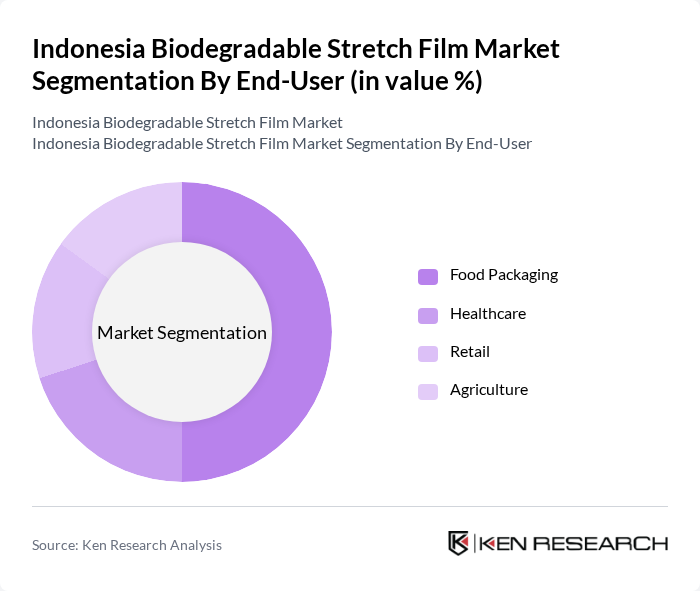

By End-User:The end-user segmentation includes food packaging, healthcare, retail, and agriculture, consistent with major application areas highlighted for biodegradable and compostable films in Asia Pacific. The food packaging sector is the largest consumer of biodegradable stretch films, driven by modern retail expansion, stricter waste-reduction expectations on brand owners, and the need to improve shelf life and protection while reducing conventional plastic use. As consumers become more environmentally conscious, food and beverage manufacturers, quick-service restaurants, and grocery chains are increasingly adopting biodegradable and compostable films for secondary and tertiary packaging to align with both voluntary sustainability targets and government waste-management policies, thereby propelling the growth of this segment relative to other end users.

Indonesia Biodegradable Stretch Film Market Competitive Landscape

The Indonesia Biodegradable Stretch Film Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bioplastik Indonesia, PT Green Packaging Indonesia, EcoFilm Solutions Indonesia, PT BioPack Indonesia, NatureWorks LLC, BASF SE, Novamont S.p.A., BioBag International AS, Amcor plc, Sealed Air Corporation, Smurfit Kappa Group, Mondi Group, Tetra Pak International S.A., Huhtamaki Group, DS Smith plc contribute to innovation, geographic expansion, and service delivery in this space.

Indonesia Biodegradable Stretch Film Market Industry Analysis

Growth Drivers

- Increasing Environmental Awareness:The Indonesian population is becoming increasingly aware of environmental issues, with 70% of consumers expressing concern over plastic waste in future. This awareness is driving demand for sustainable packaging solutions, including biodegradable stretch films. The government reported a 15% increase in eco-friendly product purchases in future, indicating a shift towards greener alternatives. As consumers prioritize sustainability, companies are responding by investing in biodegradable materials, further propelling market growth.

- Government Initiatives for Sustainable Packaging:The Indonesian government has implemented various initiatives to promote sustainable packaging, including the National Plastic Waste Management Roadmap, which aims to reduce plastic waste by 30% in future. In future, the government allocated IDR 500 billion (approximately USD 35 million) to support biodegradable product development. These initiatives are encouraging manufacturers to adopt biodegradable stretch films, aligning with national sustainability goals and enhancing market growth prospects.

- Rising Demand from Food and Beverage Sector:The food and beverage sector in Indonesia is projected to grow by 8% annually, with a significant shift towards sustainable packaging solutions. In future, the sector accounted for 40% of the total demand for biodegradable stretch films, driven by consumer preferences for eco-friendly packaging. Major food brands are increasingly adopting biodegradable options, leading to a surge in production and innovation within the biodegradable stretch film market, further supporting its growth.

Market Challenges

- High Production Costs:The production costs of biodegradable stretch films remain significantly higher than conventional plastics, with estimates indicating a 30% premium for biodegradable materials. This cost disparity poses a challenge for manufacturers, particularly small and medium enterprises (SMEs) that struggle to compete on price. As a result, many companies are hesitant to invest in biodegradable options, limiting market penetration and growth potential in the short term.

- Competition from Conventional Plastics:The Indonesian market is still heavily reliant on conventional plastics, which accounted for 80% of the packaging market in future. The low cost and widespread availability of traditional plastic products create significant competition for biodegradable alternatives. This reliance on conventional materials hinders the adoption of biodegradable stretch films, as consumers and businesses often prioritize cost over sustainability, presenting a substantial challenge for market growth.

Indonesia Biodegradable Stretch Film Market Future Outlook

The future of the biodegradable stretch film market in Indonesia appears promising, driven by increasing environmental awareness and supportive government policies. As consumer preferences shift towards sustainable packaging, manufacturers are likely to invest more in innovative biodegradable solutions. Additionally, the expansion of e-commerce and the food sector will further fuel demand. Collaborations with eco-friendly brands and advancements in biodegradable technology will create new opportunities, positioning the market for significant growth in the coming years.

Market Opportunities

- Expansion in E-commerce Packaging:The rapid growth of e-commerce in Indonesia, projected to reach IDR 300 trillion (approximately USD 21 billion) in future, presents a significant opportunity for biodegradable stretch films. As online retailers seek sustainable packaging solutions, the demand for biodegradable options is expected to rise, providing manufacturers with a lucrative market segment to target.

- Collaborations with Eco-friendly Brands:Partnerships with eco-friendly brands are becoming increasingly important in the biodegradable stretch film market. Collaborating with companies that prioritize sustainability can enhance brand visibility and credibility. In future, 25% of biodegradable film manufacturers reported successful partnerships, leading to increased sales and market share, highlighting the potential for growth through strategic alliances.