Region:Asia

Author(s):Shubham

Product Code:KRAD5352

Pages:99

Published On:December 2025

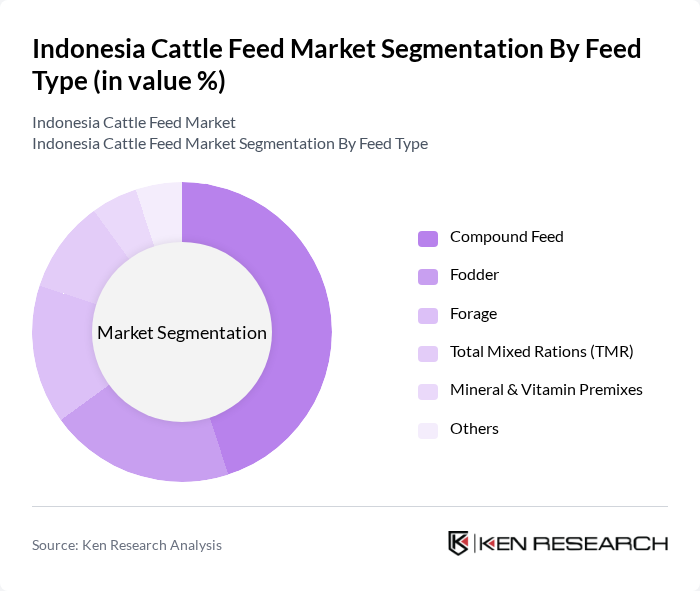

By Feed Type:The feed type segmentation includes various categories such as Compound Feed, Fodder, Forage, Total Mixed Rations (TMR), Mineral & Vitamin Premixes, and Others. Among these, Compound Feed is the leading subsegment due to its balanced nutritional profile, consistent quality, and suitability for intensive and semi-intensive production systems, which are increasingly adopted in Indonesia. The increasing trend of commercial farming, the growth of integrated feed–farm operations, and the need for high-quality formulated rations to improve milk yield and weight gain have further propelled the demand for Compound Feed.

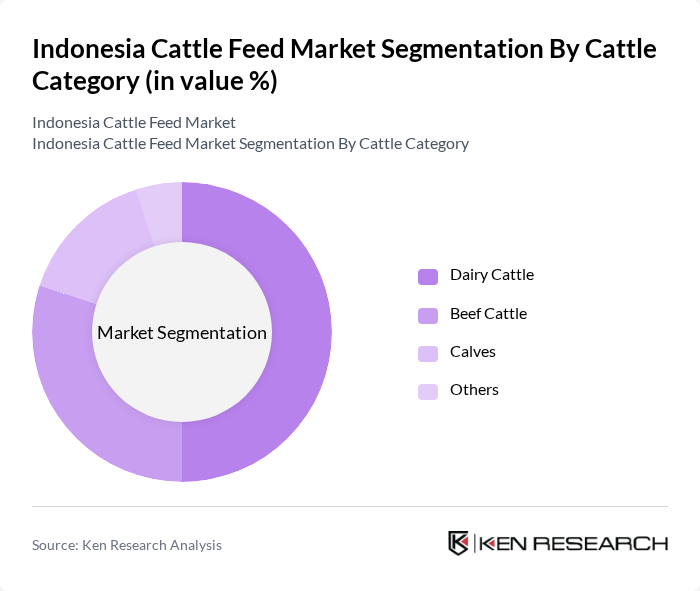

By Cattle Category:The cattle category segmentation includes Dairy Cattle, Beef Cattle, Calves, and Others. Dairy Cattle is the dominant subsegment, driven by the increasing demand for milk and dairy products in Indonesia and the policy focus on improving national milk self-sufficiency. The growing consumer preference for dairy consumption, urbanization-driven changes in diets, and the expansion of smallholder and commercial dairy farms have significantly contributed to the rise in demand for specialized feed tailored for dairy cattle, including high-energy concentrates and mineral–vitamin-enriched rations.

The Indonesia Cattle Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Charoen Pokphand Indonesia Tbk, PT Japfa Comfeed Indonesia Tbk, PT Malindo Feedmill Tbk, PT Sierad Produce Tbk, PT Cargill Indonesia, PT Gold Coin Indonesia, PT Suprama, PT Greenfields Indonesia, PT Sinar Mas Agro Resources and Technology Tbk (SMART Tbk), PT CJ Feed and Care Indonesia, PT De Heus Indonesia, PT FKS Multi Agro Tbk, PT Provimi Indonesia (Cargill Group), PT Wonokoyo Jaya Corporindo, PT Buana Karya Bhakti contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia cattle feed market appears promising, driven by increasing investments in livestock farming and a growing emphasis on sustainable practices. In future, the integration of digital technologies in feed management is expected to enhance efficiency and traceability. Additionally, the rise of organic feed products will cater to health-conscious consumers, creating new market segments. These trends indicate a shift towards more innovative and environmentally friendly solutions in the cattle feed industry, positioning it for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Feed Type | Compound Feed Fodder Forage Total Mixed Rations (TMR) Mineral & Vitamin Premixes Others |

| By Cattle Category | Dairy Cattle Beef Cattle Calves Others |

| By Distribution Channel | Direct Sales to Large Farms Dealers and Retail Outlets Cooperatives Online Sales Wholesalers Others |

| By Form | Pellets Mash Crumbles Others |

| By Ingredient | Cereals (Corn, Wheat, etc.) Oilseed Meal (Soybean Meal, etc.) By-products (Bran, Molasses, etc.) Additives (Vitamins, Minerals, Enzymes, etc.) Others |

| By Production System | Commercial Feed Mills Integrated Operations On-farm Mixing Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Feed Manufacturers | 60 | Production Managers, Sales Directors |

| Livestock Farmers | 120 | Farm Owners, Herd Managers |

| Veterinary Professionals | 80 | Veterinarians, Animal Nutritionists |

| Feed Distributors | 70 | Logistics Coordinators, Supply Chain Managers |

| Government Agricultural Officials | 40 | Policy Makers, Agricultural Advisors |

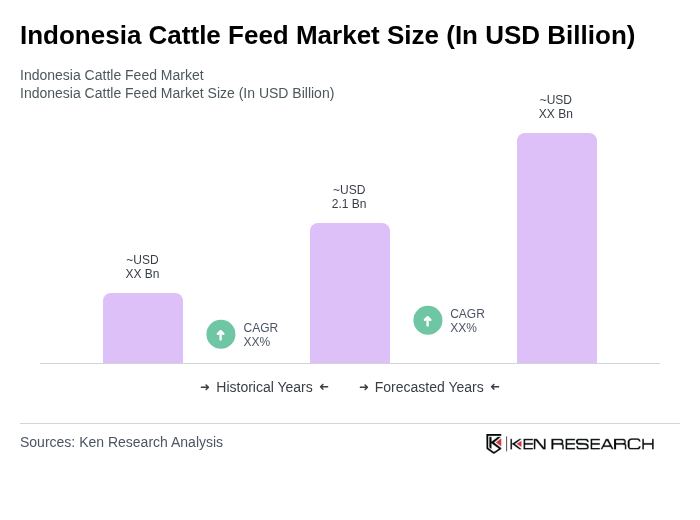

The Indonesia Cattle Feed Market is valued at approximately USD 2.1 billion, reflecting its significant share within the broader animal feed market, which totals around USD 8.7 billion for all species in Indonesia.