Region:Asia

Author(s):Geetanshi

Product Code:KRAB1498

Pages:99

Published On:January 2026

By Type:The market is segmented into various types, including Electronic Health Records (EHR), Practice Management Software, Revenue Cycle Management Solutions, Patient Engagement Solutions, Telehealth Solutions, Analytics and Reporting Tools, and Others. Among these, Electronic Health Records (EHR) is the leading sub-segment due to the increasing need for efficient patient data management and regulatory compliance. The growing trend of telehealth solutions is also gaining traction, especially post-pandemic, as healthcare providers seek to offer remote care options.

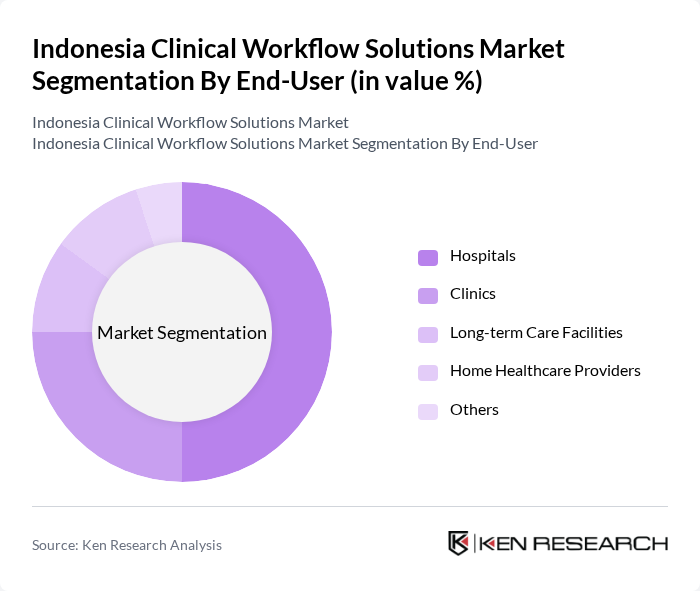

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-term Care Facilities, Home Healthcare Providers, and Others. Hospitals are the dominant end-user segment, driven by the need for comprehensive solutions that enhance operational efficiency and patient care. The increasing number of private and public hospitals in urban areas is further propelling the demand for clinical workflow solutions.

The Indonesia Clinical Workflow Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Medikaloka Hermina Tbk, PT. Mitra Keluarga Karyasehat Tbk, PT. Siloam International Hospitals Tbk, PT. SehatQ, PT. Alodokter, PT. Halodoc, PT. KlikDokter, PT. Global Mediacom Tbk, PT. Citra Medika, PT. Aplikasi Kesehatan Indonesia, PT. Ruma, PT. Jiva, PT. Kesehatan Digital Indonesia, PT. Medika Komunika, PT. Bina Sehat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clinical workflow solutions market in Indonesia appears promising, driven by ongoing technological advancements and increasing healthcare demands. As the government continues to invest in healthcare infrastructure, the integration of innovative solutions will likely enhance operational efficiencies. Furthermore, the growing emphasis on patient-centered care will push healthcare providers to adopt more sophisticated systems, ensuring better patient outcomes and streamlined processes. The market is expected to evolve rapidly, adapting to the changing needs of both providers and patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Health Records (EHR) Practice Management Software Revenue Cycle Management Solutions Patient Engagement Solutions Telehealth Solutions Analytics and Reporting Tools Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Home Healthcare Providers Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Functionality | Administrative Functions Clinical Functions Financial Functions Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By User Type | Healthcare Professionals Administrative Staff IT Staff Others |

| By Integration Level | Standalone Solutions Integrated Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Workflow Management | 100 | Hospital Administrators, IT Directors |

| Clinical Decision Support Systems | 80 | Clinical Managers, Healthcare IT Specialists |

| Patient Management Solutions | 70 | Nurse Managers, Patient Care Coordinators |

| Telehealth Integration | 60 | Telehealth Program Directors, IT Support Staff |

| Electronic Health Records (EHR) Systems | 90 | Health Information Managers, Physicians |

The Indonesia Clinical Workflow Solutions Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health technologies and the need for improved patient care efficiency across healthcare facilities.