Region:Asia

Author(s):Shubham

Product Code:KRAC2252

Pages:98

Published On:October 2025

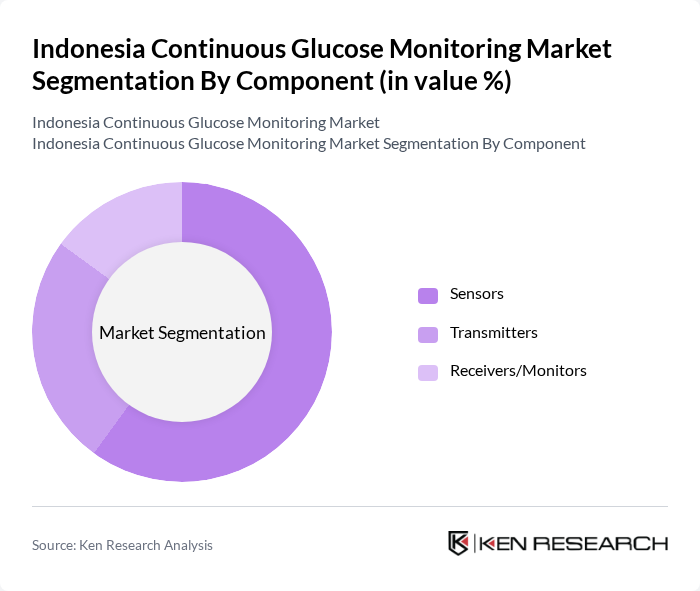

By Component:The components of continuous glucose monitoring systems include sensors, transmitters, and receivers/monitors. Among these,sensorsare the most critical as they directly measure glucose levels in the interstitial fluid. The increasing demand for accurate and real-time glucose monitoring has led to a surge in the adoption of advanced sensor technologies. Transmitters and receivers/monitors also play essential roles, but the sensor segment is currently leading the market due to its direct impact on patient management and outcomes .

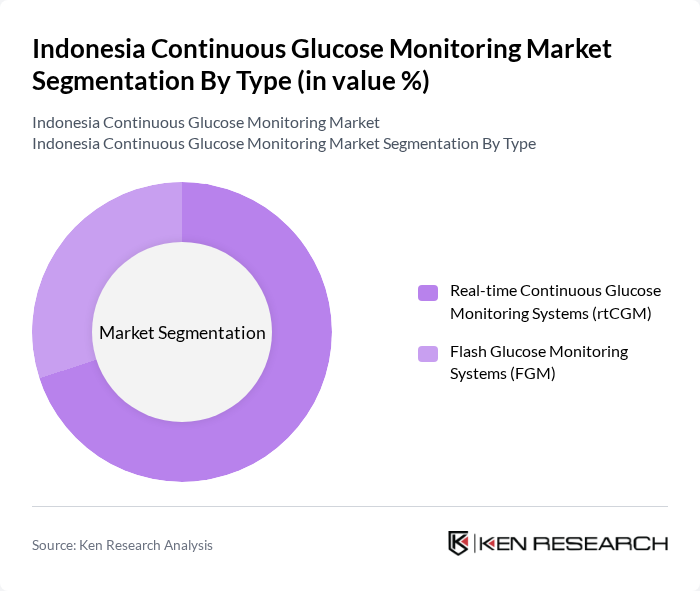

By Type:Continuous glucose monitoring systems are categorized into real-time continuous glucose monitoring systems (rtCGM) and flash glucose monitoring systems (FGM). ThertCGM segmentis currently dominating the market due to its ability to provide real-time glucose readings and alerts, which are crucial for effective diabetes management. The growing preference for real-time data among patients and healthcare providers is driving the adoption of rtCGM systems over FGMs .

The Indonesia Continuous Glucose Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Dexcom, Inc., Medtronic plc, Roche Diabetes Care, Ascensia Diabetes Care, Senseonics Holdings, Inc., GlySens Incorporated, Insulet Corporation, Nova Biomedical, Ypsomed AG, Glooko, Inc., LifeScan, Inc., A. Menarini Diagnostics, Biolinq, Inc., PT Enseval Putera Megatrading Tbk, PT Kimia Farma Tbk, PT Phapros Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the continuous glucose monitoring market in Indonesia appears promising, driven by increasing diabetes prevalence and technological advancements. As healthcare providers and patients embrace digital health solutions, the integration of CGM with telehealth services is expected to enhance patient engagement and adherence to treatment. Furthermore, the focus on preventive healthcare will likely lead to increased investments in diabetes management programs, fostering a more supportive environment for CGM adoption and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Sensors Transmitters Receivers/Monitors |

| By Type | Real-time Continuous Glucose Monitoring Systems (rtCGM) Flash Glucose Monitoring Systems (FGM) |

| By End-User | Hospitals Homecare Settings Diabetes Clinics Research Institutions |

| By Distribution Channel | Direct Sales Online Retail Pharmacies Medical Supply Stores |

| By Age Group | Pediatric Adult Geriatric |

| By Technology | Invasive Monitoring Technology Non-Invasive Monitoring Technology |

| By Application | Diabetes Management Clinical Research Health Monitoring |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 60 | Endocrinologists, Diabetes Educators |

| Patients Using CGM | 100 | Type 1 and Type 2 Diabetes Patients |

| Pharmacy Managers | 50 | Pharmacy Managers, Inventory Managers |

| Insurance Providers | 40 | Health Insurance Underwriters, Claims Adjusters |

| Diabetes Advocacy Groups | 40 | Advocacy Leaders, Community Health Workers |

The Indonesia Continuous Glucose Monitoring Market is valued at approximately USD 3 million, driven by the increasing prevalence of diabetes, rising healthcare expenditure, and advancements in glucose monitoring technology.