Region:Asia

Author(s):Geetanshi

Product Code:KRAD1122

Pages:93

Published On:November 2025

By Type:The creative software market in Indonesia is diverse, encompassing various types of software that cater to different creative needs. The subsegments include Graphic Design Software, Video Editing Software, Animation Software, Music Production Software, Web Development Software, UI/UX Design Software, Game Development Software, AR/VR Design Software, Desktop Publishing Software, and Others. Among these, Graphic Design Software and Video Editing Software are particularly prominent due to the increasing demand for visual content across social media and marketing platforms.

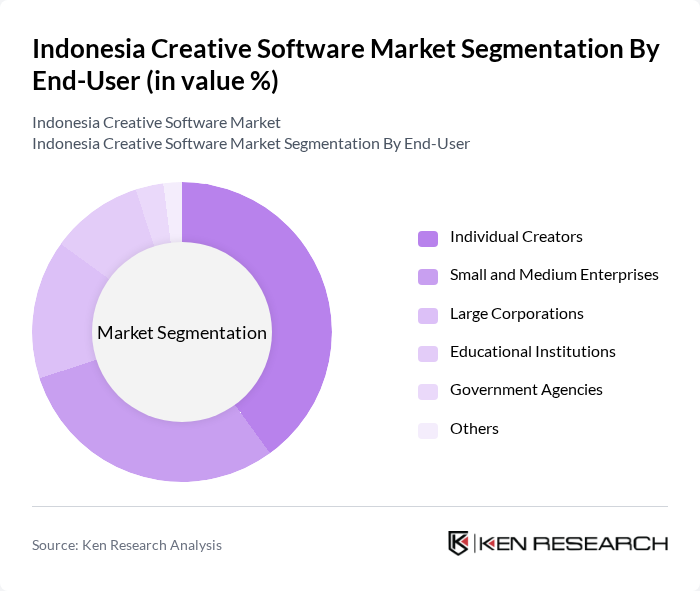

By End-User:The end-user segmentation of the creative software market includes Individual Creators, Small and Medium Enterprises (SMEs), Large Corporations, Educational Institutions, Government Agencies, and Others. Individual Creators and SMEs are the largest segments, driven by the growing number of freelancers and small businesses seeking affordable and accessible creative tools to enhance their digital content and marketing efforts.

The Indonesia Creative Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adobe Systems Incorporated, Corel Corporation, Autodesk, Inc., Avid Technology, Inc., CyberLink Corp., Magix Software GmbH, Serif (Europe) Ltd., Affinity (Serif Group), Canva Pty Ltd, Wacom Co., Ltd., Clip Studio Paint (CELSYS, Inc.), Sketch (Bohemian Coding), InVision App, Inc., Figma, Inc., Blender Foundation, PT GITS Indonesia, PT Suitmedia Kreasi Indonesia, PT Kibar Kreasi Indonesia (Dicoding), PT Soltius Indonesia, PT Nodeflux Teknologi Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian creative software market appears promising, driven by technological advancements and increasing digital engagement. As the government invests in improving internet infrastructure, particularly in rural areas, more users will gain access to creative tools. Additionally, the integration of artificial intelligence in software solutions is expected to enhance user experience, making creative processes more efficient. The growing trend of remote work will also fuel demand for collaboration tools, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Graphic Design Software Video Editing Software Animation Software Music Production Software Web Development Software UI/UX Design Software Game Development Software AR/VR Design Software Desktop Publishing Software Others |

| By End-User | Individual Creators Small and Medium Enterprises Large Corporations Educational Institutions Government Agencies Others |

| By Industry | Entertainment & Media Education Marketing and Advertising E-commerce & Retail Telecommunication Others |

| By Distribution Channel | Direct Sales Online Marketplaces Retail Stores Subscription Services Others |

| By Pricing Model | One-Time Purchase Subscription-Based Freemium Pay-Per-Use Others |

| By User Skill Level | Beginners Intermediate Advanced Professionals Others |

| By Geographic Distribution | Java Sumatra Bali Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Graphic Design Software Users | 120 | Freelance Designers, Agency Creative Directors |

| Video Editing Software Users | 100 | Filmmakers, Content Creators, YouTubers |

| Animation Software Users | 80 | Animators, Game Developers, Multimedia Artists |

| Creative Software Resellers | 60 | Software Distributors, Retail Managers |

| Educational Institutions Using Creative Software | 70 | Art School Administrators, Curriculum Developers |

The Indonesia Creative Software Market is valued at approximately USD 1.3 billion, driven by the increasing demand for digital content creation, social media growth, and the rise of e-commerce and online education platforms.