Region:Asia

Author(s):Geetanshi

Product Code:KRAD4139

Pages:87

Published On:December 2025

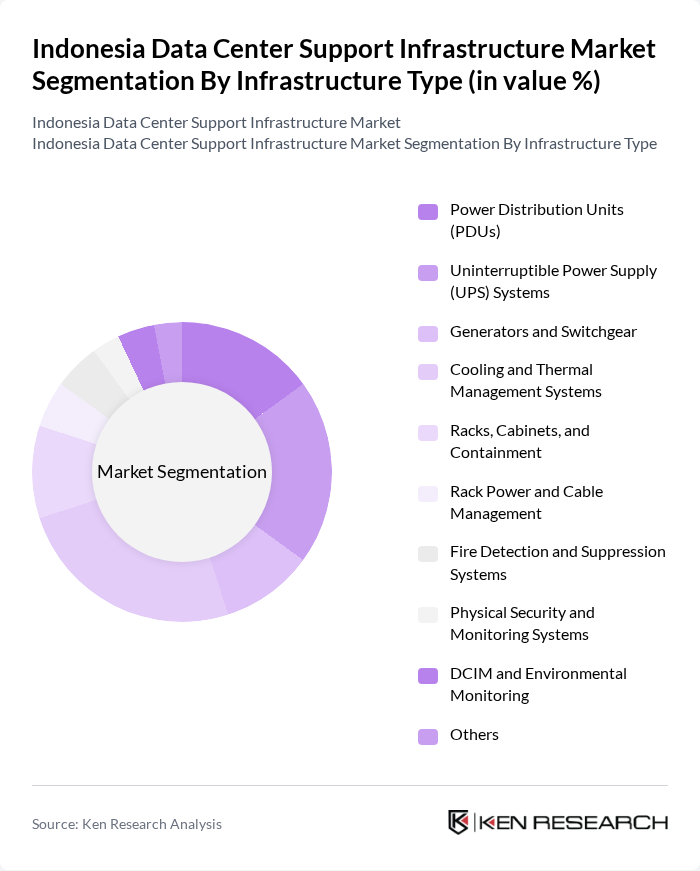

By Infrastructure Type:The infrastructure type segment includes various components essential for the reliable and efficient operation of data centers. Key subsegments include Power Distribution Units (PDUs), Uninterruptible Power Supply (UPS) Systems, Generators and Switchgear, Cooling and Thermal Management Systems, Racks, Cabinets, and Containment, Rack Power and Cable Management, Fire Detection and Suppression Systems, Physical Security and Monitoring Systems, DCIM and Environmental Monitoring, and Others. The demand for Cooling and Thermal Management Systems is particularly high due to the increasing density of IT loads, the expansion of hyperscale and colocation facilities, and the need to improve Power Usage Effectiveness (PUE) through advanced liquid and air-based cooling solutions.

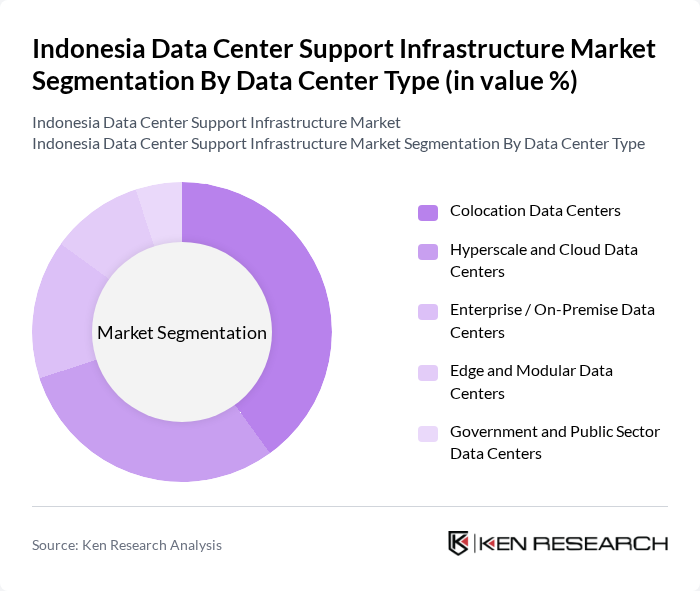

By Data Center Type:This segment categorizes data centers based on their operational models. The subsegments include Colocation Data Centers, Hyperscale and Cloud Data Centers, Enterprise / On-Premise Data Centers, Edge and Modular Data Centers, and Government and Public Sector Data Centers. Colocation Data Centers are currently leading the market due to the increasing trend of businesses outsourcing their data storage and compute needs, the growth of wholesale colocation for cloud and content providers, and a preference for scalable, carrier-neutral facilities that meet data localization and security requirements.

The Indonesia Data Center Support Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT Global Data Centers Indonesia (PT NTT Indonesia Nexcenter), PT Telekomunikasi Indonesia (Telkom Indonesia) / Telkomsigma, PT DCI Indonesia Tbk (DCI Indonesia), PT Indosat Tbk (Indosat Ooredoo Hutchison), PT XL Axiata Tbk (XL Axiata Data Center), PT Aplikanusa Lintasarta (Lintasarta Cloudeka Data Center), PT Biznet Gio Nusantara (Biznet Data Center & Biznet Gio), PT Cyberindo Aditama (CBN Data Center / CBN Cloud), Equinix Inc. (including former PT GTN Data Center), Princeton Digital Group (PDG) Indonesia, EdgeConneX Indonesia, Keppel Data Centres Indonesia, ST Telemedia Global Data Centres (STT GDC Indonesia), Amazon Web Services (AWS) Jakarta Region, Google Cloud Region Jakarta contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's data center support infrastructure market appears promising, driven by technological advancements and increasing digitalization. The adoption of AI and machine learning technologies is expected to enhance operational efficiencies, while the shift towards edge computing will facilitate faster data processing. Additionally, the growing emphasis on sustainability will lead to innovations in energy-efficient data center designs, aligning with global environmental standards. These trends indicate a robust growth trajectory for the market, fostering a competitive landscape that attracts both local and international investments.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure Type | Power Distribution Units (PDUs) Uninterruptible Power Supply (UPS) Systems Generators and Switchgear Cooling and Thermal Management Systems Racks, Cabinets, and Containment Rack Power and Cable Management Fire Detection and Suppression Systems Physical Security and Monitoring Systems DCIM and Environmental Monitoring Others |

| By Data Center Type | Colocation Data Centers Hyperscale and Cloud Data Centers Enterprise / On-Premise Data Centers Edge and Modular Data Centers Government and Public Sector Data Centers |

| By Power Capacity | Up to 1 MW MW to 5 MW MW to 10 MW Above 10 MW |

| By Tier Standard | Tier I & Tier II Tier III Tier IV |

| By End-User Vertical | IT and Telecom Banking, Financial Services and Insurance (BFSI) E-commerce and Digital Services Manufacturing and Industrial Government and Defense Healthcare and Life Sciences Media and Entertainment Others |

| By Cooling Configuration | Air-Based Cooling (CRAC/CRAH, In-row, In-rack) Liquid and Immersion Cooling Chillers and Cooling Towers Containment (Hot Aisle / Cold Aisle) Free Cooling and Adiabatic Systems |

| By Geography Within Indonesia | Greater Jakarta (Jabodetabek) West Java (including Bekasi, Cikarang, Karawang) Central & East Java (including Surabaya) Batam & Riau Islands Bali & Eastern Indonesia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Cloud Infrastructure Providers | 90 | Cloud Architects, Business Development Managers |

| Enterprise Data Center Operations | 80 | IT Operations Managers, Facility Engineers |

| Energy Efficiency Solutions | 60 | Sustainability Officers, Energy Managers |

| Disaster Recovery Services | 70 | Risk Management Officers, IT Security Managers |

The Indonesia Data Center Support Infrastructure Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing demand for cloud services and digital transformation across various sectors, including banking, telecom, and e-commerce.