Region:Asia

Author(s):Dev

Product Code:KRAA4912

Pages:88

Published On:September 2025

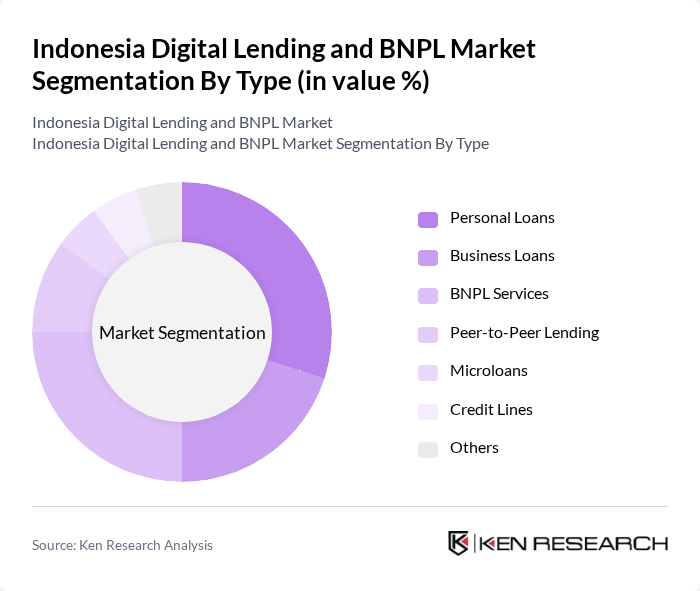

By Type:The market can be segmented into various types, including Personal Loans, Business Loans, BNPL Services, Peer-to-Peer Lending, Microloans, Credit Lines, and Others. Each of these subsegments caters to different consumer needs and preferences, with Personal Loans and BNPL Services being particularly popular among consumers seeking quick and flexible financing options.

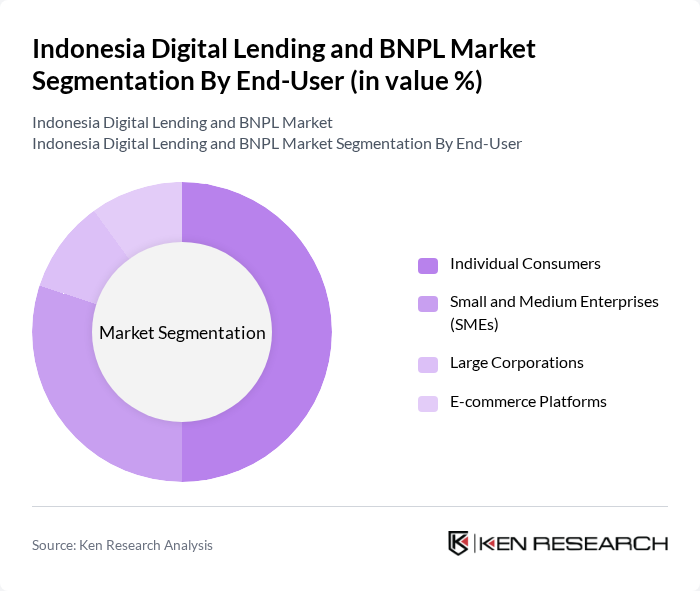

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and E-commerce Platforms. Individual Consumers and SMEs are the primary users of digital lending services, driven by their need for accessible financing solutions to meet personal and business needs.

The Indonesia Digital Lending and BNPL Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Negara Indonesia, Kredit Pintar, Akulaku, OVO, Gojek, ShopeePay, JULO, Home Credit Indonesia, Tunaiku, Bank Rakyat Indonesia, KreditGo, Pinjam Gampang, Danamas, Investree, Modalku contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's digital lending and BNPL market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in credit scoring is expected to enhance risk assessment, reducing default rates. Additionally, the growing trend of mobile-first solutions will likely lead to increased user engagement. As the regulatory environment continues to evolve, companies that adapt to these changes while focusing on customer experience will be well-positioned to capture market share and drive sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Peer-to-Peer Lending Microloans Credit Lines Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations E-commerce Platforms |

| By Application | Retail Purchases Service Payments Business Expansion Emergency Funding |

| By Distribution Channel | Online Platforms Mobile Applications Financial Institutions Third-party Aggregators |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees |

| By Loan Amount | Microloans (up to IDR 1 million) Small Loans (IDR 1 million - IDR 10 million) Medium Loans (IDR 10 million - IDR 50 million) Large Loans (above IDR 50 million) |

| By Repayment Period | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (over 2 years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Lending Users | 150 | Consumers aged 18-45, recent borrowers |

| BNPL Service Users | 120 | Shoppers using BNPL for e-commerce purchases |

| Fintech Industry Experts | 50 | Financial analysts, fintech consultants |

| Regulatory Stakeholders | 30 | Government officials, policy makers in finance |

| Small Business Owners | 80 | Entrepreneurs utilizing digital lending for business expansion |

The Indonesia Digital Lending and BNPL Market is valued at approximately USD 15 billion, driven by the increasing adoption of digital financial services, a surge in e-commerce activities, and a growing unbanked population seeking accessible credit solutions.