Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4884

Pages:91

Published On:December 2025

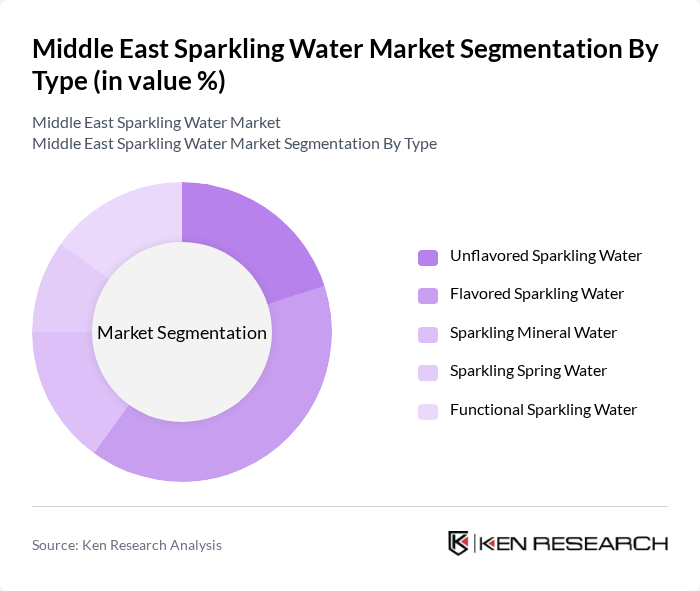

By Type:The sparkling water market can be segmented into various types, including Unflavored Sparkling Water, Flavored Sparkling Water, Sparkling Mineral Water, Sparkling Spring Water, and Functional Sparkling Water. This aligns with broader regional segmentation where unflavored and flavored sparkling bottled water are the primary product categories. Among these, Flavored Sparkling Water is currently the leading sub-segment in value terms, supported by rising demand for flavored and functional water and the strong performance of sparkling formats within the flavored water category in the Middle East and Africa. The demand for unique and exotic flavors, often with low or zero sugar, has surged, particularly among younger consumers who seek refreshing, healthier alternatives to traditional carbonated soft drinks.

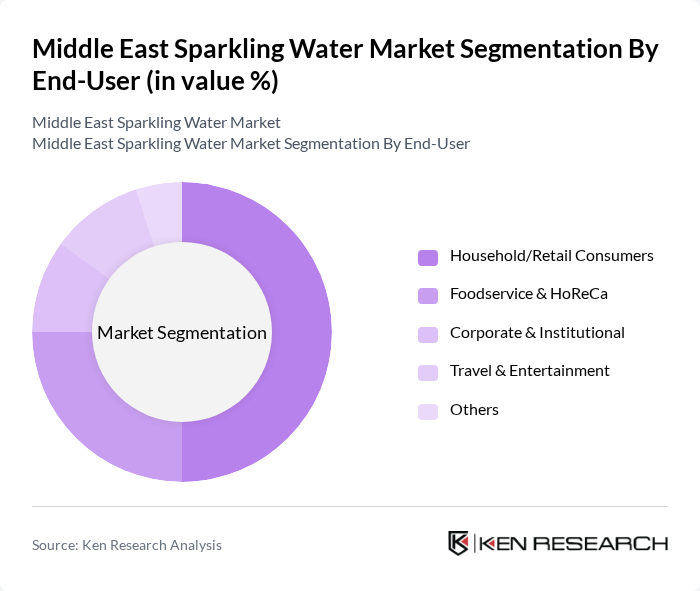

By End-User:The market can also be segmented based on end-users, including Household/Retail Consumers, Foodservice & HoReCa (Restaurants, Cafés, Hotels), Corporate & Institutional (Offices, Government, Education), Travel & Entertainment (Airlines, Lounges, Events, Catering), and Others. This structure is consistent with the way bottled and sparkling water consumption is split between off-trade (retail/household) and on-trade (HoReCa and institutional) channels in the Middle East. The Household/Retail Consumers segment is the most significant, as at-home consumption of bottled and sparkling water continues to rise, driven by health trends, the replacement of sugary soft drinks, and the convenience of purchasing packaged beverages through supermarkets, convenience stores, and e-commerce platforms.

The Middle East Sparkling Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Perrier, S.Pellegrino), PepsiCo, Inc. (Aquafina, bubly), The Coca-Cola Company (Schweppes, Topo Chico, locally marketed sparkling ranges), National Beverage Corp. (LaCroix), Talking Rain Beverage Company (Sparkling Ice), Danone S.A. (Evian, Badoit), Spindrift Beverage Co., AHA Sparkling Water (The Coca-Cola Company), Rani Refreshments (Aujan Group Holding), Masafi Co. LLC, Al Ain Water (Agthia Group PJSC), Mai Dubai LLC, Almarai Company (Bottled Water & Sparkling Offerings), Al Jomaih Bottling Plants (PepsiCo Bottler, KSA), Gulf International Beverage / Local Private Label and Retail Brands contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East sparkling water market is poised for significant growth, driven by evolving consumer preferences and a shift towards healthier lifestyles. As the demand for innovative flavors and functional beverages rises, brands are likely to invest in product development and marketing strategies that emphasize health benefits. Additionally, the increasing focus on sustainability will encourage companies to adopt eco-friendly practices, enhancing brand loyalty and attracting environmentally conscious consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Unflavored Sparkling Water Flavored Sparkling Water Sparkling Mineral Water Sparkling Spring Water Functional Sparkling Water |

| By End-User | Household/Retail Consumers Foodservice & HoReCa (Restaurants, Cafés, Hotels) Corporate & Institutional (Offices, Government, Education) Travel & Entertainment (Airlines, Lounges, Events, Catering) Others |

| By Packaging Type | PET Bottles Glass Bottles Cans Refillable/Dispensing Systems Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Independent Retailers & Groceries On-Trade (HoReCa) Online & E-commerce |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Palestine, others) North Africa (Egypt, Morocco, Algeria, Tunisia, others) Rest of Middle East & Africa |

| By Price Range | Premium Segment Mid-range Segment Budget Segment Private Label / Value Brands |

| By Flavor Profile | Citrus Flavors (Lemon, Lime, Orange, Grapefruit) Berry Flavors (Strawberry, Raspberry, Mixed Berry) Herbal & Botanical Flavors (Mint, Ginger, Cucumber, etc.) Exotic & Regional Flavors (Pomegranate, Tropical, Local Fruits) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sparkling Water | 150 | Health-conscious Consumers, Regular Sparkling Water Drinkers |

| Retail Insights on Sparkling Water Sales | 120 | Store Managers, Beverage Category Buyers |

| Distribution Channel Effectiveness | 90 | Distributors, Logistics Managers |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

| Health and Wellness Impact on Beverage Choices | 100 | Nutritionists, Fitness Trainers, Health Coaches |

The Middle East sparkling water market is valued at approximately USD 1.0 billion, reflecting a significant share of global sparkling water consumption within the broader bottled water category. This growth is driven by increasing health consciousness and a shift towards premium beverage options.