Region:Asia

Author(s):Geetanshi

Product Code:KRAA0095

Pages:80

Published On:August 2025

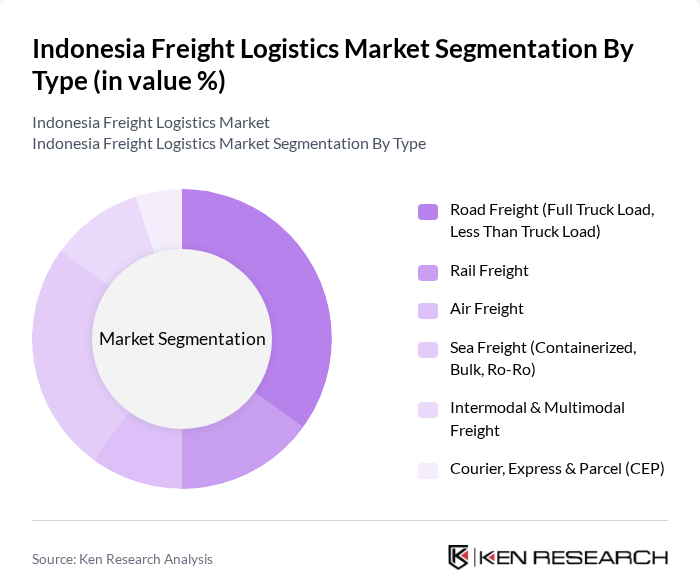

By Type:The freight logistics market is segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal & Multimodal Freight, and Courier, Express & Parcel (CEP). Each segment plays a crucial role in the logistics ecosystem, serving diverse transportation needs and cargo types .

The Road Freight segment, particularly Full Truck Load (FTL) and Less Than Truck Load (LTL), dominates the market due to its flexibility and cost-effectiveness for transporting goods over short to medium distances. The increasing demand for timely deliveries, especially in urban areas, has led to a surge in road freight services. The rise of e-commerce and last-mile delivery requirements has further fueled the need for efficient road logistics solutions, making it a critical component of the freight logistics landscape .

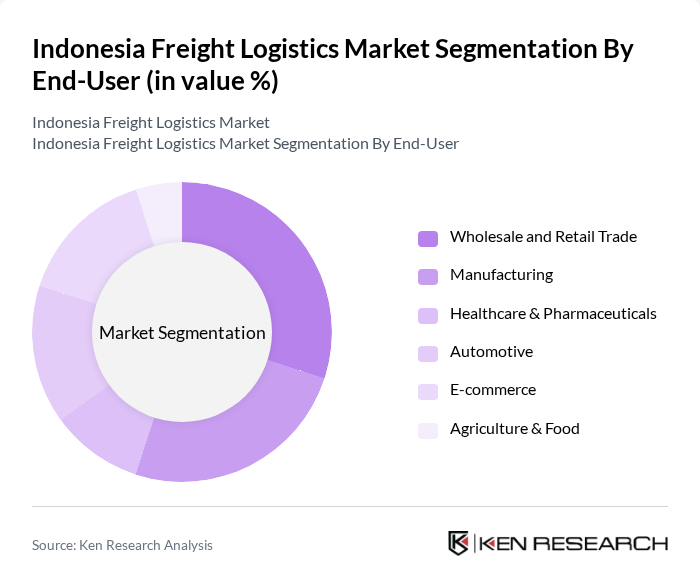

By End-User:The freight logistics market is segmented by end-users, including Wholesale and Retail Trade, Manufacturing, Healthcare & Pharmaceuticals, Automotive, E-commerce, Agriculture & Food, and Others. Each segment has unique logistics requirements that influence the demand for various freight services .

The Wholesale and Retail Trade segment leads the market, driven by increasing consumer demand for goods and the rapid growth of e-commerce. Retailers require efficient logistics solutions to manage inventory and ensure timely deliveries to customers. The rise of online shopping and omnichannel retailing has further intensified the need for robust logistics services, making this segment a key player in the freight logistics market .

The Indonesia Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as JNE Express, TIKI, Pos Indonesia, SiCepat Ekspres, Ninja Xpress, Wahana Prestasi Logistik, Garuda Indonesia Cargo, Lion Parcel, SAP Express, DB Schenker Indonesia, Kuehne + Nagel Indonesia, DHL Supply Chain Indonesia, Agility Logistics Indonesia, Yusen Logistics Indonesia, and FedEx Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's freight logistics market appears promising, driven by technological advancements and a focus on sustainability. As digital transformation accelerates, logistics companies are expected to adopt automation and AI, enhancing operational efficiency. Additionally, the growing emphasis on sustainable practices will likely lead to increased investments in green logistics solutions, positioning the market for significant growth. The combination of these trends will create a more resilient and competitive logistics landscape in Indonesia.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight (Full Truck Load, Less Than Truck Load) Rail Freight Air Freight Sea Freight (Containerized, Bulk, Ro-Ro) Intermodal & Multimodal Freight Courier, Express & Parcel (CEP) |

| By End-User | Wholesale and Retail Trade Manufacturing Healthcare & Pharmaceuticals Automotive E-commerce Agriculture & Food Others |

| By Region | Java (Jakarta, Surabaya, etc.) Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara |

| By Service Type | Freight Forwarding Warehousing & Storage (Temperature Controlled, Non-Temperature Controlled) Customs Brokerage Last-Mile Delivery Value-Added Services Others |

| By Cargo Type | Perishable Goods Non-Perishable Goods Hazardous Materials Bulk Cargo High-Value Goods Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Solutions Automated Logistics Systems IoT & Real-Time Tracking Others |

| By Policy Support | Government Subsidies Tax Incentives Infrastructure Development Programs National Logistics Ecosystem (NLE) Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Logistics | 60 | Logistics Managers, Supply Chain Coordinators |

| E-commerce Fulfillment Operations | 50 | E-commerce Operations Managers, Warehouse Supervisors |

| Retail Distribution Networks | 40 | Distribution Managers, Inventory Control Specialists |

| Transportation Service Providers | 45 | Fleet Managers, Business Development Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Indonesia Freight Logistics Market is valued at approximately USD 39 billion, reflecting significant growth driven by increasing demand for efficient supply chain solutions, urbanization, and the expansion of e-commerce activities.