Region:Asia

Author(s):Geetanshi

Product Code:KRAA5670

Pages:80

Published On:January 2026

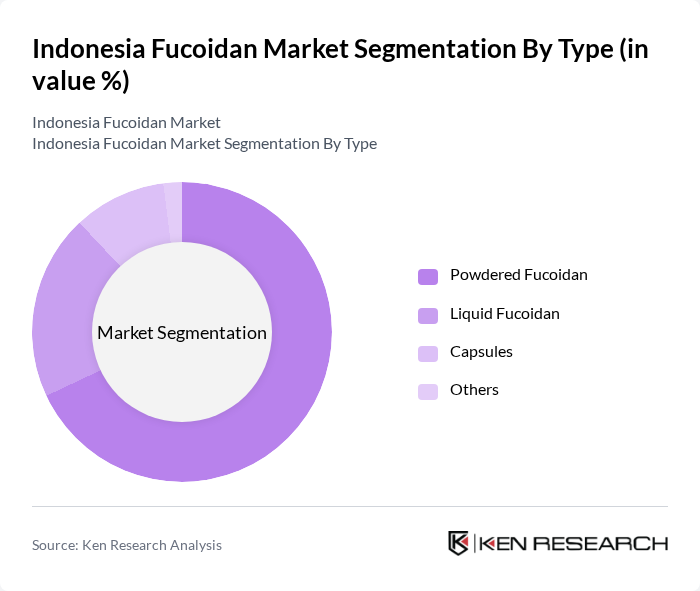

By Type:The market is segmented into various types, including Liquid Fucoidan, Powdered Fucoidan, Capsules, and Others. Powdered Fucoidan currently dominates the global market with a 68.2% share, driven by easy integration and storage capabilities. Consumers prefer powdered forms for their versatility and shelf stability, particularly in dietary supplements and functional food applications. Liquid Fucoidan also holds a significant share, appealing to those seeking rapid absorption and convenience. Capsules are popular for their portability and precise dosing, while the 'Others' category includes various innovative formats that are emerging in the market.

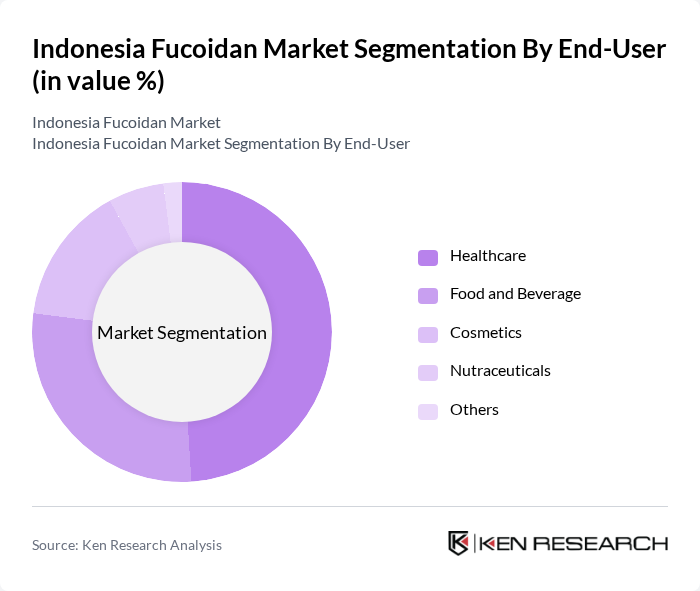

By End-User:The end-user segmentation includes Healthcare, Food and Beverage, Cosmetics, Nutraceuticals, and Others. The Healthcare sector dominates the market with a 49.4% share, driven by the increasing use of fucoidan in dietary supplements and functional foods aimed at enhancing health and wellness. The Food and Beverage industry is also growing, as consumers seek natural ingredients for health benefits. Cosmetics and Nutraceuticals are emerging segments, with rising interest in natural beauty products and health supplements. The 'Others' category includes various niche applications that are gaining traction.

The Indonesia Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Fucoidan Indonesia, PT. Algaecare, PT. Seaweed Solutions, PT. BioMarine, PT. Green Sea, PT. Ocean Harvest, PT. Marine Bio, PT. Sea Health, PT. Algaeforce, PT. Seaweed Innovations, PT. Bioactive Seaweed, PT. Nutraceuticals Indonesia, PT. Marine Nutrients, PT. Sea Essence, PT. EcoSea contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fucoidan market in Indonesia appears promising, driven by increasing health awareness and a growing preference for natural products. As consumers continue to prioritize health and wellness, the demand for fucoidan is expected to rise. Additionally, innovations in product development and strategic partnerships with research institutions will likely enhance the market's growth. E-commerce platforms will play a crucial role in expanding market reach, making fucoidan products more accessible to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Fucoidan Powdered Fucoidan Capsules Others |

| By End-User | Healthcare Food and Beverage Cosmetics Nutraceuticals Others |

| By Source | Brown Seaweed Red Seaweed Green Seaweed Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Application | Dietary Supplements Functional Foods Personal Care Products Others |

| By Region | Java Sumatra Bali Kalimantan Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Retailers | 100 | Store Managers, Product Buyers |

| Fucoidan Product Manufacturers | 45 | Production Managers, Quality Control Officers |

| Health and Wellness Practitioners | 50 | Nutritionists, Herbalists |

| Consumers of Health Supplements | 100 | Health-Conscious Individuals, Fitness Enthusiasts |

| Distributors and Wholesalers | 60 | Sales Managers, Logistics Coordinators |

The Indonesia Fucoidan Market is valued at approximately USD 18 million, reflecting a growing interest in health benefits associated with fucoidan, particularly in healthcare and nutraceutical sectors.