Region:Asia

Author(s):Geetanshi

Product Code:KRAA5700

Pages:91

Published On:January 2026

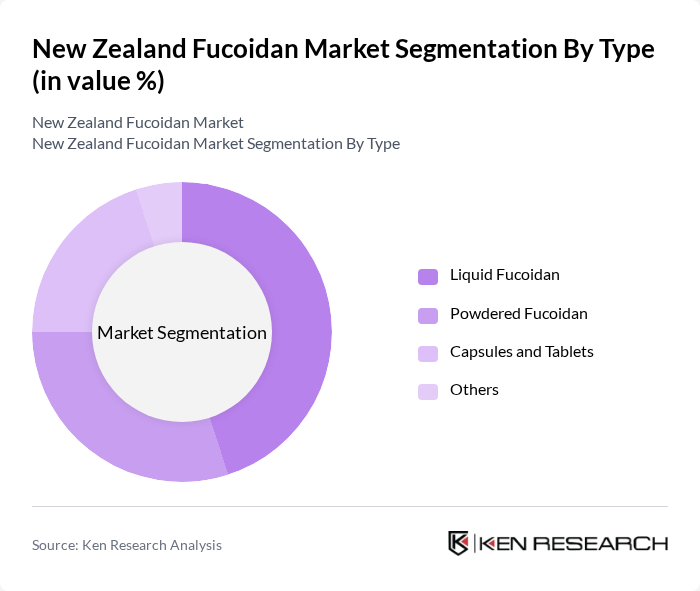

By Type:The market is segmented into Liquid Fucoidan, Powdered Fucoidan, Capsules and Tablets, and Others. Among these, Liquid Fucoidan is the leading sub-segment due to its ease of consumption and rapid absorption in the body. Consumers prefer liquid forms for their convenience and effectiveness, which has led to a significant increase in demand. Powdered Fucoidan also holds a substantial share, particularly among health enthusiasts who incorporate it into smoothies and health drinks. Capsules and Tablets are popular for their portability and precise dosage, appealing to a segment of consumers who prioritize convenience.

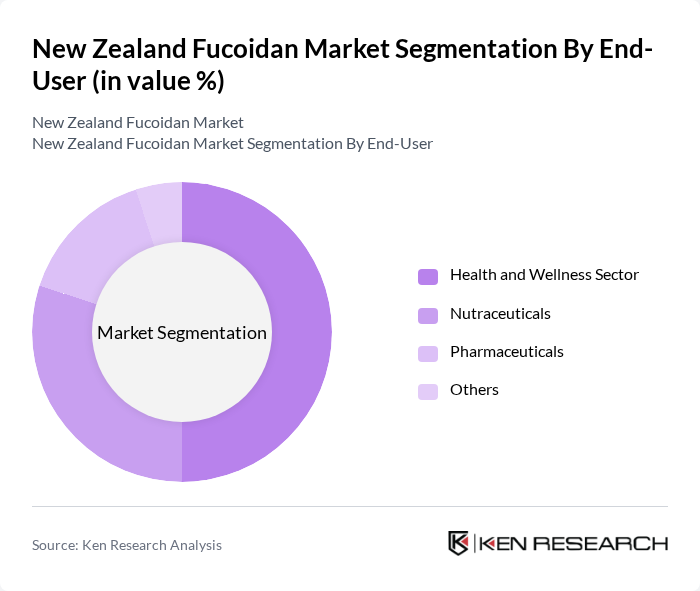

By End-User:The market is categorized into Health and Wellness Sector, Nutraceuticals, Pharmaceuticals, and Others. The Health and Wellness Sector is the dominant end-user, driven by the increasing trend of preventive healthcare and the growing popularity of dietary supplements. Consumers are increasingly seeking natural products to enhance their health, leading to a surge in fucoidan usage in this sector. Nutraceuticals also represent a significant portion of the market, as they incorporate fucoidan into various health products aimed at improving overall well-being. The pharmaceutical sector is gradually adopting fucoidan for its potential therapeutic benefits, although it currently holds a smaller share compared to the other segments.

The New Zealand Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as New Zealand Fucoidan Co., Seaweed Solutions Ltd., BioMarine Ingredients, Green Seaweed Innovations, Ocean Harvest Technology, Marine Bioactives, Algae Health Products, Pure Fucoidan NZ, SeaVeg Ltd., Kelp & Co., BioFucus Ltd., Algalife, New Zealand Seaweed Co., EcoMarine Solutions, Fucoidan Health contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand fucoidan market is poised for growth, driven by increasing health consciousness and a shift towards natural supplements. As consumers become more informed about the benefits of fucoidan, demand is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate access to fucoidan products, enhancing market penetration. Innovations in product formulations and collaborations with health institutions will further bolster market dynamics, creating a favorable environment for growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Fucoidan Powdered Fucoidan Capsules and Tablets Others |

| By End-User | Health and Wellness Sector Nutraceuticals Pharmaceuticals Others |

| By Source | Brown Seaweed Red Seaweed Green Seaweed Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Health Food Stores Others |

| By Application | Dietary Supplements Functional Foods Personal Care Products Others |

| By Consumer Demographics | Age Group (Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Others |

| By Region | North Island South Island Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Retailers | 100 | Store Managers, Product Buyers |

| Fucoidan Product Manufacturers | 45 | Production Managers, Quality Control Officers |

| Consumers of Health Supplements | 120 | Health-Conscious Individuals, Fitness Enthusiasts |

| Healthcare Professionals | 50 | Nutritionists, General Practitioners |

| Distributors and Wholesalers | 60 | Supply Chain Managers, Sales Representatives |

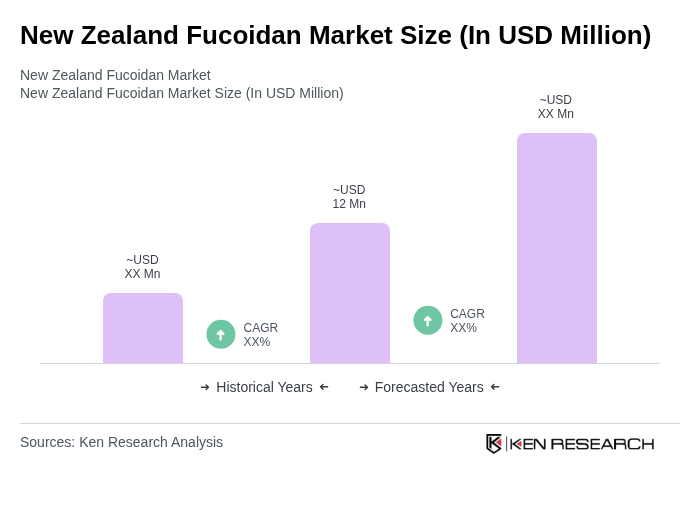

The New Zealand Fucoidan Market is valued at approximately USD 12 million, reflecting a growing interest in the health benefits of fucoidan, particularly its anti-inflammatory and immune-boosting properties.