Region:Asia

Author(s):Geetanshi

Product Code:KRAA5679

Pages:89

Published On:January 2026

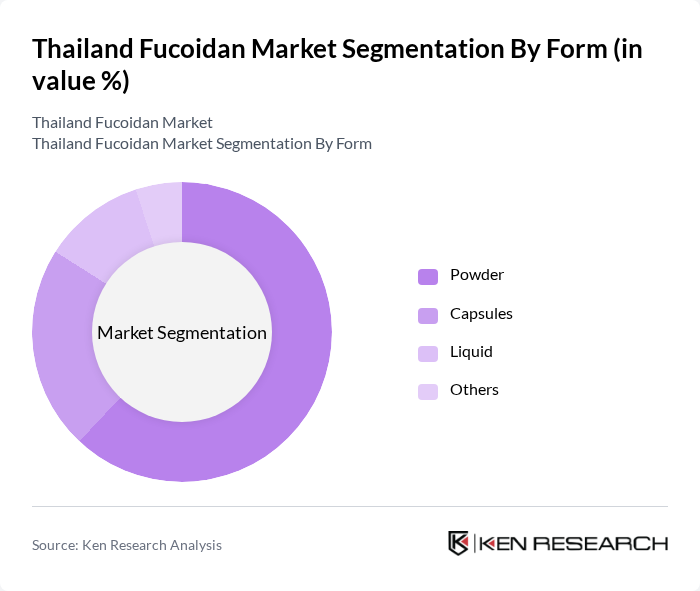

By Form:The market is segmented into various forms of fucoidan products, including powder, capsules, liquid, and others. Among these, the powder form is currently the most popular due to its versatility and ease of incorporation into various health products, commanding approximately 62% market share. Capsules are also gaining traction as consumers prefer convenient dosage forms. The liquid segment, while smaller, is favored for its quick absorption and effectiveness. The "others" category includes unique formulations that cater to niche markets.

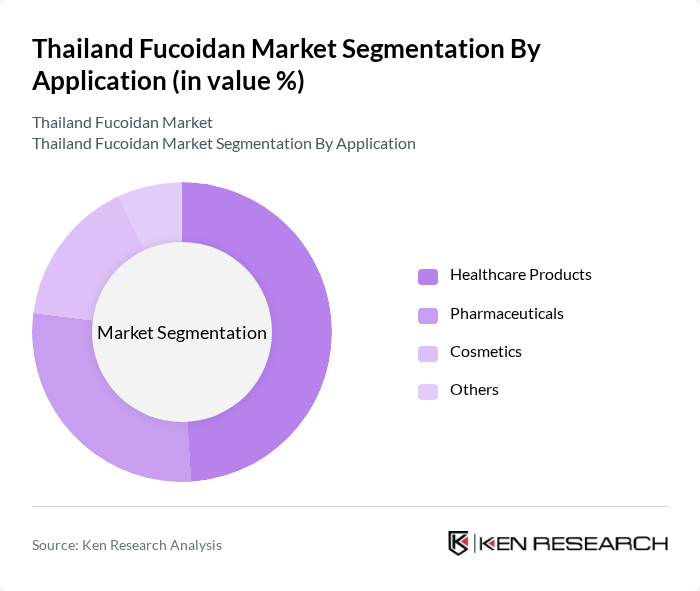

By Application:This segmentation includes healthcare products, pharmaceuticals, cosmetics, and others. The healthcare products segment leads the market, driven by the increasing consumer focus on preventive health measures and natural remedies, accounting for approximately 49% of market share. Pharmaceuticals are also significant, as fucoidan is recognized for its therapeutic properties in targeted drug delivery and oncology applications. The cosmetics segment is growing due to the rising demand for natural ingredients in skincare products, while the "others" category encompasses various innovative applications.

The Thailand Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marine Bioproducts, Fucoidan Solutions, Seaweed Industries, Thai Fucoidan Co., Ltd., BioMarine Ingredients, Green Seaweed Co., Ocean Harvest Technology, Algaetech International, Seaweed Nutraceuticals, Thai Seaweed Products, BioSea Solutions, Marine Nutraceuticals, Seaweed Innovations, EcoMarine Products, Thai Marine Biotech contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand fucoidan market is poised for significant growth, driven by increasing health consciousness and a shift towards natural products. As consumers become more educated about the benefits of fucoidan, demand is expected to rise across various sectors, including health supplements and cosmetics. Additionally, advancements in extraction technology may reduce production costs, making fucoidan more accessible. Collaborations with research institutions will likely enhance product innovation, further solidifying fucoidan's position in the market.

| Segment | Sub-Segments |

|---|---|

| By Form | Powder Capsules Liquid Others |

| By Application | Healthcare Products Pharmaceuticals Cosmetics Others |

| By Distribution Channel | Direct Sales Online Retailers Specialty Stores Pharmacies/Drugstores Others |

| By Seaweed Type | Mozuku Wakame Kombu Others |

| By End Use | Dietary Supplements Food & Beverages Cosmetics & Personal Care Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Manufacturers | 45 | Product Development Managers, Quality Assurance Officers |

| Seaweed Processors | 38 | Operations Managers, Supply Chain Coordinators |

| Retailers of Nutraceuticals | 42 | Category Managers, Purchasing Agents |

| Research Institutions | 18 | Marine Biologists, Nutritional Scientists |

| Regulatory Bodies | 12 | Policy Makers, Compliance Officers |

The Thailand Fucoidan Market is valued at approximately USD 118 million, reflecting a significant growth trend driven by increasing consumer awareness of fucoidan's health benefits, particularly in immune support and anti-inflammatory properties.