Oman Fucoidan Market Overview

- The Oman Fucoidan Market is valued at USD 12 million, based on a five-year historical analysis. This growth is primarily driven by the increasing awareness of health benefits associated with fucoidan, particularly in the nutraceutical and dietary supplement sectors, alongside rising demand for preventive healthcare and natural wellness products. The rising demand for natural and organic products has further propelled the market, as consumers seek alternatives to synthetic ingredients.

- Key players in this market include Muscat, Salalah, and Sohar, which dominate due to their strategic coastal locations that facilitate the harvesting of seaweed. The presence of established supply chains and processing facilities in these cities enhances their competitive edge, making them pivotal in the fucoidan market.

- The Ministerial Decision No. 68/2021 issued by the Ministry of Agriculture, Fisheries and Water Resources governs sustainable seaweed harvesting practices. This initiative aims to ensure the long-term viability of marine resources while supporting local economies. The regulation mandates licensing for commercial harvesting activities, adherence to quotas and seasonal restrictions, and compliance with environmental impact assessments to protect marine ecosystems.

Oman Fucoidan Market Segmentation

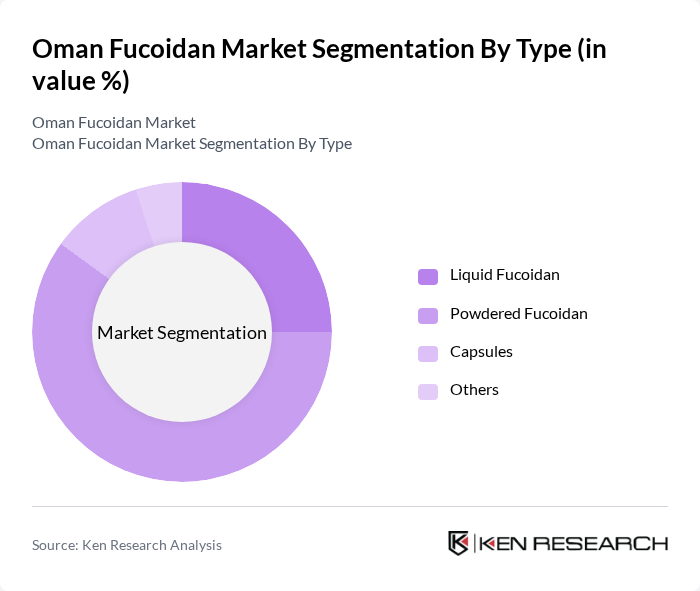

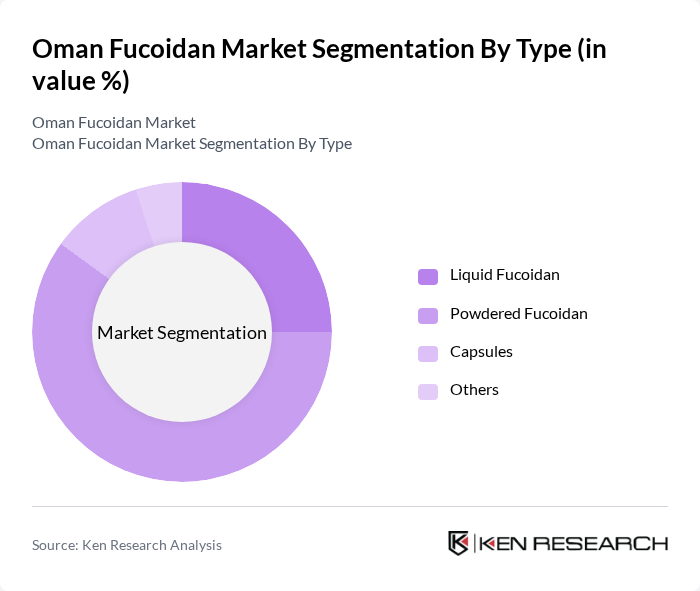

By Type:The market is segmented into Liquid Fucoidan, Powdered Fucoidan, Capsules, and Others. Among these, Powdered Fucoidan is the leading subsegment due to its versatility, longer shelf life, stability during storage and transportation, and ease of incorporation into dietary supplements, functional foods, and nutraceutical formulations. The demand for liquid forms is also significant, particularly in applications requiring direct consumption. Capsules are popular for their convenience, while other forms cater to niche markets.

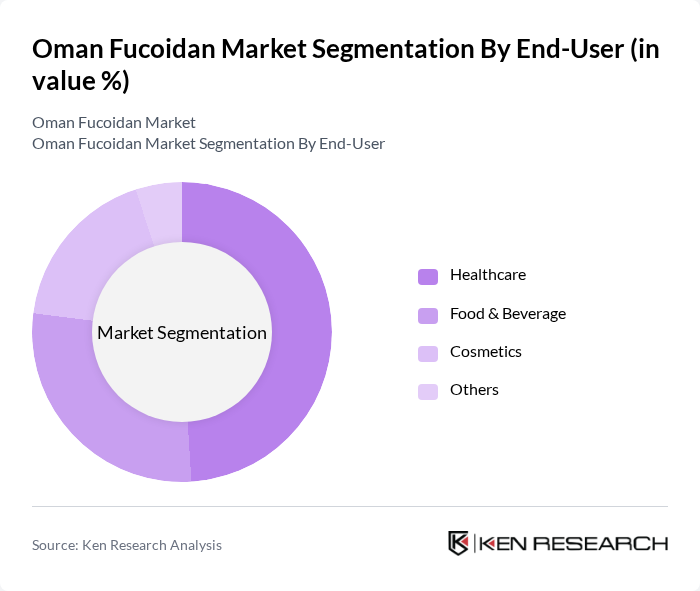

By End-User:The end-user segmentation includes Healthcare, Food & Beverage, Cosmetics, and Others. The healthcare sector is the dominant segment, driven by the increasing incorporation of fucoidan in dietary supplements, functional foods, and preventive healthcare products leveraging its immune support, anti-inflammatory, and antioxidant properties. The food and beverage industry is also growing, as manufacturers seek to enhance product offerings with natural ingredients. Cosmetics are emerging as a significant user of fucoidan, leveraging its skin health benefits, while other sectors represent niche applications.

Oman Fucoidan Market Competitive Landscape

The Oman Fucoidan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marine Bioactives, Algaia, Fucoidan Force, Kappa Bioscience, Seaweed Solutions, BioCare Copenhagen, Nutraceuticals International, Ocean Harvest Technology, GreenWave, Seaweed & Co., Algalif, BioFucus, Seaweed Technologies, Fucus Bio, Oceanic Nutraceuticals contribute to innovation, geographic expansion, and service delivery in this space.

Oman Fucoidan Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The growing awareness of health and wellness among Omani consumers is driving the fucoidan market. In future, the health supplement market in Oman is projected to reach approximately OMR 55 million, reflecting a 10% increase from the previous year. This trend is fueled by rising incidences of lifestyle-related diseases, prompting consumers to seek natural health solutions. The emphasis on preventive healthcare is further supported by government initiatives promoting healthy living, which enhances the demand for fucoidan as a natural supplement.

- Rising Demand for Natural Supplements:The shift towards natural and organic products is significantly influencing the fucoidan market in Oman. In future, the natural supplements segment is expected to account for around 30% of the total dietary supplements market, valued at OMR 18 million. This trend is driven by consumers' preference for products perceived as safer and more effective. The increasing availability of fucoidan products in health stores and online platforms is also contributing to this rising demand, aligning with global health trends.

- Expanding Applications in Cosmetics:The cosmetic industry in Oman is increasingly incorporating fucoidan due to its beneficial properties for skin health. In future, the market for natural cosmetics is projected to reach OMR 25 million, with fucoidan-based products expected to capture a significant share. The ingredient's anti-aging and moisturizing properties are appealing to consumers, leading to a surge in product formulations that include fucoidan. This trend is supported by a growing beauty-conscious population seeking effective, natural skincare solutions.

Market Challenges

- Limited Awareness Among Consumers:Despite the benefits of fucoidan, consumer awareness remains low in Oman. A recent survey indicated that only 30% of consumers recognized fucoidan as a health supplement. This lack of knowledge hampers market growth, as potential customers are unaware of its health benefits. Educational campaigns and marketing strategies are essential to increase awareness and drive demand, but the current gap presents a significant challenge for market players.

- High Production Costs:The production of fucoidan is often associated with high costs due to the extraction processes and sourcing of quality seaweed. In future, production costs are estimated to be around OMR 1.8 million for local manufacturers, which can limit profit margins. This financial burden may deter new entrants and restrict the growth of existing companies. Addressing these cost challenges through technological advancements and efficient sourcing is crucial for market sustainability.

Oman Fucoidan Market Future Outlook

The Oman fucoidan market is poised for growth, driven by increasing health consciousness and a shift towards natural products. As consumer preferences evolve, companies are likely to innovate and diversify their product offerings. The integration of technology in product development will enhance the efficacy and appeal of fucoidan-based products. Additionally, collaborations with research institutions may lead to new applications and formulations, further expanding market potential. Overall, the future looks promising for the fucoidan market in Oman, with significant opportunities for growth and innovation.

Market Opportunities

- Growth in E-commerce Platforms:The rise of e-commerce in Oman presents a significant opportunity for fucoidan products. With online sales projected to reach OMR 12 million in future, companies can leverage digital platforms to reach a broader audience. This shift allows for targeted marketing strategies and improved customer engagement, enhancing product visibility and accessibility in the market.

- Collaborations with Research Institutions:Partnering with research institutions can drive innovation in fucoidan applications. Such collaborations can lead to the development of new formulations and enhance product credibility. In future, investments in research and development are expected to increase by 15%, providing a fertile ground for breakthroughs that can significantly impact market growth and consumer acceptance.