Region:Asia

Author(s):Rebecca

Product Code:KRAC9791

Pages:92

Published On:November 2025

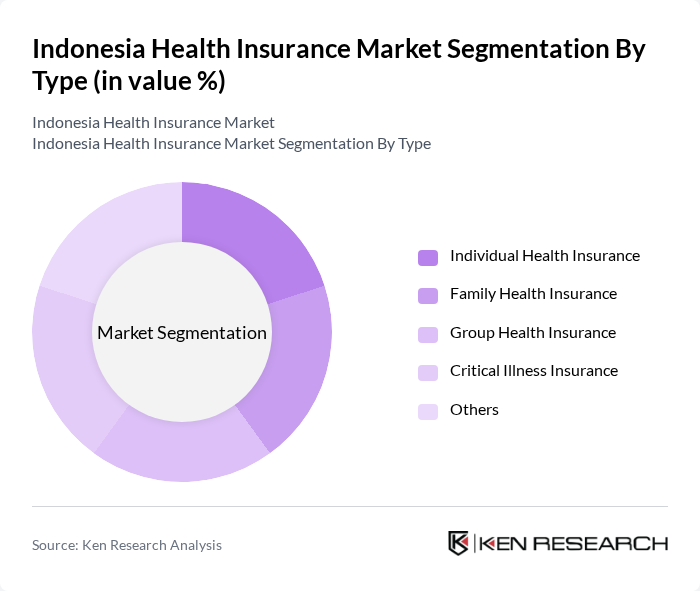

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with individual and family health insurance being particularly popular due to the increasing focus on personal health and wellness. The market is witnessing a shift towards more personalized and flexible insurance offerings, driven by digitalization and evolving consumer expectations .

The Individual Health Insurance segment is currently dominating the market, driven by a growing awareness of personal health management and the increasing prevalence of lifestyle-related diseases. Consumers are increasingly opting for tailored insurance plans that offer comprehensive coverage for outpatient and inpatient services. The trend towards individual policies is also influenced by the rise of digital platforms that facilitate easy access to insurance products, making it more convenient for individuals to secure their health coverage .

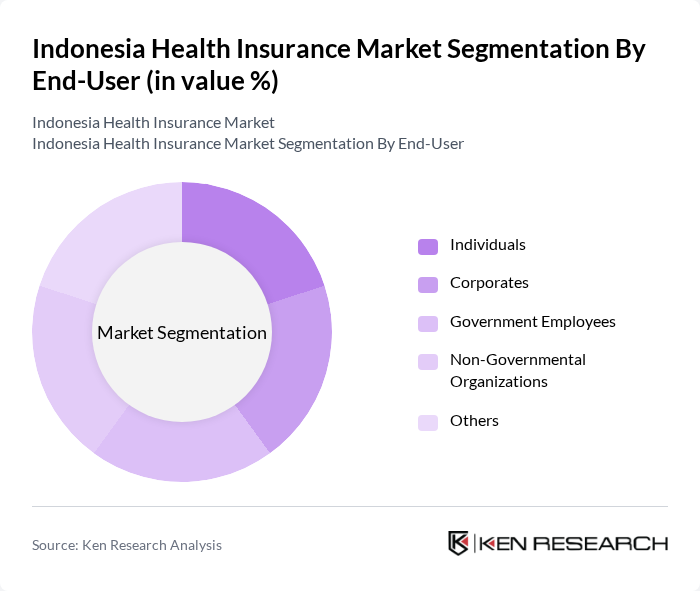

By End-User:The market is segmented by end-users, including Individuals, Corporates, Government Employees, Non-Governmental Organizations, and Others. Each segment reflects different purchasing behaviors and insurance needs, with individuals and corporates being the primary consumers of health insurance products. Notably, employer-funded group covers are expanding rapidly, supported by rising medical inflation and competitive talent markets .

Among the end-user segments, Individuals represent the largest share of the market, driven by the increasing number of people seeking personal health coverage. The rise in disposable income and awareness of health risks has led to a surge in individual policy purchases. Corporates also play a significant role, as many companies provide health insurance as part of employee benefits, reflecting a growing trend towards employee wellness programs .

The Indonesia Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Asuransi Jiwa Manulife Indonesia, PT Prudential Life Assurance, PT Allianz Life Indonesia, PT AXA Mandiri Financial Services, PT BNI Life Insurance, PT Sinarmas MSIG Life, PT AIA Financial, PT Sequis Life, PT Cigna Insurance, PT FWD Life Indonesia, PT Tokio Marine Life Insurance Indonesia, PT Great Eastern Life Indonesia, PT Avrist Assurance, PT Sinar Mas Multiartha, PT Lippo Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia health insurance market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of digital health services and telemedicine is expected to enhance accessibility and efficiency in healthcare delivery. Additionally, as the government continues to promote universal health coverage, private insurers will likely adapt by offering customized products that cater to diverse consumer needs. This evolving landscape presents opportunities for innovation and growth, positioning the market for a dynamic future.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Others |

| By End-User | Individuals Corporates Government Employees Non-Governmental Organizations Others |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Dental and Vision Coverage Others |

| By Distribution Channel | Direct Sales Brokers and Agents Online Platforms Banks and Financial Institutions Others |

| By Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Employment Status Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies Others |

| By Payment Method | Monthly Premiums Annual Premiums One-Time Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 100 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Clients | 60 | HR Managers, Benefits Coordinators from various industries |

| Healthcare Providers (Hospitals and Clinics) | 40 | Administrators, Financial Officers, Medical Directors |

| Insurance Brokers and Agents | 40 | Insurance Agents, Brokers specializing in health insurance |

| Government Health Officials | 40 | Policy Makers, Health Program Managers |

The Indonesia Health Insurance Market is valued at approximately USD 21.8 billion, reflecting significant growth driven by increasing healthcare demands, rising awareness of health insurance benefits, and government initiatives aimed at expanding coverage.