Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4977

Pages:100

Published On:December 2025

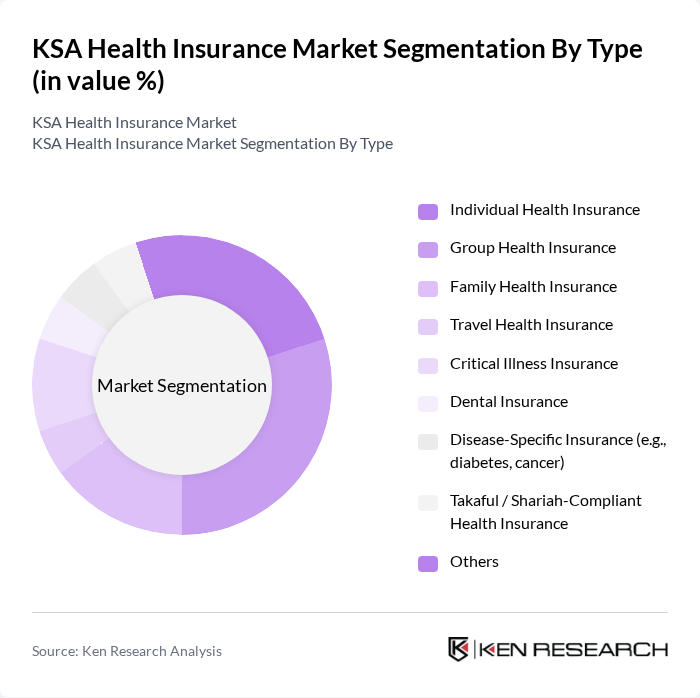

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Group Health Insurance, Family Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, Disease-Specific Insurance, Takaful / Shariah-Compliant Health Insurance, and Others. Group Health Insurance currently represents the dominant product category, driven by employer-sponsored schemes for large corporates and government-related entities. At the same time, individual and family policies are growing faster, supported by rising numbers of freelancers, self-employed nationals, and SMEs seeking more flexible and customized coverage solutions.

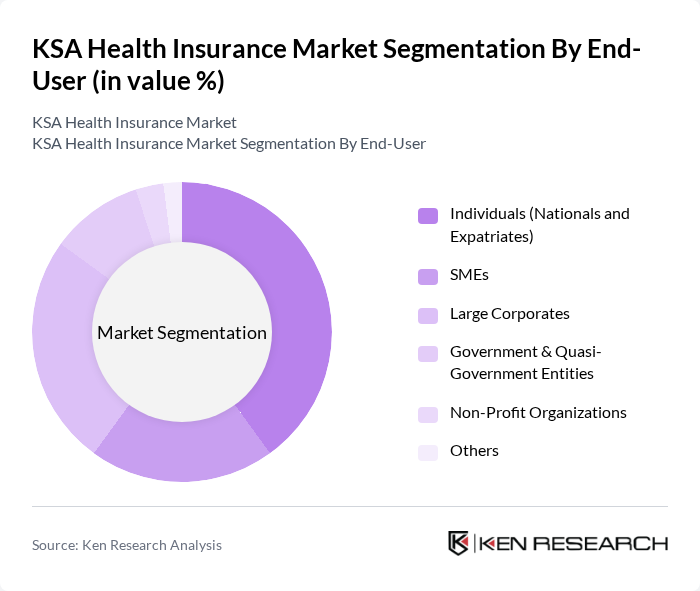

By End-User:The end-user segmentation includes Individuals (Nationals and Expatriates), SMEs, Large Corporates, Government & Quasi-Government Entities, Non-Profit Organizations, and Others. Large corporates currently account for the largest share of premiums, reflecting the long-standing dominance of employer-based schemes for sizable workforces. However, SMEs and individual policyholders are emerging as key growth segments as Vision 2030 accelerates entrepreneurship, private-sector job creation, and flexible work models, encouraging demand for tailored health insurance solutions beyond traditional corporate group plans.

The KSA Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Company for Cooperative Insurance (Tawuniya), Bupa Arabia for Cooperative Insurance, Mediterranean & Gulf Cooperative Insurance & Reinsurance Co. (Medgulf), Al Rajhi Company for Cooperative Insurance (Al Rajhi Takaful), Gulf Insurance Group – Saudi Arabia (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance Co., United Cooperative Assurance Co. (UCA), Alinma Tokio Marine Co., Al Ahlia Cooperative Insurance Co., Etihad Cooperative Insurance Co., AlJazira Takaful Taawuni Co., Al Sagr Cooperative Insurance Co., Alinmaia Cooperative Insurance Co. (formerly Al-Bilad Insurance), Arabian Shield Cooperative Insurance Co., Walaa Cooperative Insurance Co. contribute to innovation, geographic expansion, and service delivery in this space.

The KSA health insurance market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of digital health solutions and telemedicine is expected to reshape service delivery, enhancing accessibility and efficiency. Additionally, the focus on preventive healthcare will likely lead to increased demand for comprehensive insurance plans. As the market adapts to these trends, insurers will need to innovate and align their offerings with consumer needs to remain competitive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Group Health Insurance Family Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Disease-Specific Insurance (e.g., diabetes, cancer) Takaful / Shariah-Compliant Health Insurance Others |

| By End-User | Individuals (Nationals and Expatriates) SMEs Large Corporates Government & Quasi-Government Entities Non-Profit Organizations Others |

| By Demographics | Age Group (Children, Working-Age Adults, Seniors) Nationality (Saudi Nationals, Expatriates) Employment Status (Employed, Dependents, Self-Employed) Income Level (Low, Middle, High) Others |

| By Coverage Type | Comprehensive Coverage (Inpatient & Outpatient) Basic / CCHI-Compliant Mandatory Coverage Supplemental / Top-Up Coverage International / GCC Coverage Others |

| By Distribution Channel | Direct Sales (Insurer Branches & Corporate Sales) Brokers Insurance Agents Online & Digital Platforms (Web, Apps, Aggregators) Banks & Bancassurance Others |

| By Policy Duration | Annual Policies Short-Term Policies (< 1 Year, e.g., Umrah/Visit) Multi-Year / Long-Term Policies Others |

| By Geographic Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Khobar, Jubail) Western Region (incl. Jeddah, Makkah, Madinah) Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policies | 150 | Policyholders, Insurance Brokers |

| Employer-Sponsored Health Plans | 120 | HR Managers, Benefits Coordinators |

| Government Health Insurance Programs | 90 | Policy Administrators, Healthcare Policy Analysts |

| Health Insurance Claims Processing | 60 | Claims Adjusters, Underwriters |

| Healthcare Provider Partnerships | 80 | Hospital Administrators, Network Managers |

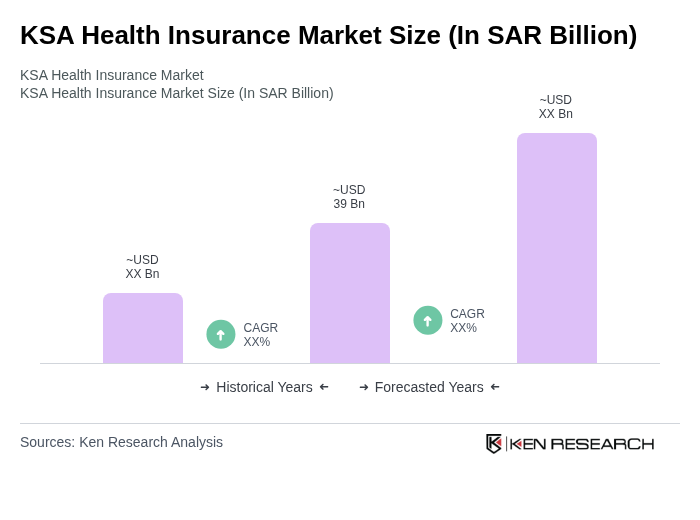

The KSA Health Insurance Market is valued at approximately SAR 39 billion, equivalent to around USD 10 billion. This valuation reflects a five-year historical analysis and is driven by increasing healthcare demand and government initiatives under Vision 2030.